library(tidyverse)

library(tidymodels)

tidymodels_prefer()

library(kernlab)

library(mlbench)

library(caret)

library(knitr)

library(ggcorrplot)

library(skimr)

library(GGally)

library(finetune)

library(lubridate)

library(baguette)

library(patchwork)

library(discrim)

library(reticulate)

library(usemodels)

library(doParallel)

library(naivebayes)

theme_set(theme_bw())Bank Marketing

Introduction

The data is sourced from the UCI ML Repository and can be downloaded here. It is related to the direct marketing campaigns of a Portuguese banking institution. The campaigns were based on phone calls. Multiple datasets are provided, however this analysis focuses on the full dataset (bank-addidtional-full.csv), which is also the latest and has the most number of inputs.

Goal

The classification goal is to predict if the client will subscribe (yes/no) a term deposit (variable y).

Data Dictionary

| Attribute Name | Type | Description |

|---|---|---|

| age | numeric | age of the person called |

| job | categorical | type of job |

| marital status | categorical | married, single or unknown |

| education | categorical | educational attainment |

| default | categorical | has credit in default? |

| housing | categorical | has housing loan? |

| loan | categorical | has personal loan? |

| contact | categorical | contact communication type |

| month | categorical | last contact month of year |

| day_of_week | categorical | last contact day of week |

| duration | numeric | last contact duration in seconds. The duration is not known before the call, so even though this has a strong impact on outcome (duration=0 => y=0), it should be discarded from the model |

| campaign | numeric | number of contacts performed during this campaign for this client (includes last contact) |

| pdays | numeric | number of days passed since client was contacted since the client was last contacted from a previous campaign. 999 means not previously contacted |

| previous | numeric | number of contacts performed during this campaign for this client |

| poutcome | categorical | outcome of the previous marketing campaign |

| emp.var.rate | numeric | employment variation rate - quarterly indicator |

| cons.price.idx | numeric | consumer price index - monthly indicator |

| cons.conf.idx | numeric | consumer confidence index - monthly indicator |

| euribor3m | numeric | euribor 3 month rate - daily indicator. These are European interest rates. |

| nr.employed | numeric | number of employees - quarterly indicator |

| y | categorical | has the client subscribed a term deposit? |

Load Packages

import pandas as pd

import numpy as np

import seaborn as sns

import matplotlib.pyplot as plt

import sklearn.metrics as metrics

import IPython.display as dsp

from IPython.display import HTML

from sklearn.model_selection import train_test_split

from sklearn.preprocessing import MinMaxScaler, FunctionTransformer, PolynomialFeatures, OneHotEncoder, PowerTransformer, LabelEncoder

from sklearn.compose import ColumnTransformer

from sklearn.pipeline import Pipeline

from sklearn.pipeline import make_pipeline

from sklearn.neighbors import KNeighborsClassifier

from sklearn.svm import SVC

from sklearn.linear_model import LogisticRegression, LogisticRegressionCV, ElasticNet, SGDClassifier, Perceptron

from sklearn.model_selection import cross_val_score, GridSearchCV, KFold, StratifiedKFold, RandomizedSearchCV

from sklearn.calibration import CalibratedClassifierCV

from sklearn.feature_selection import VarianceThreshold

from sklearn.naive_bayes import GaussianNB

from xgboost import XGBClassifier

sns.set_theme()

import warnings

warnings.filterwarnings('ignore')Load Data

Sample 10 rows

#knitr::kable(as_tibble(head(data_bank_marketing, n=10)))

set.seed(42)

knitr::kable(slice_sample(data_bank_marketing, n=10))| age | job | marital | education | default | housing | loan | contact | month | day_of_week | duration | campaign | pdays | previous | poutcome | emp.var.rate | cons.price.idx | cons.conf.idx | euribor3m | nr.employed | y |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 23 | blue-collar | married | basic.9y | no | yes | no | cellular | may | wed | 52 | 4 | 999 | 0 | nonexistent | -18 | 92893 | -462 | 1.281 | 50991 | no |

| 45 | admin. | married | basic.9y | unknown | yes | no | telephone | jun | thu | 60 | 1 | 999 | 0 | nonexistent | 14 | 94465 | -418 | 4.866 | 52281 | no |

| 41 | technician | single | university.degree | no | no | no | cellular | jul | thu | 537 | 2 | 999 | 0 | nonexistent | 14 | 93918 | -427 | 4.962 | 52281 | no |

| 31 | blue-collar | single | unknown | no | yes | no | telephone | may | fri | 273 | 2 | 999 | 0 | nonexistent | 11 | 93994 | -364 | 4.864 | 5191 | no |

| 36 | technician | single | professional.course | no | no | no | cellular | jun | fri | 146 | 2 | 999 | 0 | nonexistent | -29 | 92963 | -408 | 1.268 | 50762 | yes |

| 50 | blue-collar | married | basic.4y | unknown | yes | yes | telephone | jun | fri | 144 | 15 | 999 | 0 | nonexistent | 14 | 94465 | -418 | 4.967 | 52281 | no |

| 28 | technician | married | basic.9y | no | yes | no | cellular | may | wed | 224 | 1 | 999 | 1 | failure | -18 | 92893 | -462 | 1.281 | 50991 | no |

| 32 | admin. | single | university.degree | no | no | no | cellular | jul | thu | 792 | 1 | 999 | 0 | nonexistent | 14 | 93918 | -427 | 4.963 | 52281 | no |

| 59 | retired | divorced | basic.4y | no | no | yes | cellular | jul | mon | 210 | 3 | 999 | 2 | failure | -17 | 94215 | -403 | 0.827 | 49916 | yes |

| 35 | technician | married | professional.course | no | no | no | cellular | apr | wed | 225 | 2 | 999 | 0 | nonexistent | -18 | 93075 | -471 | 1.415 | 50991 | no |

pd.set_option('display.width', 500)

#pd.set_option('precision', 3)

sample=data_bank_marketing.sample(10)

dsp.Markdown(sample.to_markdown(index=False))| age | job | marital | education | default | housing | loan | contact | month | day_of_week | duration | campaign | pdays | previous | poutcome | emp.var.rate | cons.price.idx | cons.conf.idx | euribor3m | nr.employed | y |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 45 | admin. | single | high.school | no | no | no | telephone | jun | wed | 192 | 6 | 999 | 0 | nonexistent | 1.4 | 94.465 | -41.8 | 4.864 | 5228.1 | no |

| 66 | retired | married | basic.4y | no | yes | yes | telephone | aug | wed | 82 | 3 | 999 | 3 | failure | -2.9 | 92.201 | -31.4 | 0.854 | 5076.2 | no |

| 33 | management | single | university.degree | no | unknown | unknown | cellular | jun | tue | 73 | 1 | 999 | 0 | nonexistent | -2.9 | 92.963 | -40.8 | 1.262 | 5076.2 | no |

| 40 | blue-collar | married | basic.4y | unknown | unknown | unknown | telephone | jul | wed | 135 | 1 | 999 | 0 | nonexistent | 1.4 | 93.918 | -42.7 | 4.962 | 5228.1 | no |

| 43 | services | divorced | professional.course | no | no | no | cellular | may | fri | 196 | 2 | 999 | 0 | nonexistent | -1.8 | 92.893 | -46.2 | 1.313 | 5099.1 | no |

| 36 | blue-collar | married | basic.6y | no | no | no | telephone | may | fri | 189 | 2 | 999 | 0 | nonexistent | 1.1 | 93.994 | -36.4 | 4.857 | 5191 | no |

| 23 | student | single | high.school | no | no | no | cellular | jun | wed | 200 | 2 | 999 | 0 | nonexistent | -2.9 | 92.963 | -40.8 | 1.26 | 5076.2 | yes |

| 27 | technician | single | professional.course | no | no | no | telephone | jun | fri | 112 | 5 | 999 | 0 | nonexistent | 1.4 | 94.465 | -41.8 | 4.967 | 5228.1 | no |

| 32 | technician | married | university.degree | no | yes | no | telephone | jul | wed | 196 | 1 | 999 | 0 | nonexistent | 1.4 | 93.918 | -42.7 | 4.962 | 5228.1 | no |

| 31 | admin. | single | high.school | no | yes | no | cellular | may | thu | 1094 | 2 | 999 | 0 | nonexistent | -1.8 | 92.893 | -46.2 | 1.266 | 5099.1 | yes |

10×21 DataFrame

Row │ age job marital education default housing lo ⋯

│ Int64 String15 String15 String31 String7 String7 St ⋯

─────┼──────────────────────────────────────────────────────────────────────────

1 │ 56 housemaid married basic.4y no no no ⋯

2 │ 57 services married high.school unknown no no

3 │ 37 services married high.school no yes no

4 │ 40 admin. married basic.6y no no no

5 │ 56 services married high.school no no ye ⋯

6 │ 45 services married basic.9y unknown no no

7 │ 59 admin. married professional.course no no no

8 │ 41 blue-collar married unknown unknown no no

9 │ 24 technician single professional.course no yes no ⋯

10 │ 25 services single high.school no yes no

15 columns omitted┌───────┬─────────────┬──────────┬─────────────────────┬─────────┬─────────┬─────────┬───────────┬─────────┬─────────────┬──────────┬──────────┬───────┬──────────┬─────────────┬──────────────┬────────────────┬───────────────┬───────────┬─────────────┬─────────┐

│ age │ job │ marital │ education │ default │ housing │ loan │ contact │ month │ day_of_week │ duration │ campaign │ pdays │ previous │ poutcome │ emp.var.rate │ cons.price.idx │ cons.conf.idx │ euribor3m │ nr.employed │ y │

│ Int64 │ String15 │ String15 │ String31 │ String7 │ String7 │ String7 │ String15 │ String3 │ String3 │ Int64 │ Int64 │ Int64 │ Int64 │ String15 │ Float64 │ Float64 │ Float64 │ Float64 │ Float64 │ String3 │

├───────┼─────────────┼──────────┼─────────────────────┼─────────┼─────────┼─────────┼───────────┼─────────┼─────────────┼──────────┼──────────┼───────┼──────────┼─────────────┼──────────────┼────────────────┼───────────────┼───────────┼─────────────┼─────────┤

│ 56 │ housemaid │ married │ basic.4y │ no │ no │ no │ telephone │ may │ mon │ 261 │ 1 │ 999 │ 0 │ nonexistent │ 1.1 │ 93.994 │ -36.4 │ 4.857 │ 5191.0 │ no │

│ 57 │ services │ married │ high.school │ unknown │ no │ no │ telephone │ may │ mon │ 149 │ 1 │ 999 │ 0 │ nonexistent │ 1.1 │ 93.994 │ -36.4 │ 4.857 │ 5191.0 │ no │

│ 37 │ services │ married │ high.school │ no │ yes │ no │ telephone │ may │ mon │ 226 │ 1 │ 999 │ 0 │ nonexistent │ 1.1 │ 93.994 │ -36.4 │ 4.857 │ 5191.0 │ no │

│ 40 │ admin. │ married │ basic.6y │ no │ no │ no │ telephone │ may │ mon │ 151 │ 1 │ 999 │ 0 │ nonexistent │ 1.1 │ 93.994 │ -36.4 │ 4.857 │ 5191.0 │ no │

│ 56 │ services │ married │ high.school │ no │ no │ yes │ telephone │ may │ mon │ 307 │ 1 │ 999 │ 0 │ nonexistent │ 1.1 │ 93.994 │ -36.4 │ 4.857 │ 5191.0 │ no │

│ 45 │ services │ married │ basic.9y │ unknown │ no │ no │ telephone │ may │ mon │ 198 │ 1 │ 999 │ 0 │ nonexistent │ 1.1 │ 93.994 │ -36.4 │ 4.857 │ 5191.0 │ no │

│ 59 │ admin. │ married │ professional.course │ no │ no │ no │ telephone │ may │ mon │ 139 │ 1 │ 999 │ 0 │ nonexistent │ 1.1 │ 93.994 │ -36.4 │ 4.857 │ 5191.0 │ no │

│ 41 │ blue-collar │ married │ unknown │ unknown │ no │ no │ telephone │ may │ mon │ 217 │ 1 │ 999 │ 0 │ nonexistent │ 1.1 │ 93.994 │ -36.4 │ 4.857 │ 5191.0 │ no │

│ 24 │ technician │ single │ professional.course │ no │ yes │ no │ telephone │ may │ mon │ 380 │ 1 │ 999 │ 0 │ nonexistent │ 1.1 │ 93.994 │ -36.4 │ 4.857 │ 5191.0 │ no │

│ 25 │ services │ single │ high.school │ no │ yes │ no │ telephone │ may │ mon │ 50 │ 1 │ 999 │ 0 │ nonexistent │ 1.1 │ 93.994 │ -36.4 │ 4.857 │ 5191.0 │ no │

└───────┴─────────────┴──────────┴─────────────────────┴─────────┴─────────┴─────────┴───────────┴─────────┴─────────────┴──────────┴──────────┴───────┴──────────┴─────────────┴──────────────┴────────────────┴───────────────┴───────────┴─────────────┴─────────┘10×21 DataFrame

Row │ age job marital education default housing loan contact month day_of_week duration campaign pdays previous poutcome emp.var.rate cons.price.idx cons.conf.idx euribor3m nr.employed y

│ Int64 String15 String15 String31 String7 String7 String7 String15 String3 String3 Int64 Int64 Int64 Int64 String15 Float64 Float64 Float64 Float64 Float64 String3

─────┼───────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────────

1 │ 56 housemaid married basic.4y no no no telephone may mon 261 1 999 0 nonexistent 1.1 93.994 -36.4 4.857 5191.0 no

2 │ 57 services married high.school unknown no no telephone may mon 149 1 999 0 nonexistent 1.1 93.994 -36.4 4.857 5191.0 no

3 │ 37 services married high.school no yes no telephone may mon 226 1 999 0 nonexistent 1.1 93.994 -36.4 4.857 5191.0 no

4 │ 40 admin. married basic.6y no no no telephone may mon 151 1 999 0 nonexistent 1.1 93.994 -36.4 4.857 5191.0 no

5 │ 56 services married high.school no no yes telephone may mon 307 1 999 0 nonexistent 1.1 93.994 -36.4 4.857 5191.0 no

6 │ 45 services married basic.9y unknown no no telephone may mon 198 1 999 0 nonexistent 1.1 93.994 -36.4 4.857 5191.0 no

7 │ 59 admin. married professional.course no no no telephone may mon 139 1 999 0 nonexistent 1.1 93.994 -36.4 4.857 5191.0 no

8 │ 41 blue-collar married unknown unknown no no telephone may mon 217 1 999 0 nonexistent 1.1 93.994 -36.4 4.857 5191.0 no

9 │ 24 technician single professional.course no yes no telephone may mon 380 1 999 0 nonexistent 1.1 93.994 -36.4 4.857 5191.0 no

10 │ 25 services single high.school no yes no telephone may mon 50 1 999 0 nonexistent 1.1 93.994 -36.4 4.857 5191.0 no| Name | data_bank_marketing |

| Number of rows | 41188 |

| Number of columns | 21 |

| _______________________ | |

| Column type frequency: | |

| character | 12 |

| numeric | 9 |

| ________________________ | |

| Group variables | None |

Variable type: character

| skim_variable | n_missing | complete_rate | min | max | empty | n_unique | whitespace |

|---|---|---|---|---|---|---|---|

| job | 0 | 1 | 6 | 13 | 0 | 12 | 0 |

| marital | 0 | 1 | 6 | 8 | 0 | 4 | 0 |

| education | 0 | 1 | 7 | 19 | 0 | 8 | 0 |

| default | 0 | 1 | 2 | 7 | 0 | 3 | 0 |

| housing | 0 | 1 | 2 | 7 | 0 | 3 | 0 |

| loan | 0 | 1 | 2 | 7 | 0 | 3 | 0 |

| contact | 0 | 1 | 8 | 9 | 0 | 2 | 0 |

| month | 0 | 1 | 3 | 3 | 0 | 10 | 0 |

| day_of_week | 0 | 1 | 3 | 3 | 0 | 5 | 0 |

| poutcome | 0 | 1 | 7 | 11 | 0 | 3 | 0 |

| euribor3m | 0 | 1 | 1 | 5 | 0 | 316 | 0 |

| y | 0 | 1 | 2 | 3 | 0 | 2 | 0 |

Variable type: numeric

| skim_variable | n_missing | complete_rate | mean | sd | p0 | p25 | p50 | p75 | p100 | hist |

|---|---|---|---|---|---|---|---|---|---|---|

| age | 0 | 1 | 40.02 | 10.42 | 17 | 32 | 38 | 47 | 98 | ▅▇▃▁▁ |

| duration | 0 | 1 | 258.29 | 259.28 | 0 | 102 | 180 | 319 | 4918 | ▇▁▁▁▁ |

| campaign | 0 | 1 | 2.57 | 2.77 | 1 | 1 | 2 | 3 | 56 | ▇▁▁▁▁ |

| pdays | 0 | 1 | 962.48 | 186.91 | 0 | 999 | 999 | 999 | 999 | ▁▁▁▁▇ |

| previous | 0 | 1 | 0.17 | 0.49 | 0 | 0 | 0 | 0 | 7 | ▇▁▁▁▁ |

| emp.var.rate | 0 | 1 | 0.93 | 15.58 | -34 | -18 | 11 | 14 | 14 | ▁▃▁▁▇ |

| cons.price.idx | 0 | 1 | 85475.22 | 26234.18 | 932 | 92893 | 93749 | 93994 | 94767 | ▁▁▁▁▇ |

| cons.conf.idx | 0 | 1 | -365.67 | 119.10 | -508 | -427 | -403 | -361 | -33 | ▇▆▁▁▂ |

| nr.employed | 0 | 1 | 42864.89 | 18170.20 | 5191 | 50175 | 50991 | 52281 | 52281 | ▂▁▁▁▇ |

age duration campaign pdays previous emp.var.rate cons.price.idx cons.conf.idx euribor3m nr.employed

count 41188.00000 41188.000000 41188.000000 41188.000000 41188.000000 41188.000000 41188.000000 41188.000000 41188.000000 41188.000000

mean 40.02406 258.285010 2.567593 962.475454 0.172963 0.081886 93.575664 -40.502600 3.621291 5167.035911

std 10.42125 259.279249 2.770014 186.910907 0.494901 1.570960 0.578840 4.628198 1.734447 72.251528

min 17.00000 0.000000 1.000000 0.000000 0.000000 -3.400000 92.201000 -50.800000 0.634000 4963.600000

25% 32.00000 102.000000 1.000000 999.000000 0.000000 -1.800000 93.075000 -42.700000 1.344000 5099.100000

50% 38.00000 180.000000 2.000000 999.000000 0.000000 1.100000 93.749000 -41.800000 4.857000 5191.000000

75% 47.00000 319.000000 3.000000 999.000000 0.000000 1.400000 93.994000 -36.400000 4.961000 5228.100000

max 98.00000 4918.000000 56.000000 999.000000 7.000000 1.400000 94.767000 -26.900000 5.045000 5228.100000<class 'pandas.core.frame.DataFrame'>

RangeIndex: 41188 entries, 0 to 41187

Data columns (total 21 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 age 41188 non-null int64

1 job 41188 non-null object

2 marital 41188 non-null object

3 education 41188 non-null object

4 default 41188 non-null object

5 housing 41188 non-null object

6 loan 41188 non-null object

7 contact 41188 non-null object

8 month 41188 non-null object

9 day_of_week 41188 non-null object

10 duration 41188 non-null int64

11 campaign 41188 non-null int64

12 pdays 41188 non-null int64

13 previous 41188 non-null int64

14 poutcome 41188 non-null object

15 emp.var.rate 41188 non-null float64

16 cons.price.idx 41188 non-null float64

17 cons.conf.idx 41188 non-null float64

18 euribor3m 41188 non-null float64

19 nr.employed 41188 non-null float64

20 y 41188 non-null object

dtypes: float64(5), int64(5), object(11)

memory usage: 6.6+ MB21×7 DataFrame

Row │ variable mean min median max nmissing eltype

│ Symbol Union… Any Union… Any Int64 DataType

─────┼────────────────────────────────────────────────────────────────────────────

1 │ age 40.0241 17 38.0 98 0 Int64

2 │ job admin. unknown 0 String15

3 │ marital divorced unknown 0 String15

4 │ education basic.4y unknown 0 String31

5 │ default no yes 0 String7

6 │ housing no yes 0 String7

7 │ loan no yes 0 String7

8 │ contact cellular telephone 0 String15

9 │ month apr sep 0 String3

10 │ day_of_week fri wed 0 String3

11 │ duration 258.285 0 180.0 4918 0 Int64

12 │ campaign 2.56759 1 2.0 56 0 Int64

13 │ pdays 962.475 0 999.0 999 0 Int64

14 │ previous 0.172963 0 0.0 7 0 Int64

15 │ poutcome failure success 0 String15

16 │ emp.var.rate 0.0818855 -3.4 1.1 1.4 0 Float64

17 │ cons.price.idx 93.5757 92.201 93.749 94.767 0 Float64

18 │ cons.conf.idx -40.5026 -50.8 -41.8 -26.9 0 Float64

19 │ euribor3m 3.62129 0.634 4.857 5.045 0 Float64

20 │ nr.employed 5167.04 4963.6 5191.0 5228.1 0 Float64

21 │ y no yes 0 String321×3 DataFrame

Row │ names scitypes types

│ Symbol DataType DataType

─────┼──────────────────────────────────────

1 │ age Count Int64

2 │ job Textual String15

3 │ marital Textual String15

4 │ education Textual String31

5 │ default Textual String7

6 │ housing Textual String7

7 │ loan Textual String7

8 │ contact Textual String15

9 │ month Textual String3

10 │ day_of_week Textual String3

11 │ duration Count Int64

12 │ campaign Count Int64

13 │ pdays Count Int64

14 │ previous Count Int64

15 │ poutcome Textual String15

16 │ emp.var.rate Continuous Float64

17 │ cons.price.idx Continuous Float64

18 │ cons.conf.idx Continuous Float64

19 │ euribor3m Continuous Float64

20 │ nr.employed Continuous Float64

21 │ y Textual String3Observations

Only in R, euribor3m is listed as a categorical attribute with 316 unique values, but the data dictionary defines it as numeric.

There are no missing values.

Most of the numeric attributes appear to be left or right skewed.

Most attributes have a high standard deviation.

data_numeric = data_bank_marketing %>% select(-c("job","marital","education","default","housing","loan","contact","month","day_of_week","poutcome","euribor3m","y"))

skew = moments::skewness(data_numeric)

knitr::kable(tidy(skew) %>% arrange(desc(abs(x) )))| names | x |

|---|---|

| pdays | -4.9220107 |

| campaign | 4.7623333 |

| previous | 3.8319027 |

| duration | 3.2630224 |

| cons.price.idx | -2.9107277 |

| cons.conf.idx | 1.9359724 |

| nr.employed | -1.5872345 |

| age | 0.7846682 |

| emp.var.rate | -0.7311321 |

skew = data_bank_marketing.select_dtypes(include=np.number).skew()

dsp.Markdown(skew.to_markdown(index=True))

#print(skew)| 0 | |

|---|---|

| age | 0.784697 |

| duration | 3.26314 |

| campaign | 4.76251 |

| pdays | -4.92219 |

| previous | 3.83204 |

| emp.var.rate | -0.724096 |

| cons.price.idx | -0.230888 |

| cons.conf.idx | 0.30318 |

| euribor3m | -0.709188 |

| nr.employed | -1.04426 |

function skewness_df(df::DataFrame)

numeric_cols = names(df, Real)

m=Matrix(data[!,numeric_cols])

sk=mapslices(skewness,m; dims=1)

sk=reshape(sk, (length(numeric_cols),1))

return hcat(numeric_cols,sk)

endskewness_df (generic function with 1 method)10×2 Matrix{Any}:

"age" 0.784668

"duration" 3.26302

"campaign" 4.76233

"pdays" -4.92201

"previous" 3.8319

"emp.var.rate" -0.724069

"cons.price.idx" -0.230879

"cons.conf.idx" 0.303169

"euribor3m" -0.709162

"nr.employed" -1.04422Observations

- Most attributes have high skewness values.

| age | duration | campaign | pdays | previous | emp.var.rate | cons.price.idx | cons.conf.idx | nr.employed | |

|---|---|---|---|---|---|---|---|---|---|

| age | 1.0000000 | -0.0008657 | 0.0045936 | -0.0343690 | 0.0243647 | 0.0048933 | -0.0194012 | 0.0803944 | -0.0148194 |

| duration | -0.0008657 | 1.0000000 | -0.0716992 | -0.0475770 | 0.0206404 | -0.0253914 | 0.0204889 | -0.0180911 | -0.0145367 |

| campaign | 0.0045936 | -0.0716992 | 1.0000000 | 0.0525836 | -0.0791415 | 0.1510747 | 0.0759259 | -0.0769437 | 0.0153579 |

| pdays | -0.0343690 | -0.0475770 | 0.0525836 | 1.0000000 | -0.5875139 | 0.2643170 | -0.0426908 | -0.0347775 | -0.0798846 |

| previous | 0.0243647 | 0.0206404 | -0.0791415 | -0.5875139 | 1.0000000 | -0.4169615 | -0.0230420 | 0.0385344 | 0.1494358 |

| emp.var.rate | 0.0048933 | -0.0253914 | 0.1510747 | 0.2643170 | -0.4169615 | 1.0000000 | 0.0552787 | -0.0061387 | -0.2773105 |

| cons.price.idx | -0.0194012 | 0.0204889 | 0.0759259 | -0.0426908 | -0.0230420 | 0.0552787 | 1.0000000 | -0.8435170 | -0.1617969 |

| cons.conf.idx | 0.0803944 | -0.0180911 | -0.0769437 | -0.0347775 | 0.0385344 | -0.0061387 | -0.8435170 | 1.0000000 | -0.0039613 |

| nr.employed | -0.0148194 | -0.0145367 | 0.0153579 | -0.0798846 | 0.1494358 | -0.2773105 | -0.1617969 | -0.0039613 | 1.0000000 |

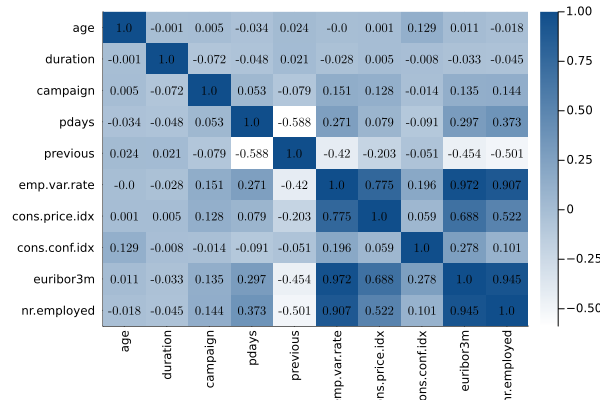

correlations = data_bank_marketing.select_dtypes(include=np.number).corr(method='pearson')

with pd.option_context('display.max_columns', 40):

print(correlations) age duration campaign pdays previous emp.var.rate cons.price.idx cons.conf.idx euribor3m nr.employed

age 1.000000 -0.000866 0.004594 -0.034369 0.024365 -0.000371 0.000857 0.129372 0.010767 -0.017725

duration -0.000866 1.000000 -0.071699 -0.047577 0.020640 -0.027968 0.005312 -0.008173 -0.032897 -0.044703

campaign 0.004594 -0.071699 1.000000 0.052584 -0.079141 0.150754 0.127836 -0.013733 0.135133 0.144095

pdays -0.034369 -0.047577 0.052584 1.000000 -0.587514 0.271004 0.078889 -0.091342 0.296899 0.372605

previous 0.024365 0.020640 -0.079141 -0.587514 1.000000 -0.420489 -0.203130 -0.050936 -0.454494 -0.501333

emp.var.rate -0.000371 -0.027968 0.150754 0.271004 -0.420489 1.000000 0.775334 0.196041 0.972245 0.906970

cons.price.idx 0.000857 0.005312 0.127836 0.078889 -0.203130 0.775334 1.000000 0.058986 0.688230 0.522034

cons.conf.idx 0.129372 -0.008173 -0.013733 -0.091342 -0.050936 0.196041 0.058986 1.000000 0.277686 0.100513

euribor3m 0.010767 -0.032897 0.135133 0.296899 -0.454494 0.972245 0.688230 0.277686 1.000000 0.945154

nr.employed -0.017725 -0.044703 0.144095 0.372605 -0.501333 0.906970 0.522034 0.100513 0.945154 1.000000names = data_bank_marketing.select_dtypes(include=np.number).columns.values.tolist()

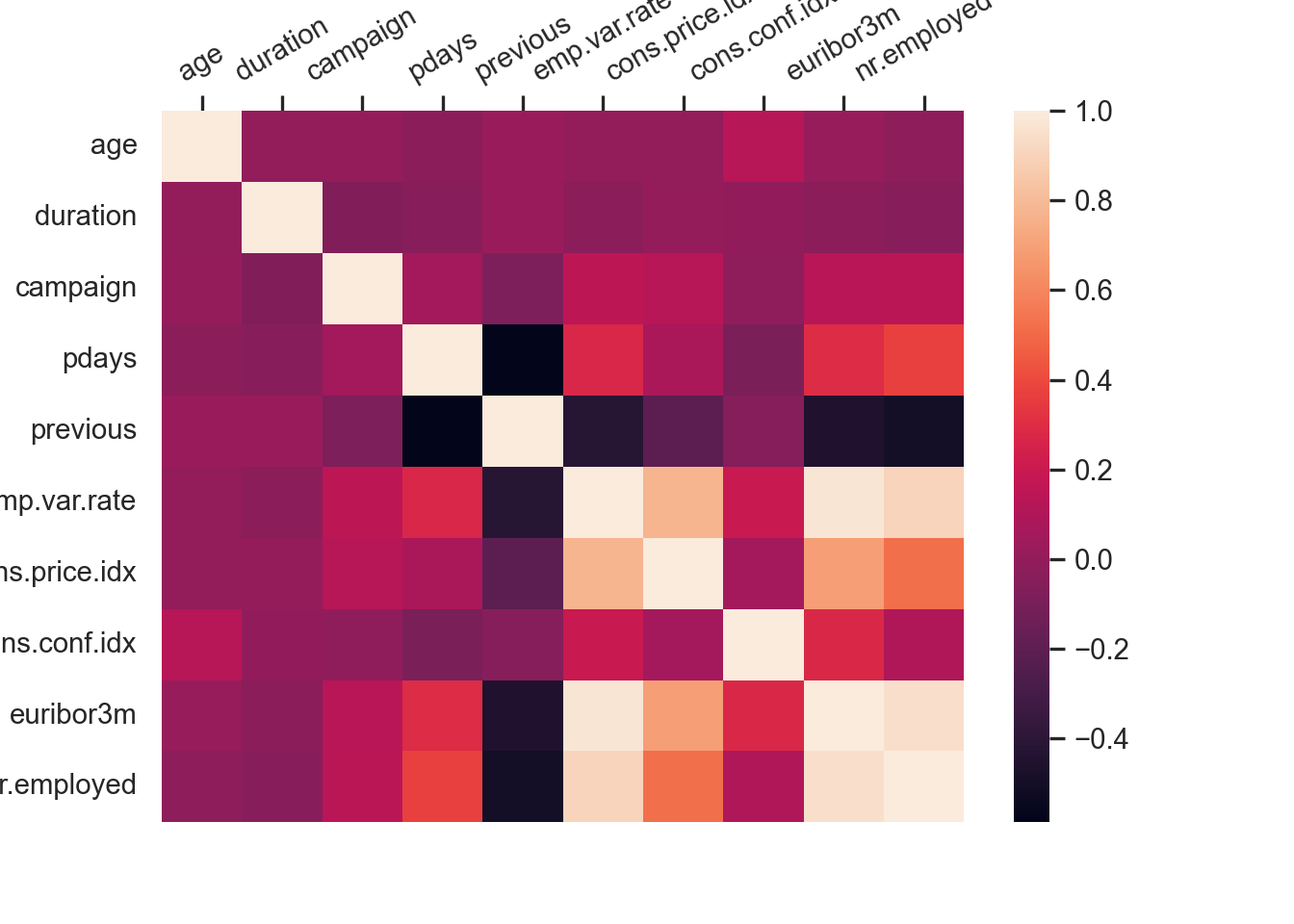

hmap=sns.heatmap(correlations,

xticklabels=correlations.columns,

yticklabels=correlations.columns)

hmap.xaxis.tick_top()

plt.xticks(rotation=30)(array([0.5, 1.5, 2.5, 3.5, 4.5, 5.5, 6.5, 7.5, 8.5, 9.5]), [Text(0.5, 1, 'age'), Text(1.5, 1, 'duration'), Text(2.5, 1, 'campaign'), Text(3.5, 1, 'pdays'), Text(4.5, 1, 'previous'), Text(5.5, 1, 'emp.var.rate'), Text(6.5, 1, 'cons.price.idx'), Text(7.5, 1, 'cons.conf.idx'), Text(8.5, 1, 'euribor3m'), Text(9.5, 1, 'nr.employed')])

function cor_df(df::DataFrame)

numeric_cols = names(df, Real)

M=Matrix(data[!,numeric_cols])

C=cor(M)

cols=reshape(numeric_cols, 1, (length(numeric_cols)))

(n,m) = size(C)

hm=heatmap(C, fc=cgrad([:white,:dodgerblue4]), xticks=(1:m,numeric_cols), xrot=90, yticks=(1:m,numeric_cols), yflip=true, show = true)

annotate!([(j, i, text(round(C[i,j],digits=3), 8,"Computer Modern",:black)) for i in 1:n for j in 1:m])

return (hm, DataFrame(vcat(cols,C), :auto))

endcor_df (generic function with 1 method)(Plot{Plots.GRBackend() n=1}, 11×10 DataFrame

Row │ x1 x2 x3 x4 x5 x6 ⋯

│ Any Any Any Any Any Any ⋯

─────┼──────────────────────────────────────────────────────────────────────────

1 │ age duration campaign pdays previous emp.var ⋯

2 │ 1.0 -0.000865705 0.00459358 -0.034369 0.0243647 -0.0003

3 │ -0.000865705 1.0 -0.0716992 -0.047577 0.0206404 -0.0279

4 │ 0.00459358 -0.0716992 1.0 0.0525836 -0.0791415 0.15075

5 │ -0.034369 -0.047577 0.0525836 1.0 -0.587514 0.27100 ⋯

6 │ 0.0243647 0.0206404 -0.0791415 -0.587514 1.0 -0.4204

7 │ -0.000370685 -0.0279679 0.150754 0.271004 -0.420489 1.0

8 │ 0.000856715 0.00531227 0.127836 0.0788891 -0.20313 0.77533

9 │ 0.129372 -0.00817287 -0.0137331 -0.0913424 -0.0509364 0.19604 ⋯

10 │ 0.0107674 -0.0328967 0.135133 0.296899 -0.454494 0.97224

11 │ -0.0177251 -0.0447032 0.144095 0.372605 -0.501333 0.90697

5 columns omitted)

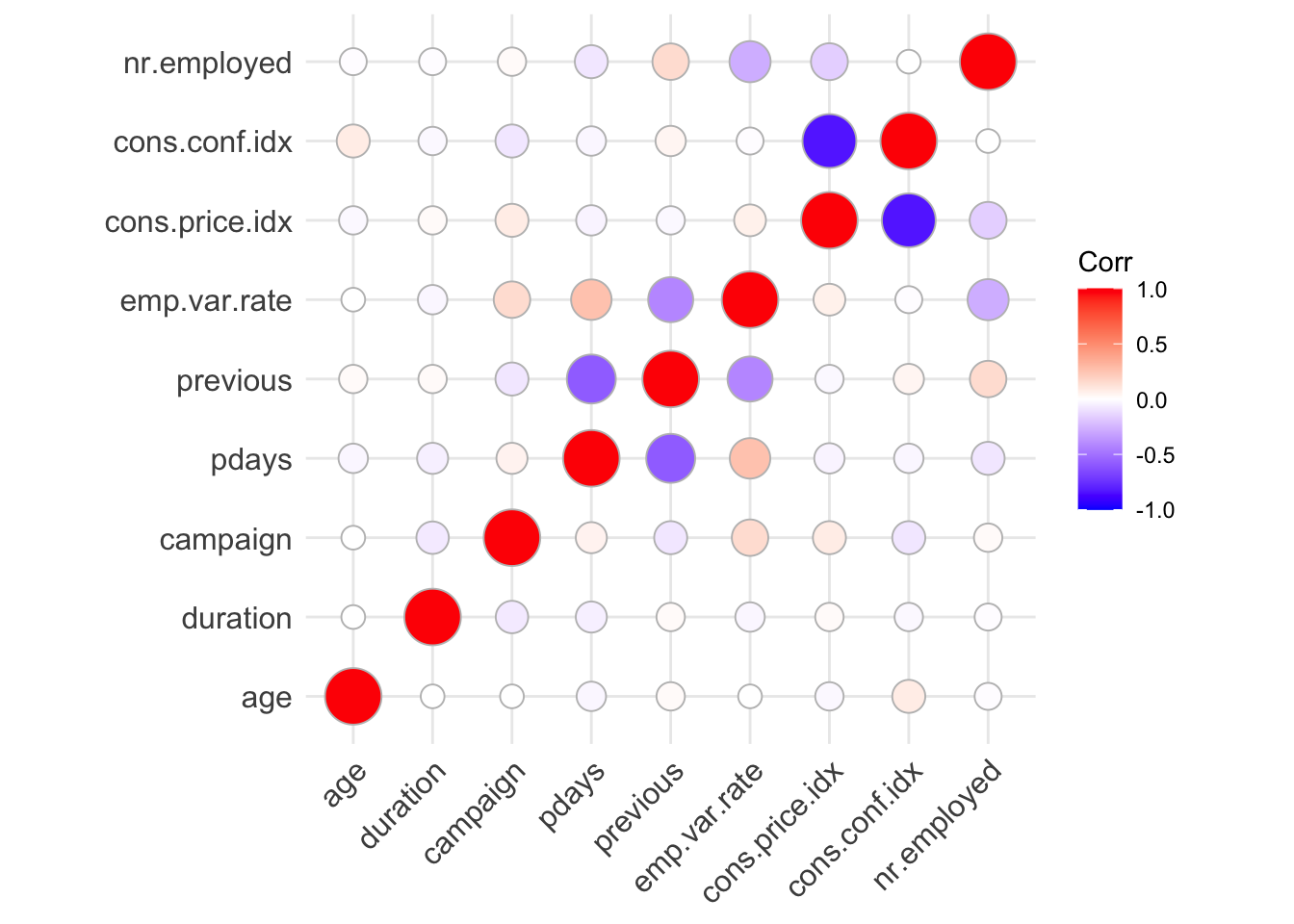

Observations

- There is a negative correlation between cons.conf.idx and cons.price.idx

#https://stackoverflow.com/questions/24901061/in-r-how-do-i-compute-factors-percentage-given-on-different-variable

get_proportions = function(data, attribute, outcome, asPercent = TRUE) {

multiplier = 1

if (asPercent) {

multiplier = 100

}

prop_df = rownames_to_column(multiplier*as.data.frame.matrix(prop.table(table(data %>% select(attribute,outcome)), 1))) %>% as_tibble() #%>% rename(attribute = rowname) %>% as_tibble()

freq_df = as_tibble(multiplier*prop.table(table(data %>% select(attribute))))

final_df = left_join(prop_df, freq_df, by = c(rowname = attribute))

}

knitr::kable(get_proportions(data_bank_marketing, 'job', 'y') %>% rename(job = rowname) %>% rename(overall = n) %>% arrange(desc(yes)))| job | no | yes | overall |

|---|---|---|---|

| student | 68.57143 | 31.428571 | 2.1244052 |

| retired | 74.76744 | 25.232558 | 4.1759736 |

| unemployed | 85.79882 | 14.201183 | 2.4618821 |

| admin. | 87.02744 | 12.972558 | 25.3034865 |

| management | 88.78249 | 11.217510 | 7.0991551 |

| unknown | 88.78788 | 11.212121 | 0.8012042 |

| technician | 89.17396 | 10.826042 | 16.3712732 |

| self-employed | 89.51443 | 10.485573 | 3.4500340 |

| housemaid | 90.00000 | 10.000000 | 2.5735651 |

| entrepreneur | 91.48352 | 8.516483 | 3.5350102 |

| services | 91.86193 | 8.138070 | 9.6363018 |

| blue-collar | 93.10568 | 6.894316 | 22.4677090 |

knitr::kable(get_proportions(data_bank_marketing, 'education', 'y') %>% rename(education = rowname) %>% rename(overall = n) %>% arrange(desc(yes)))| education | no | yes | overall |

|---|---|---|---|

| illiterate | 77.77778 | 22.222222 | 0.043702 |

| unknown | 85.49971 | 14.500289 | 4.202680 |

| university.degree | 86.27548 | 13.724523 | 29.542585 |

| professional.course | 88.65154 | 11.348465 | 12.729436 |

| high.school | 89.16448 | 10.835523 | 23.101389 |

| basic.4y | 89.75096 | 10.249042 | 10.138875 |

| basic.6y | 91.79756 | 8.202443 | 5.564728 |

| basic.9y | 92.17535 | 7.824649 | 14.676605 |

knitr::kable(get_proportions(data_bank_marketing, 'marital', 'y') %>% rename(marital = rowname) %>% rename(overall = n) %>% arrange(desc(yes)))| marital | no | yes | overall |

|---|---|---|---|

| unknown | 85.00000 | 15.00000 | 0.1942313 |

| single | 85.99585 | 14.00415 | 28.0858502 |

| divorced | 89.67910 | 10.32090 | 11.1974361 |

| married | 89.84275 | 10.15725 | 60.5224823 |

knitr::kable(get_proportions(data_bank_marketing, 'default', 'y') %>% rename(default = rowname) %>% rename(overall = n) %>% arrange(desc(yes)))| default | no | yes | overall |

|---|---|---|---|

| no | 87.12103 | 12.87897 | 79.1201321 |

| unknown | 94.84704 | 5.15296 | 20.8725842 |

| yes | 100.00000 | 0.00000 | 0.0072837 |

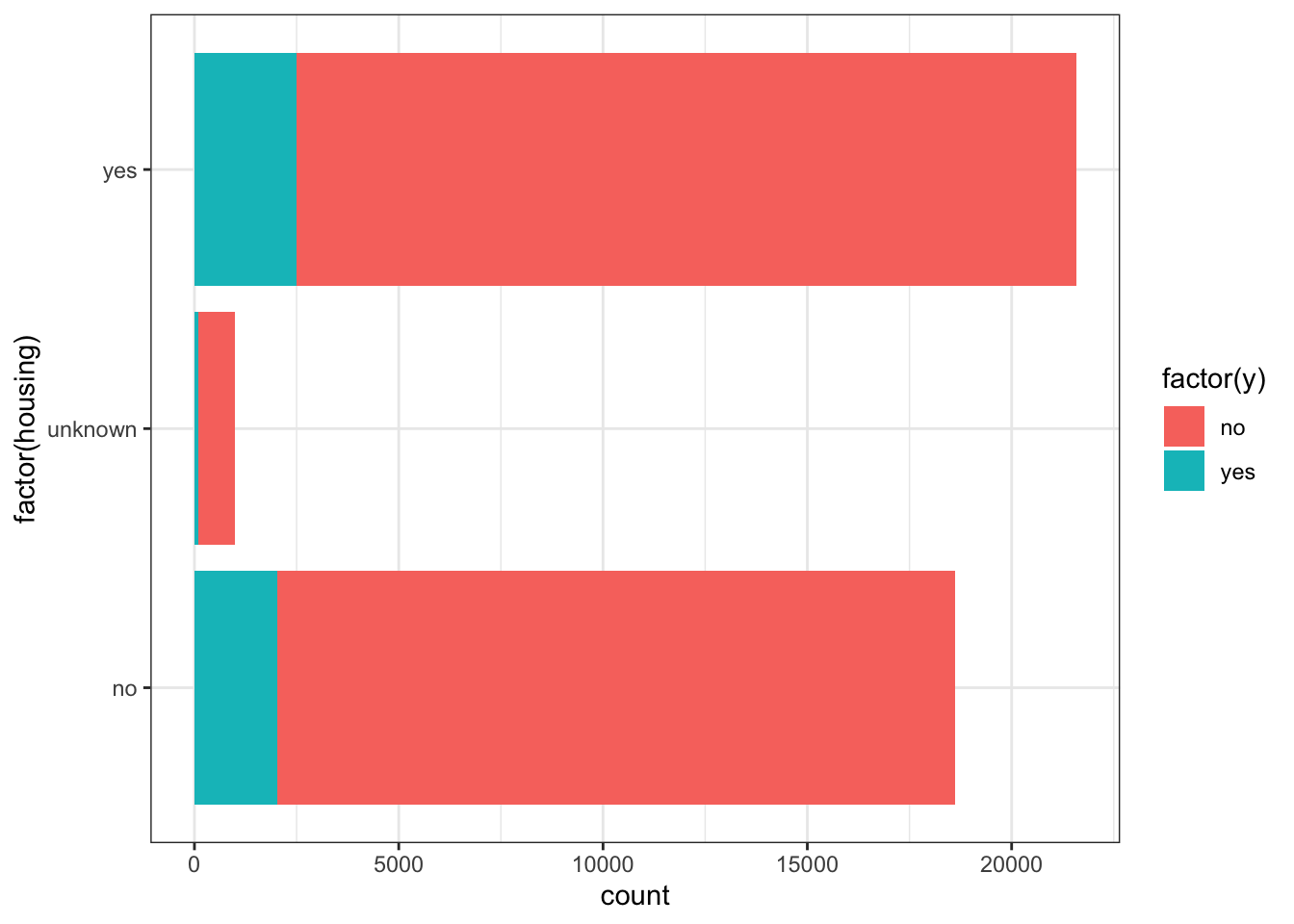

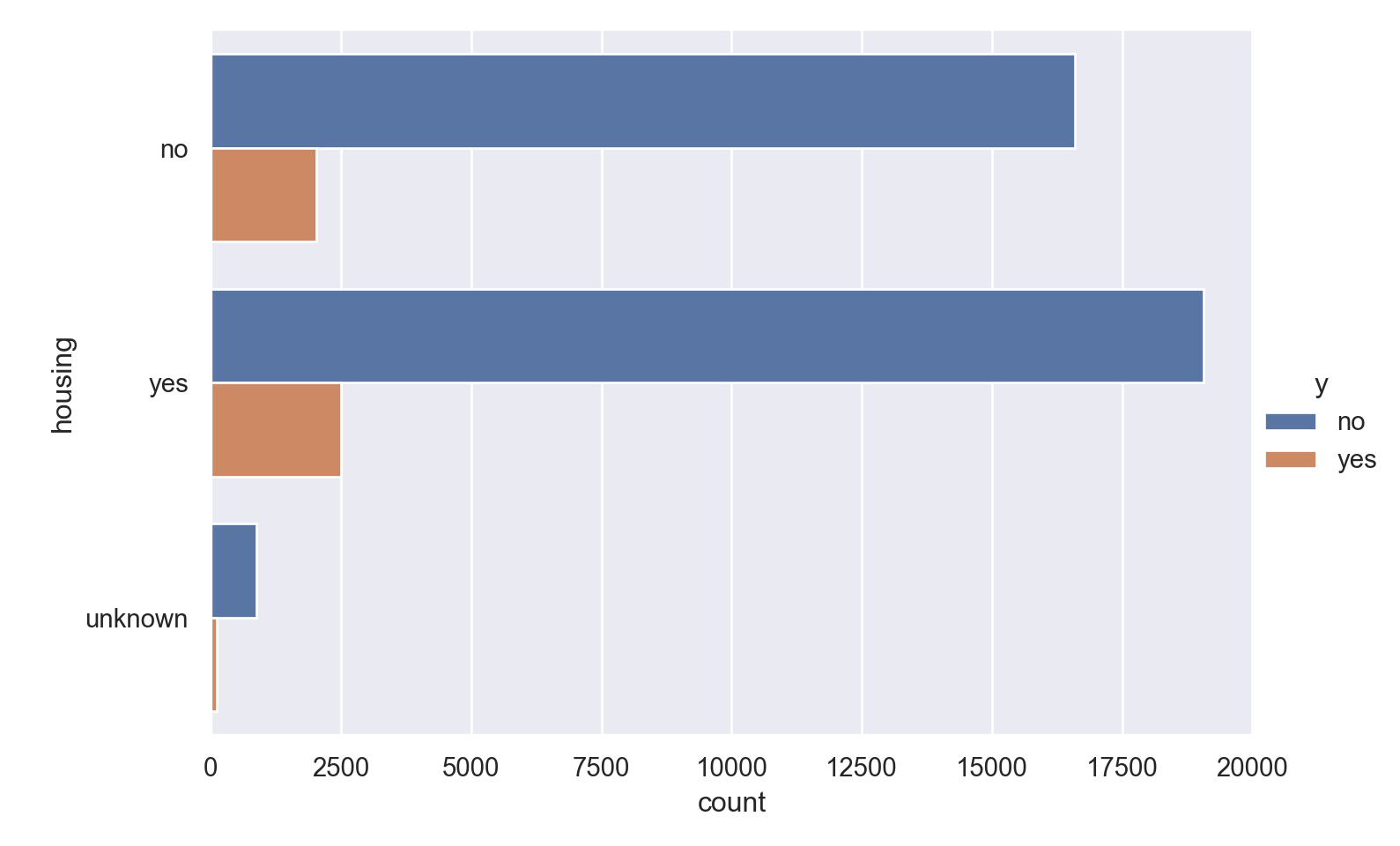

knitr::kable(get_proportions(data_bank_marketing, 'housing', 'y') %>% rename(housing = rowname) %>% rename(overall = n) %>% arrange(desc(yes)))| housing | no | yes | overall |

|---|---|---|---|

| yes | 88.38061 | 11.61939 | 52.384190 |

| no | 89.12040 | 10.87960 | 45.212198 |

| unknown | 89.19192 | 10.80808 | 2.403613 |

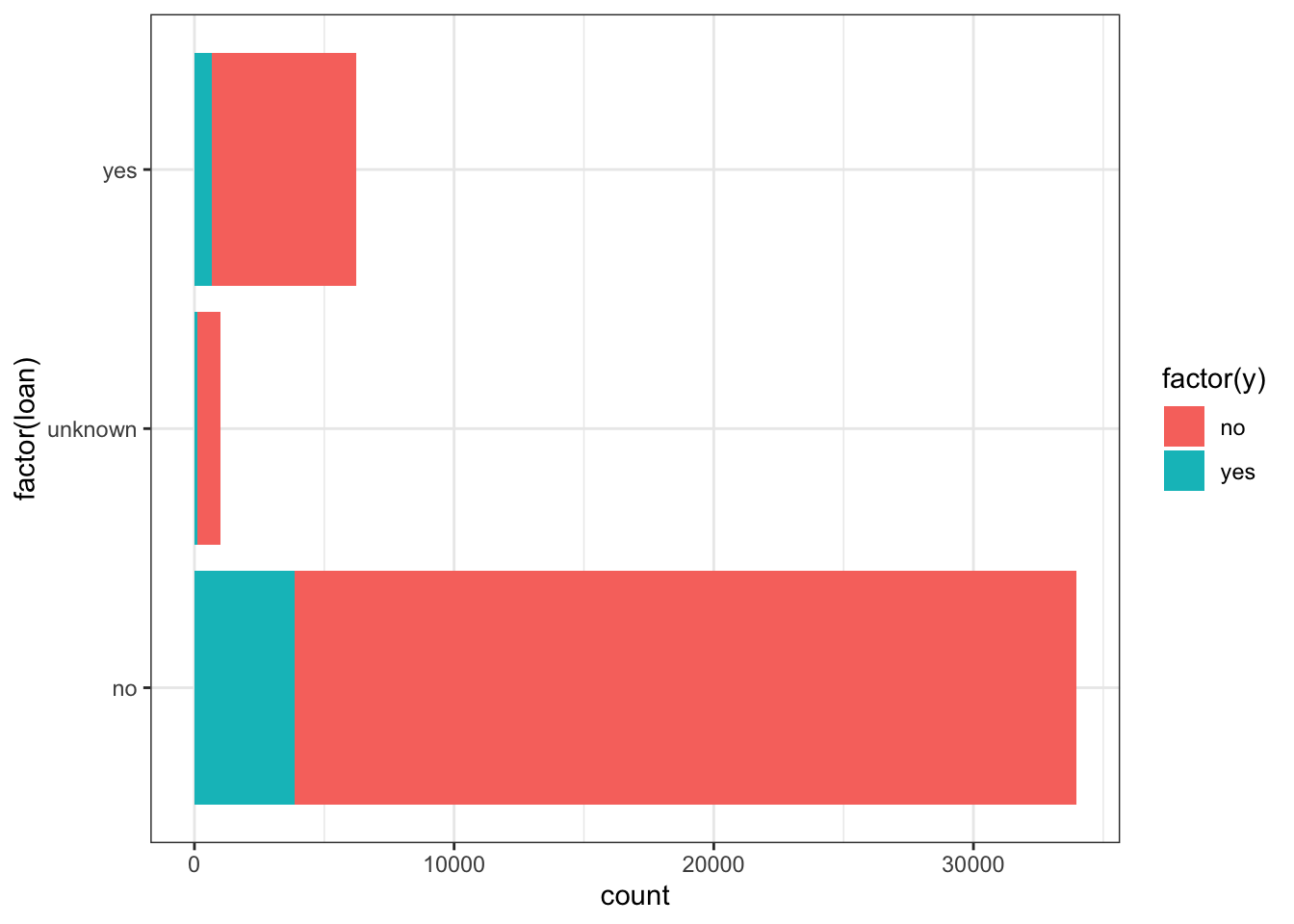

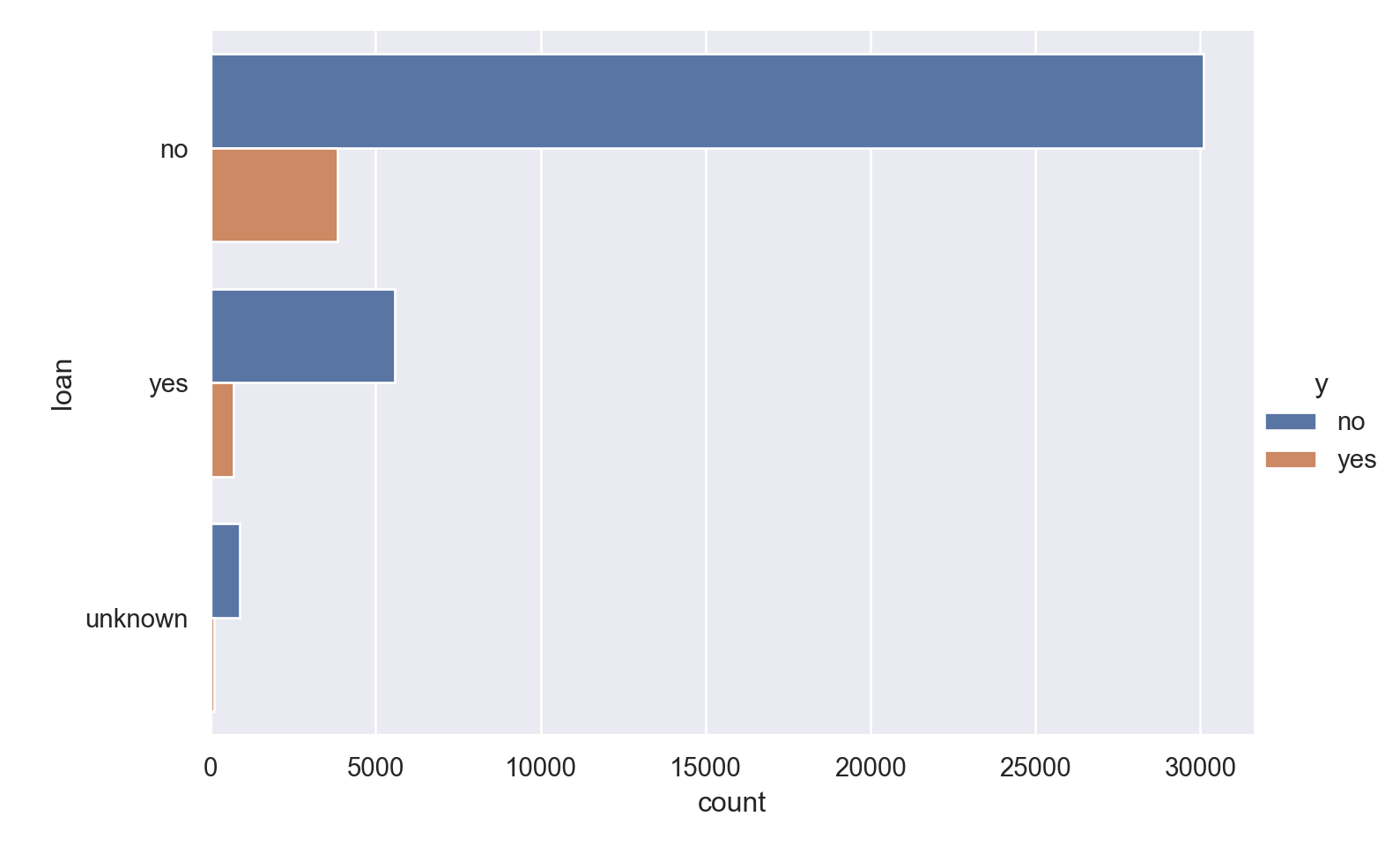

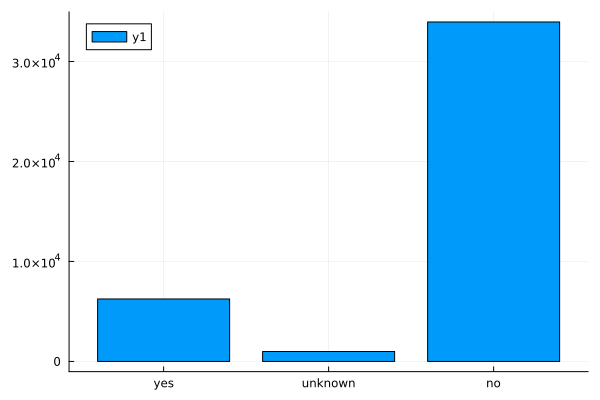

knitr::kable(get_proportions(data_bank_marketing, 'loan', 'y') %>% rename(loan = rowname) %>% rename(overall = n) %>% arrange(desc(yes)))| loan | no | yes | overall |

|---|---|---|---|

| no | 88.65979 | 11.34021 | 82.426920 |

| yes | 89.06850 | 10.93150 | 15.169467 |

| unknown | 89.19192 | 10.80808 | 2.403613 |

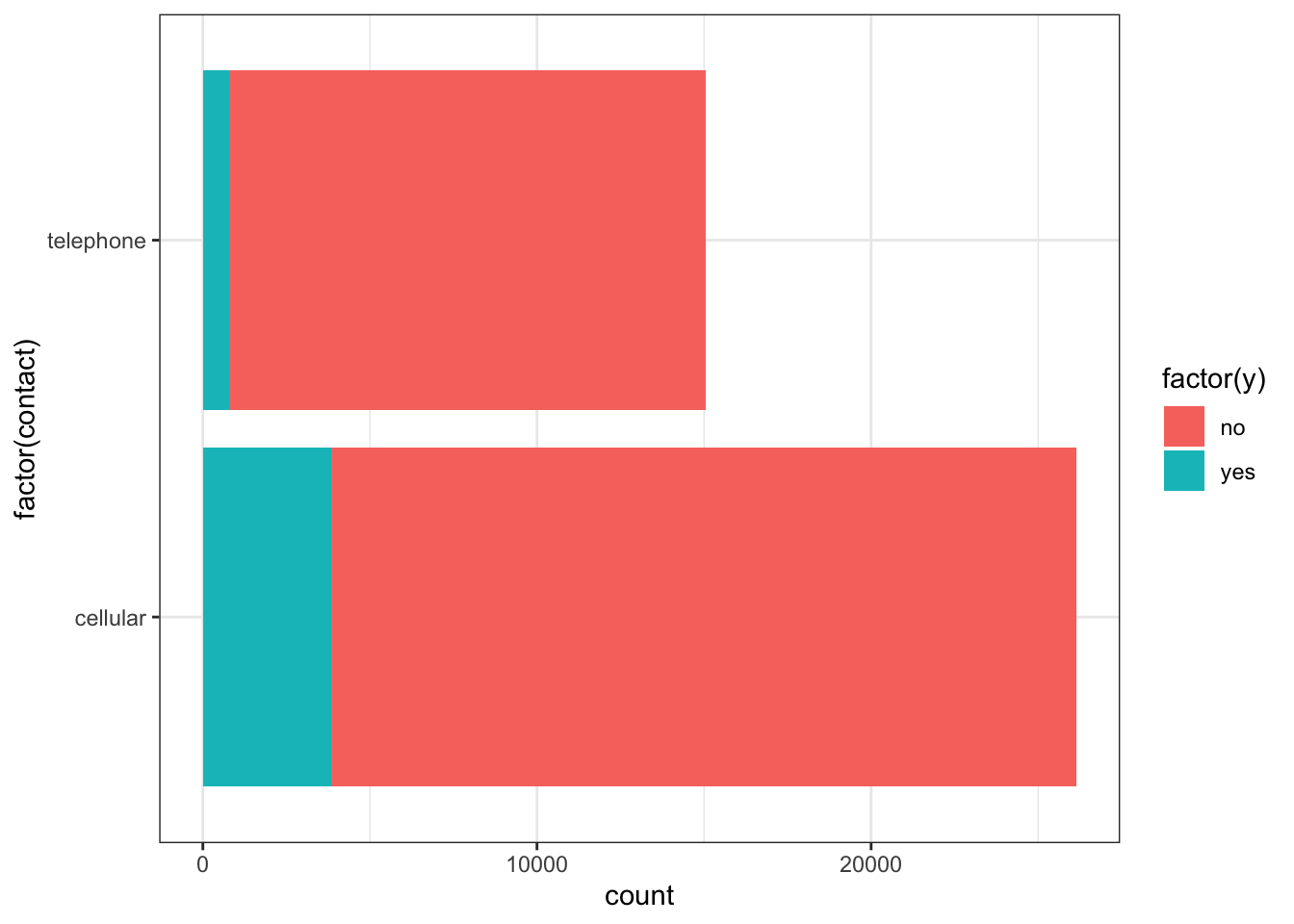

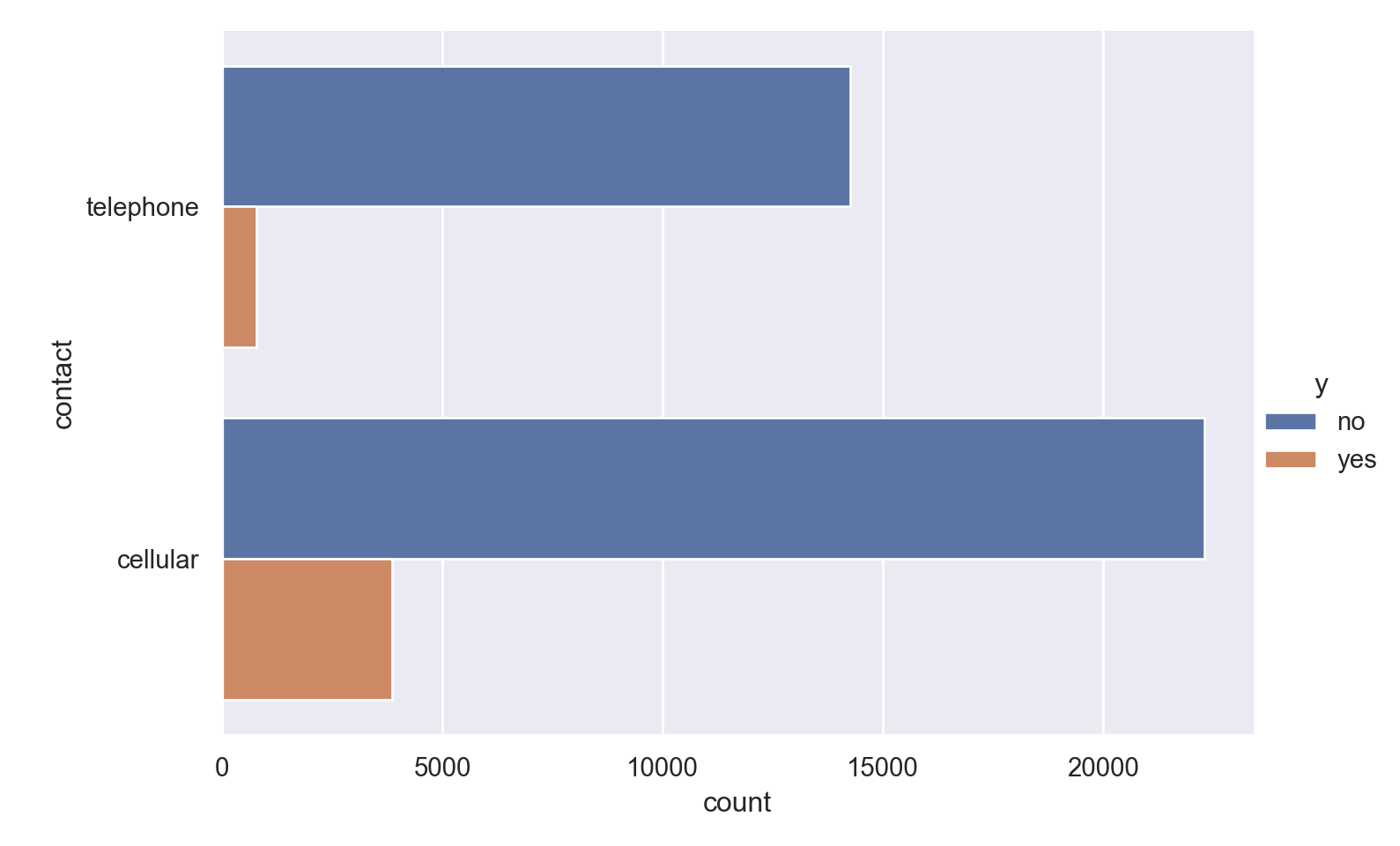

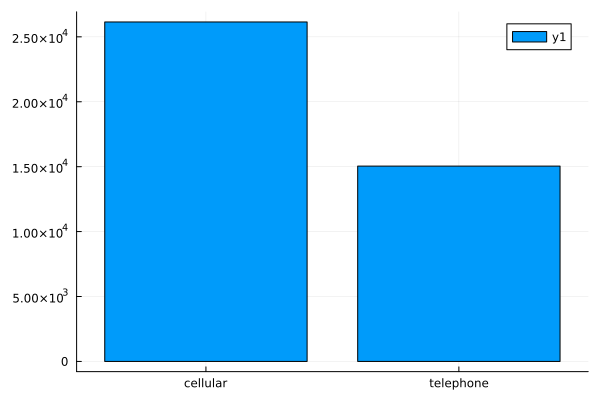

knitr::kable(get_proportions(data_bank_marketing, 'contact', 'y') %>% rename(contact = rowname) %>% rename(overall = n) %>% arrange(desc(yes)))| contact | no | yes | overall |

|---|---|---|---|

| cellular | 85.26239 | 14.737607 | 63.4748 |

| telephone | 94.76868 | 5.231321 | 36.5252 |

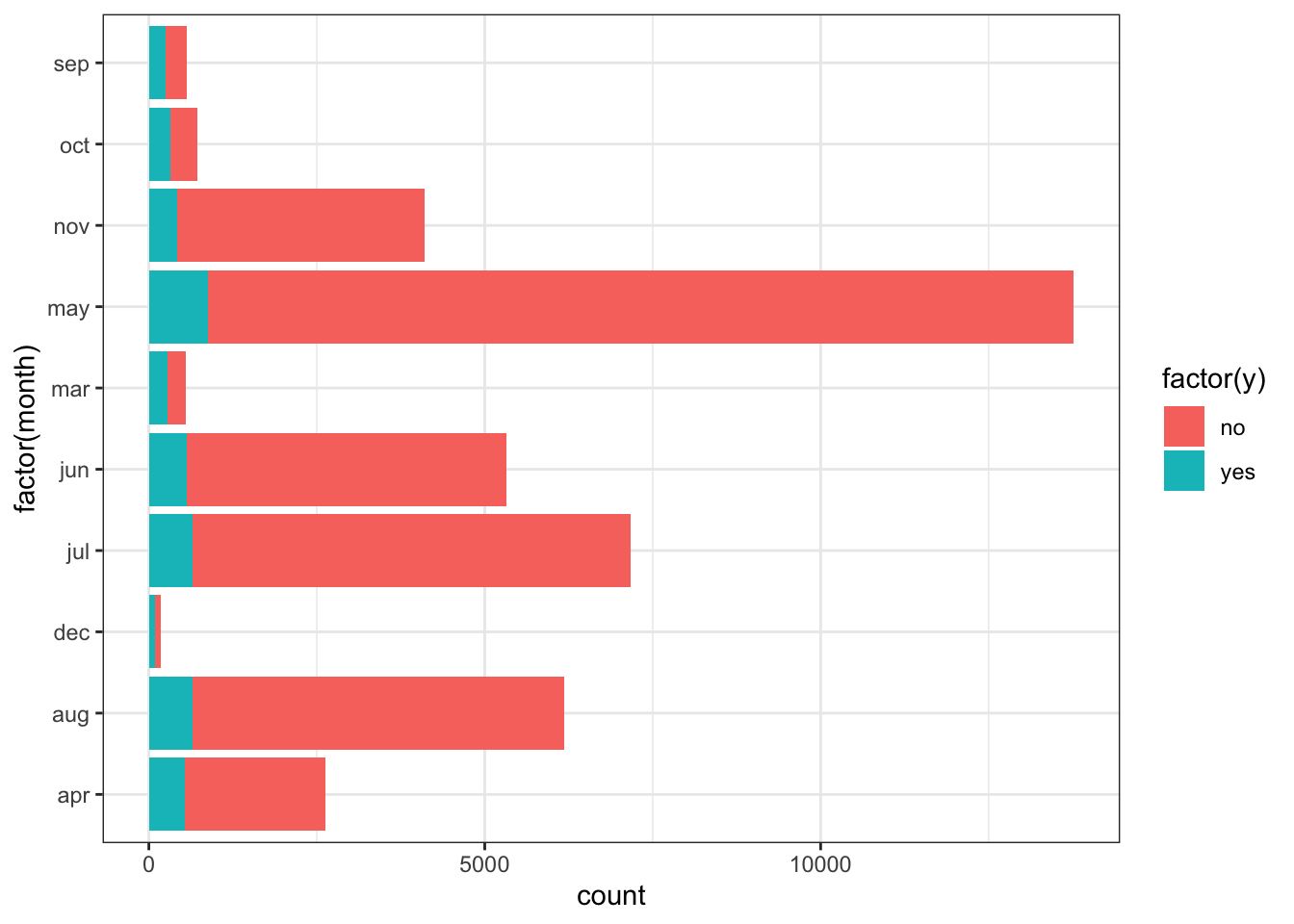

knitr::kable(get_proportions(data_bank_marketing, 'month', 'y') %>% rename(month = rowname) %>% rename(overall = n) %>% arrange(desc(yes)))| month | no | yes | overall |

|---|---|---|---|

| mar | 49.45055 | 50.549450 | 1.3256288 |

| dec | 51.09890 | 48.901099 | 0.4418763 |

| sep | 55.08772 | 44.912281 | 1.3838982 |

| oct | 56.12813 | 43.871866 | 1.7432262 |

| apr | 79.52128 | 20.478723 | 6.3902107 |

| aug | 89.39786 | 10.602137 | 14.9995144 |

| jun | 89.48853 | 10.511470 | 12.9115276 |

| nov | 89.85613 | 10.143867 | 9.9567835 |

| jul | 90.95344 | 9.046557 | 17.4176945 |

| may | 93.56526 | 6.434745 | 33.4296397 |

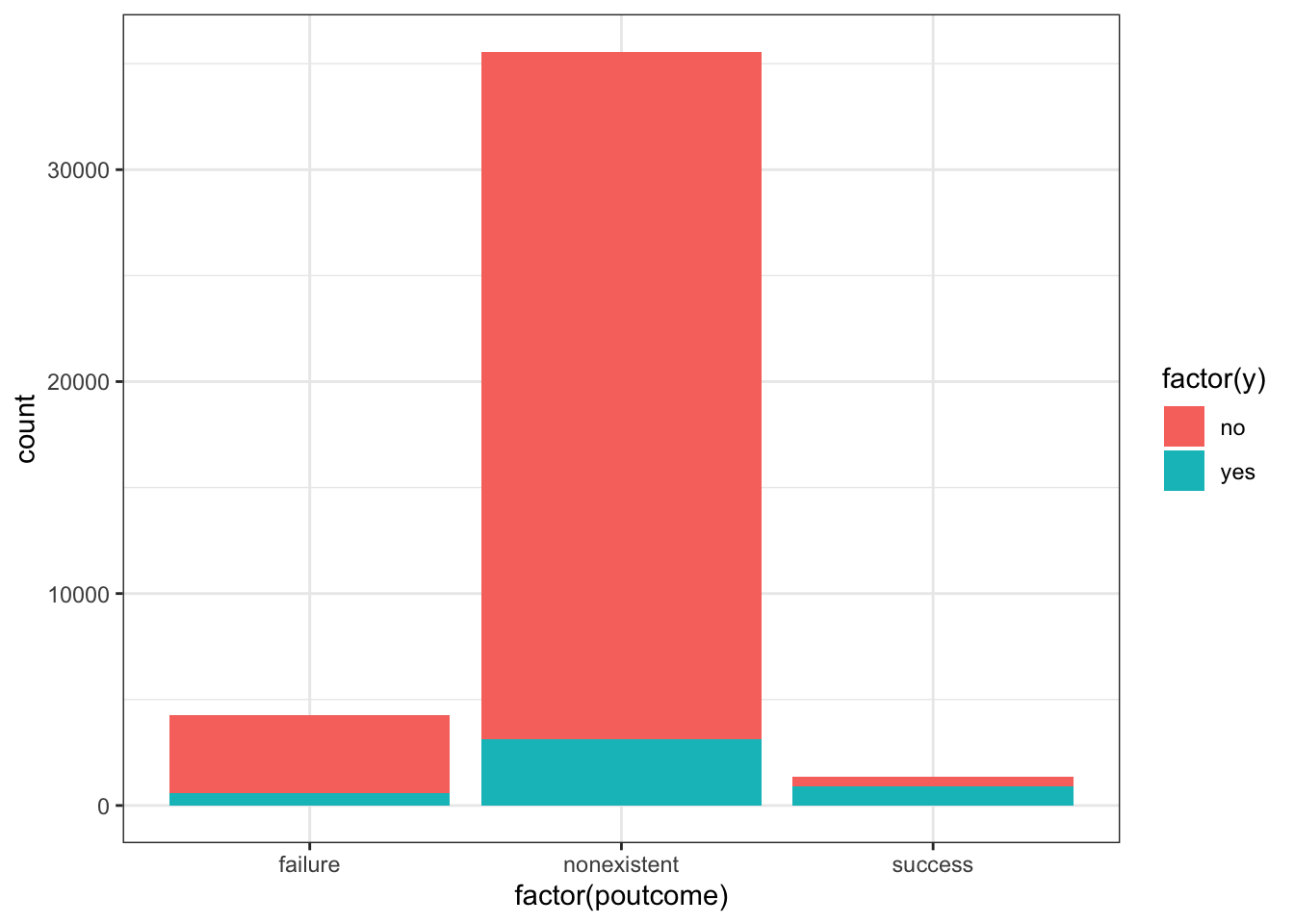

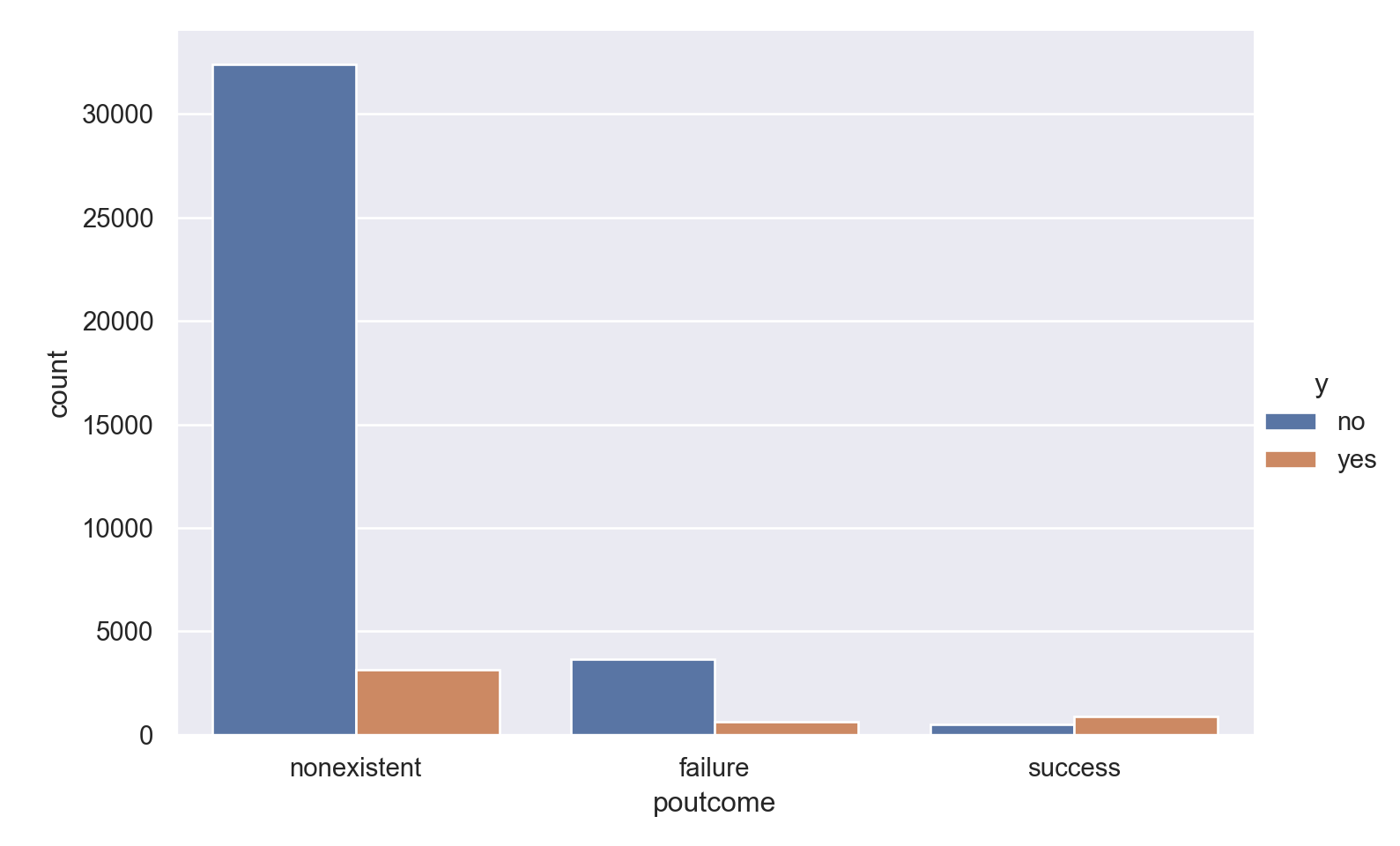

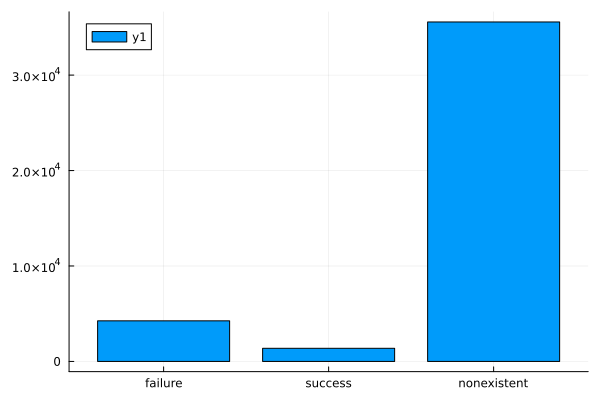

knitr::kable(get_proportions(data_bank_marketing, 'poutcome', 'y') %>% rename(poutcome = rowname) %>% rename(overall = n) %>% arrange(desc(yes)))| poutcome | no | yes | overall |

|---|---|---|---|

| success | 34.88711 | 65.112892 | 3.333495 |

| failure | 85.77140 | 14.228598 | 10.323395 |

| nonexistent | 91.16779 | 8.832213 | 86.343110 |

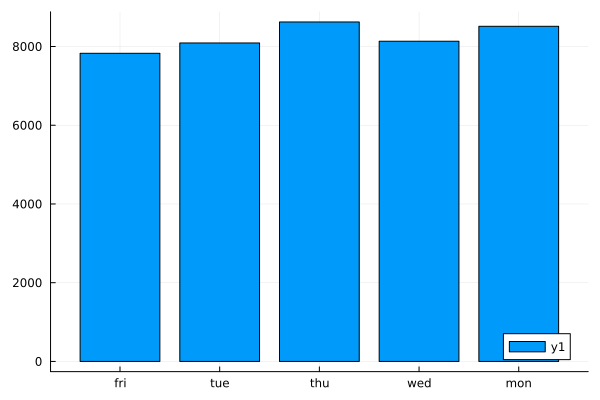

knitr::kable(get_proportions(data_bank_marketing, 'day_of_week', 'y') %>% rename(day_of_week = rowname) %>% rename(overall = n) %>% arrange(desc(yes)))| day_of_week | no | yes | overall |

|---|---|---|---|

| thu | 87.88125 | 12.11875 | 20.93571 |

| tue | 88.22002 | 11.77998 | 19.64164 |

| wed | 88.33292 | 11.66708 | 19.74847 |

| fri | 89.19126 | 10.80874 | 19.00311 |

| mon | 90.05168 | 9.94832 | 20.67107 |

def get_proportions(df, category, outcome):

df=data_bank_marketing[[category,outcome]].groupby(category).value_counts(normalize=True).mul(100)

df_overall=data_bank_marketing[[category]].groupby(category)

df_overall=(df_overall.value_counts()/sum(df_overall.value_counts())).mul(100)

df_overall=pd.DataFrame(df_overall).reset_index()

df_overall=df_overall.rename(columns={0:'overall'})

df_yes=df.iloc[1::2]

df_yes=pd.DataFrame(df_yes).reset_index().drop([outcome], axis = 1)

df_yes=df_yes.rename(columns={0:'yes'})

df_no=df.iloc[::2]

df_no=pd.DataFrame(df_no).reset_index().drop([outcome], axis = 1)

df_no=df_no.rename(columns={0:'no'})

final_df = df_no.join(df_yes['yes'])

final_df = final_df.join(df_overall['overall']).sort_values('yes', ascending=False)

return final_df

proportions=get_proportions(data_bank_marketing,'job', 'y')

dsp.Markdown(proportions.to_markdown(index=False))| job | no | yes | overall |

|---|---|---|---|

| student | 68.5714 | 31.4286 | 2.12441 |

| retired | 74.7674 | 25.2326 | 4.17597 |

| unemployed | 85.7988 | 14.2012 | 2.46188 |

| admin. | 87.0274 | 12.9726 | 25.3035 |

| management | 88.7825 | 11.2175 | 7.09916 |

| unknown | 88.7879 | 11.2121 | 0.801204 |

| technician | 89.174 | 10.826 | 16.3713 |

| self-employed | 89.5144 | 10.4856 | 3.45003 |

| housemaid | 90 | 10 | 2.57357 |

| entrepreneur | 91.4835 | 8.51648 | 3.53501 |

| services | 91.8619 | 8.13807 | 9.6363 |

| blue-collar | 93.1057 | 6.89432 | 22.4677 |

proportions=get_proportions(data_bank_marketing,'education', 'y')

dsp.Markdown(proportions.to_markdown(index=False))| education | no | yes | overall |

|---|---|---|---|

| illiterate | 77.7778 | 22.2222 | 0.043702 |

| unknown | 85.4997 | 14.5003 | 4.20268 |

| university.degree | 86.2755 | 13.7245 | 29.5426 |

| professional.course | 88.6515 | 11.3485 | 12.7294 |

| high.school | 89.1645 | 10.8355 | 23.1014 |

| basic.4y | 89.751 | 10.249 | 10.1389 |

| basic.6y | 91.7976 | 8.20244 | 5.56473 |

| basic.9y | 92.1754 | 7.82465 | 14.6766 |

proportions=get_proportions(data_bank_marketing, 'marital', 'y')

dsp.Markdown(proportions.to_markdown(index=False))| marital | no | yes | overall |

|---|---|---|---|

| unknown | 85 | 15 | 0.194231 |

| single | 85.9959 | 14.0041 | 28.0859 |

| divorced | 89.6791 | 10.3209 | 11.1974 |

| married | 89.8427 | 10.1573 | 60.5225 |

proportions=get_proportions(data_bank_marketing, 'default', 'y')

dsp.Markdown(proportions.to_markdown(index=False))| default | no | yes | overall |

|---|---|---|---|

| no | 87.121 | 12.879 | 79.1201 |

| unknown | 94.847 | 5.15296 | 20.8726 |

| yes | 100 | nan | 0.00728367 |

proportions=get_proportions(data_bank_marketing, 'housing', 'y')

dsp.Markdown(proportions.to_markdown(index=False))| housing | no | yes | overall |

|---|---|---|---|

| yes | 88.3806 | 11.6194 | 52.3842 |

| no | 89.1204 | 10.8796 | 45.2122 |

| unknown | 89.1919 | 10.8081 | 2.40361 |

proportions=get_proportions(data_bank_marketing, 'loan', 'y')

dsp.Markdown(proportions.to_markdown(index=False))| loan | no | yes | overall |

|---|---|---|---|

| no | 88.6598 | 11.3402 | 82.4269 |

| yes | 89.0685 | 10.9315 | 15.1695 |

| unknown | 89.1919 | 10.8081 | 2.40361 |

proportions=get_proportions(data_bank_marketing, 'contact', 'y')

dsp.Markdown(proportions.to_markdown(index=False))| contact | no | yes | overall |

|---|---|---|---|

| cellular | 85.2624 | 14.7376 | 63.4748 |

| telephone | 94.7687 | 5.23132 | 36.5252 |

proportions=get_proportions(data_bank_marketing, 'month', 'y')

dsp.Markdown(proportions.to_markdown(index=False))| month | no | yes | overall |

|---|---|---|---|

| mar | 50.5495 | 49.4505 | 1.32563 |

| dec | 51.0989 | 48.9011 | 0.441876 |

| sep | 55.0877 | 44.9123 | 1.3839 |

| oct | 56.1281 | 43.8719 | 1.74323 |

| apr | 79.5213 | 20.4787 | 6.39021 |

| aug | 89.3979 | 10.6021 | 14.9995 |

| jun | 89.4885 | 10.5115 | 12.9115 |

| nov | 89.8561 | 10.1439 | 9.95678 |

| jul | 90.9534 | 9.04656 | 17.4177 |

| may | 93.5653 | 6.43474 | 33.4296 |

proportions=get_proportions(data_bank_marketing, 'poutcome', 'y')

dsp.Markdown(proportions.to_markdown(index=False))| poutcome | no | yes | overall |

|---|---|---|---|

| success | 65.1129 | 34.8871 | 3.3335 |

| failure | 85.7714 | 14.2286 | 10.3234 |

| nonexistent | 91.1678 | 8.83221 | 86.3431 |

proportions=get_proportions(data_bank_marketing, 'day_of_week', 'y')

dsp.Markdown(proportions.to_markdown(index=False))| day_of_week | no | yes | overall |

|---|---|---|---|

| thu | 87.8812 | 12.1188 | 20.9357 |

| tue | 88.22 | 11.78 | 19.6416 |

| wed | 88.3329 | 11.6671 | 19.7485 |

| fri | 89.1913 | 10.8087 | 19.0031 |

| mon | 90.0517 | 9.94832 | 20.6711 |

function get_proportions(df::DataFrame, category::String, outcome::String, filter_str::String)

gdf_outcome = groupby(df, [category, outcome])

D = DataFrame(combine(gdf_outcome, nrow))

counts_1=@chain D begin

filter(outcome => isequal(filter_str), _)

select(:nrow)

end

counts_2=@chain D begin

filter(outcome => !isequal(filter_str), _)

select(:nrow)

end

if nrow(counts_1) != nrow(counts_2)

diff = nrow(counts_1) - nrow(counts_2)

U = counts_1

if diff > 0 #counts_1 has more rows

U = counts_2

end

i=0

while i < abs(diff)

push!(U, [0])

i += 1

end

end

rename!(counts_1, :nrow=>:yes)

rename!(counts_2, :nrow=>:no)

counts=DataFrame(hcat(counts_1,counts_2))

@transform!(counts, :all = :yes .+ :no)

@transform!(counts, :prop = :yes ./ :all)

@transform!(counts, :overall = :all ./ nrow(df))

counts.prop .*= 100

counts.overall .*= 100

N = unique(select(D, category))

sort!(hcat(N,select(counts,[:prop,:overall])), :prop, rev=true)

endget_proportions (generic function with 1 method)12×3 DataFrame

Row │ job prop overall

│ String15 Float64 Float64

─────┼────────────────────────────────────

1 │ student 31.4286 2.12441

2 │ retired 25.2326 4.17597

3 │ unemployed 14.2012 2.46188

4 │ admin. 12.9726 25.3035

5 │ management 11.2175 7.09916

6 │ unknown 11.2121 0.801204

7 │ technician 10.826 16.3713

8 │ self-employed 10.4856 3.45003

9 │ housemaid 10.0 2.57357

10 │ entrepreneur 8.51648 3.53501

11 │ services 8.13807 9.6363

12 │ blue-collar 6.89432 22.46778×3 DataFrame

Row │ education prop overall

│ String31 Float64 Float64

─────┼──────────────────────────────────────────

1 │ illiterate 22.2222 0.043702

2 │ unknown 14.5003 4.20268

3 │ university.degree 13.7245 29.5426

4 │ professional.course 11.3485 12.7294

5 │ high.school 10.8355 23.1014

6 │ basic.4y 10.249 10.1389

7 │ basic.6y 8.20244 5.56473

8 │ basic.9y 7.82465 14.67664×3 DataFrame

Row │ marital prop overall

│ String15 Float64 Float64

─────┼──────────────────────────────

1 │ unknown 15.0 0.194231

2 │ single 14.0041 28.0859

3 │ divorced 10.3209 11.1974

4 │ married 10.1573 60.52253×3 DataFrame

Row │ default prop overall

│ String7 Float64 Float64

─────┼────────────────────────────────

1 │ no 12.879 79.1201

2 │ unknown 5.15296 20.8726

3 │ yes 0.0 0.007283673×3 DataFrame

Row │ housing prop overall

│ String7 Float64 Float64

─────┼────────────────────────────

1 │ yes 11.6194 52.3842

2 │ no 10.8796 45.2122

3 │ unknown 10.8081 2.403613×3 DataFrame

Row │ loan prop overall

│ String7 Float64 Float64

─────┼────────────────────────────

1 │ no 11.3402 82.4269

2 │ yes 10.9315 15.1695

3 │ unknown 10.8081 2.403612×3 DataFrame

Row │ contact prop overall

│ String15 Float64 Float64

─────┼──────────────────────────────

1 │ cellular 14.7376 63.4748

2 │ telephone 5.23132 36.525210×3 DataFrame

Row │ month prop overall

│ String3 Float64 Float64

─────┼──────────────────────────────

1 │ mar 50.5495 1.32563

2 │ dec 48.9011 0.441876

3 │ sep 44.9123 1.3839

4 │ oct 43.8719 1.74323

5 │ apr 20.4787 6.39021

6 │ aug 10.6021 14.9995

7 │ jun 10.5115 12.9115

8 │ nov 10.1439 9.95678

9 │ jul 9.04656 17.4177

10 │ may 6.43474 33.4296Observations

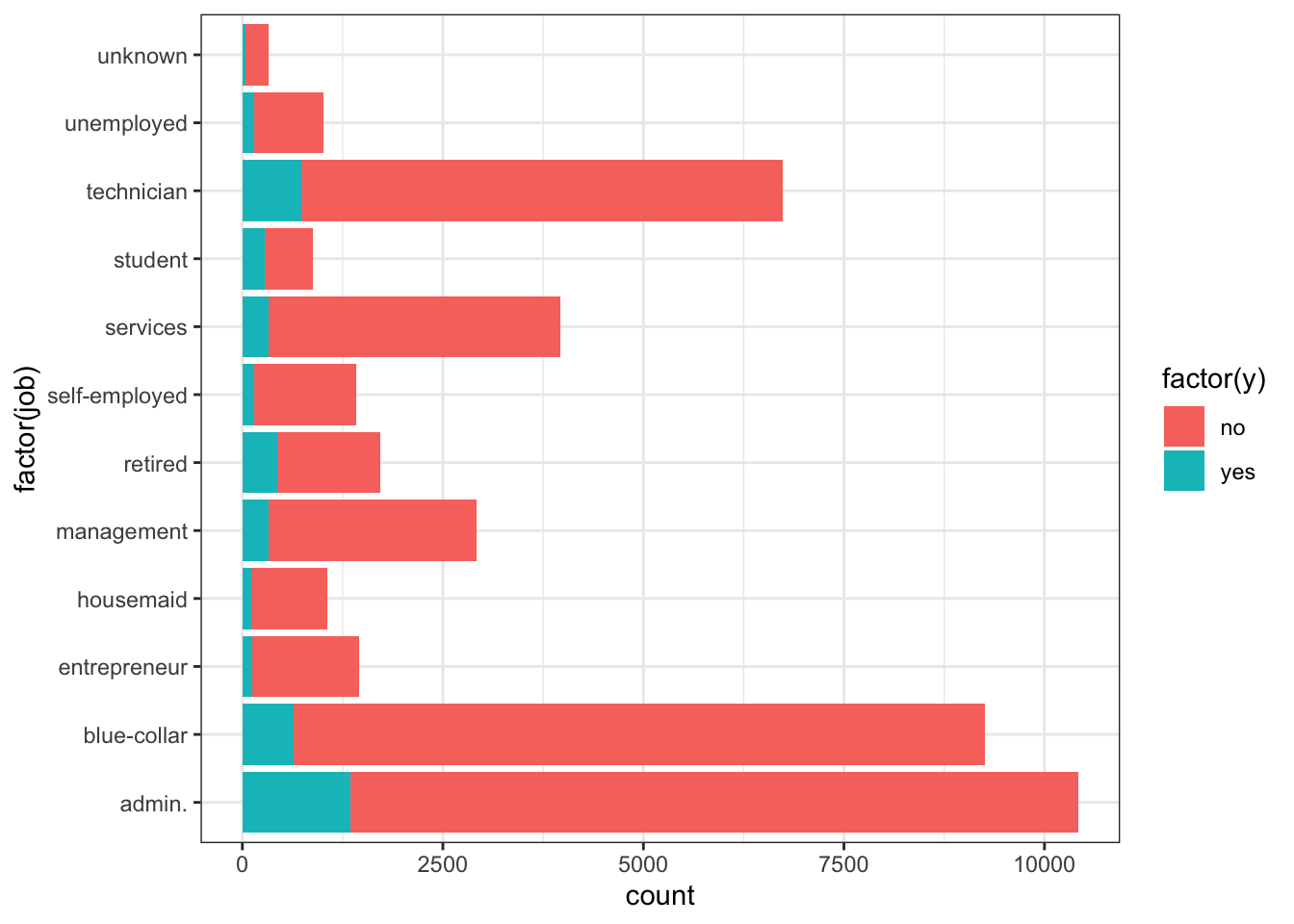

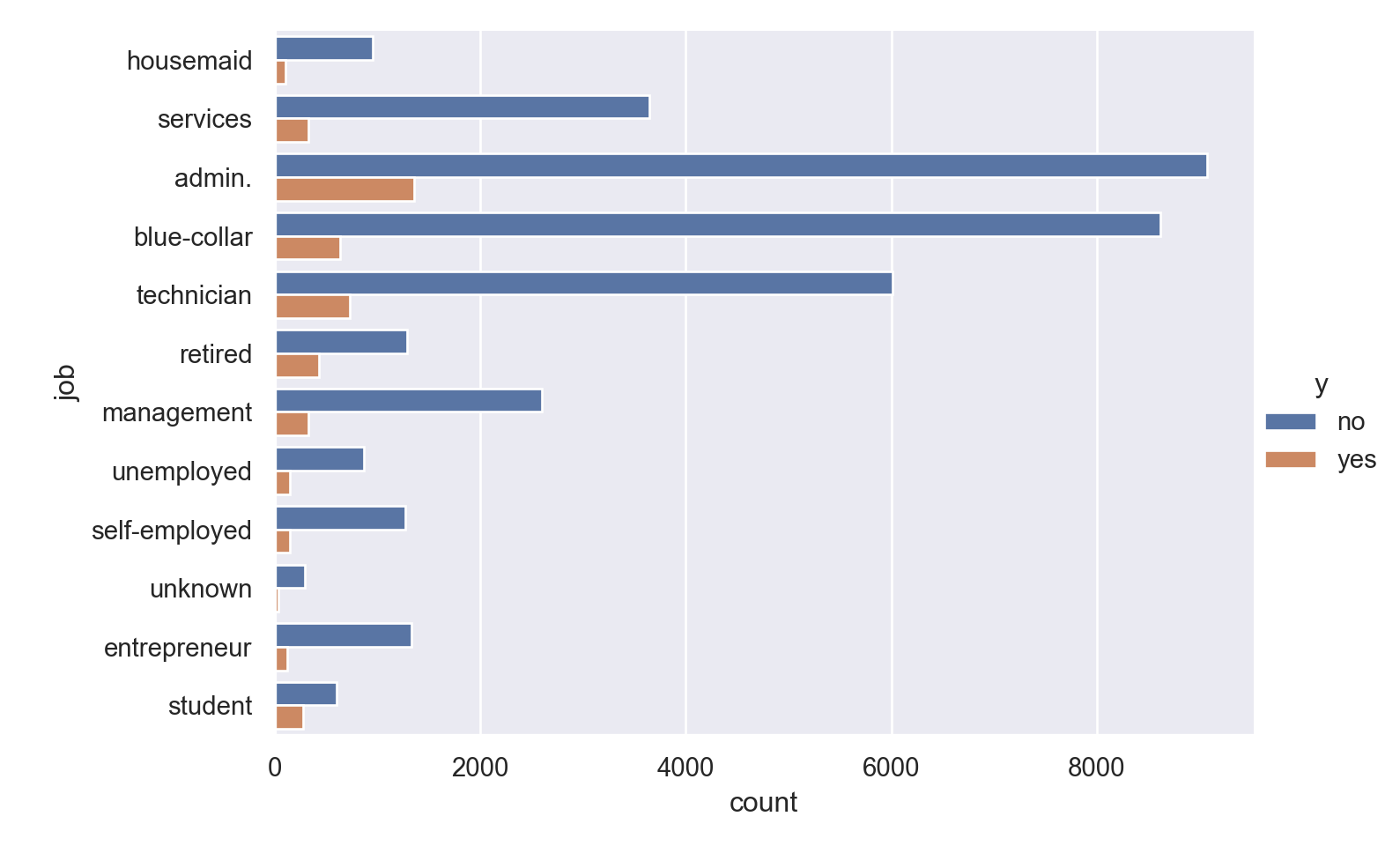

job: There is higher percentage of yes outcome for students and retired persons, but the overall proportion of these categories is low. Perhaps a targeted campaign could be fruitful. Among the higher frequencies, admin has higher proportion of yes outcome.

education: There is higher percentage of yes outcome for illiterate - but this number can be ignored as the frequency of the category is negligible. Among the higher frequencies, university.degree has the highest positive outcome.

marital: unknown and single people have the highest positive outcome.

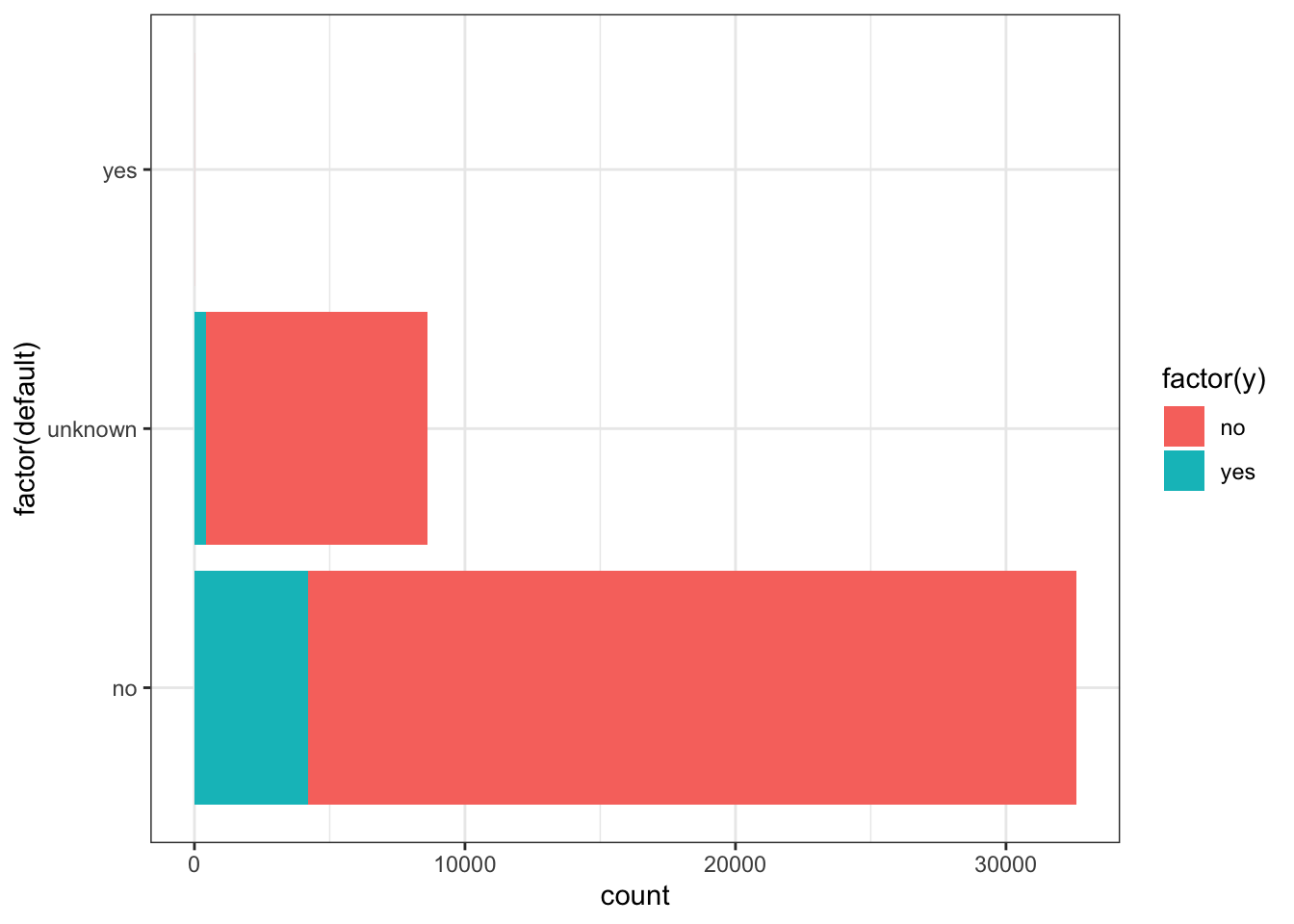

default: Very few people have credit defaults; none of those that do opt for the deposit

housing: Those having housing loans are slightly more likely to opt for the deposit; but the difference is only 1%

contact: Curiously, those contacted on cellular phones have a significantly higher possibility of subscribing to the deposit; this may be worth investigating further to determine causation.

month: For some reason, the months where there were much fewer calls have a much larger chance of subscribing for the loan. This definitely seems to be worthy of further investigation

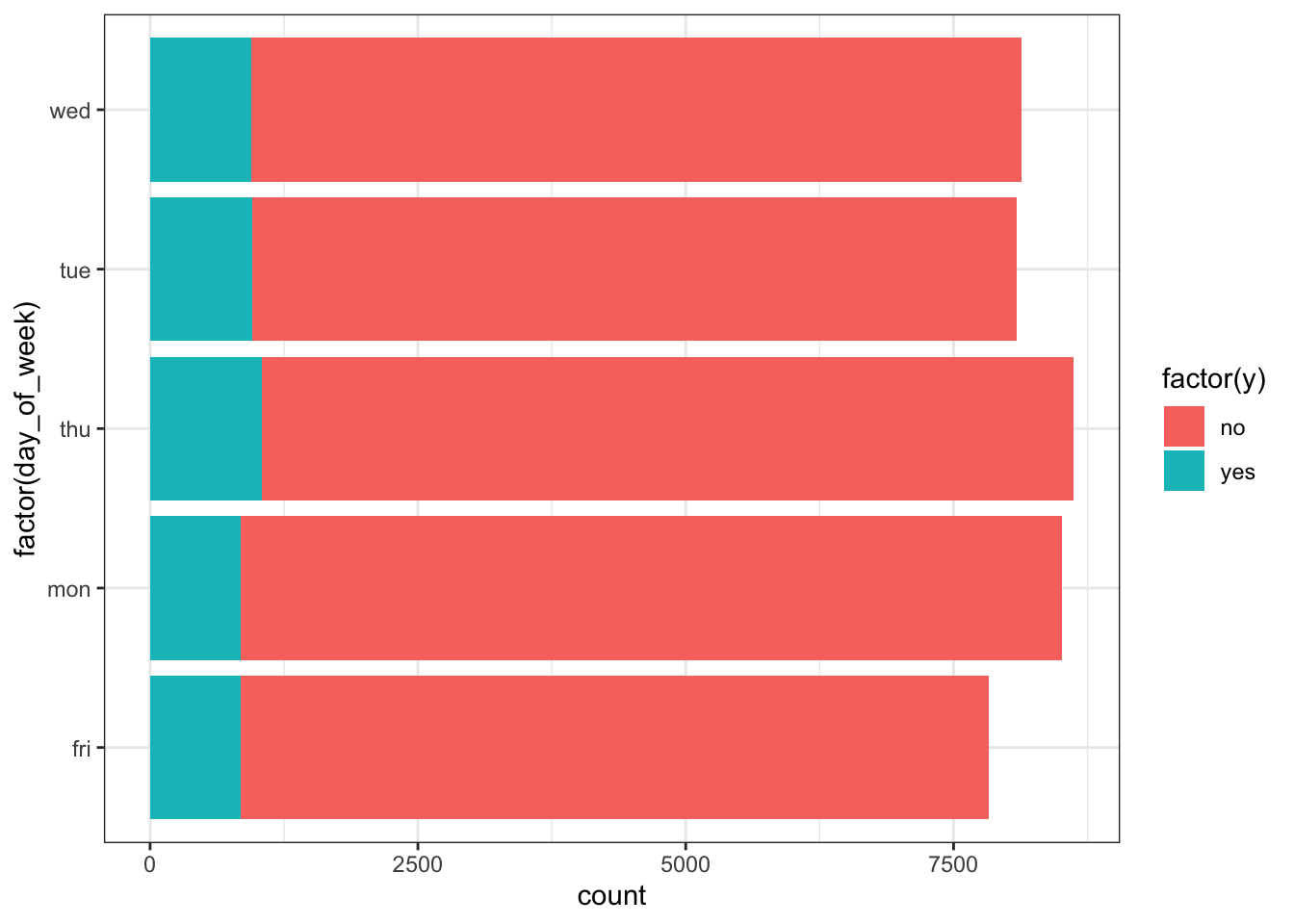

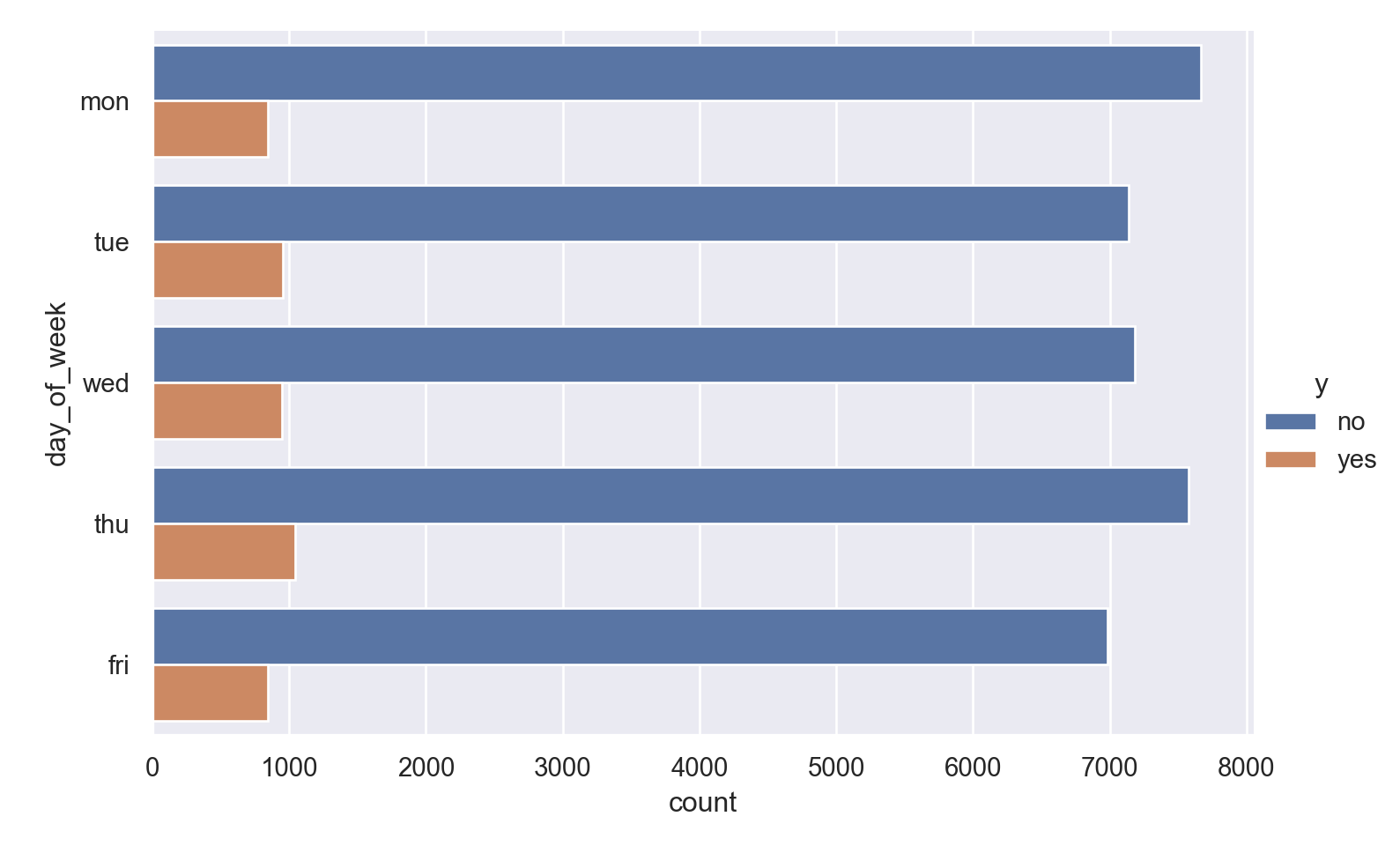

day_of_week: Not a significant difference in outcome across the days of the week; though Thursdays have a slightly higher chance of positive outcome, and Mondays slightly lower.

- Apply relevant transformations to reduce positive and negative skews in the data.

Numeric Attributes

Observations

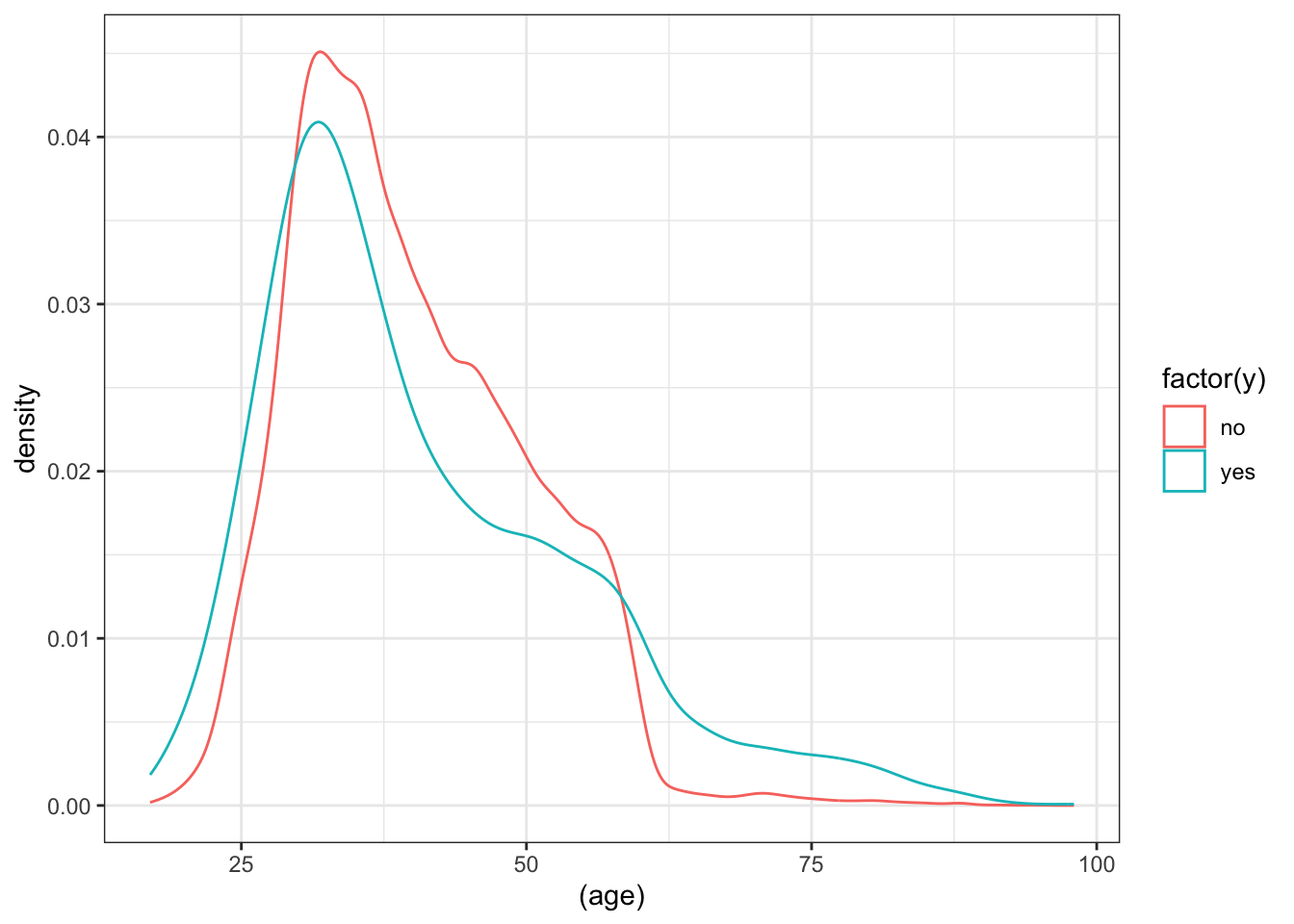

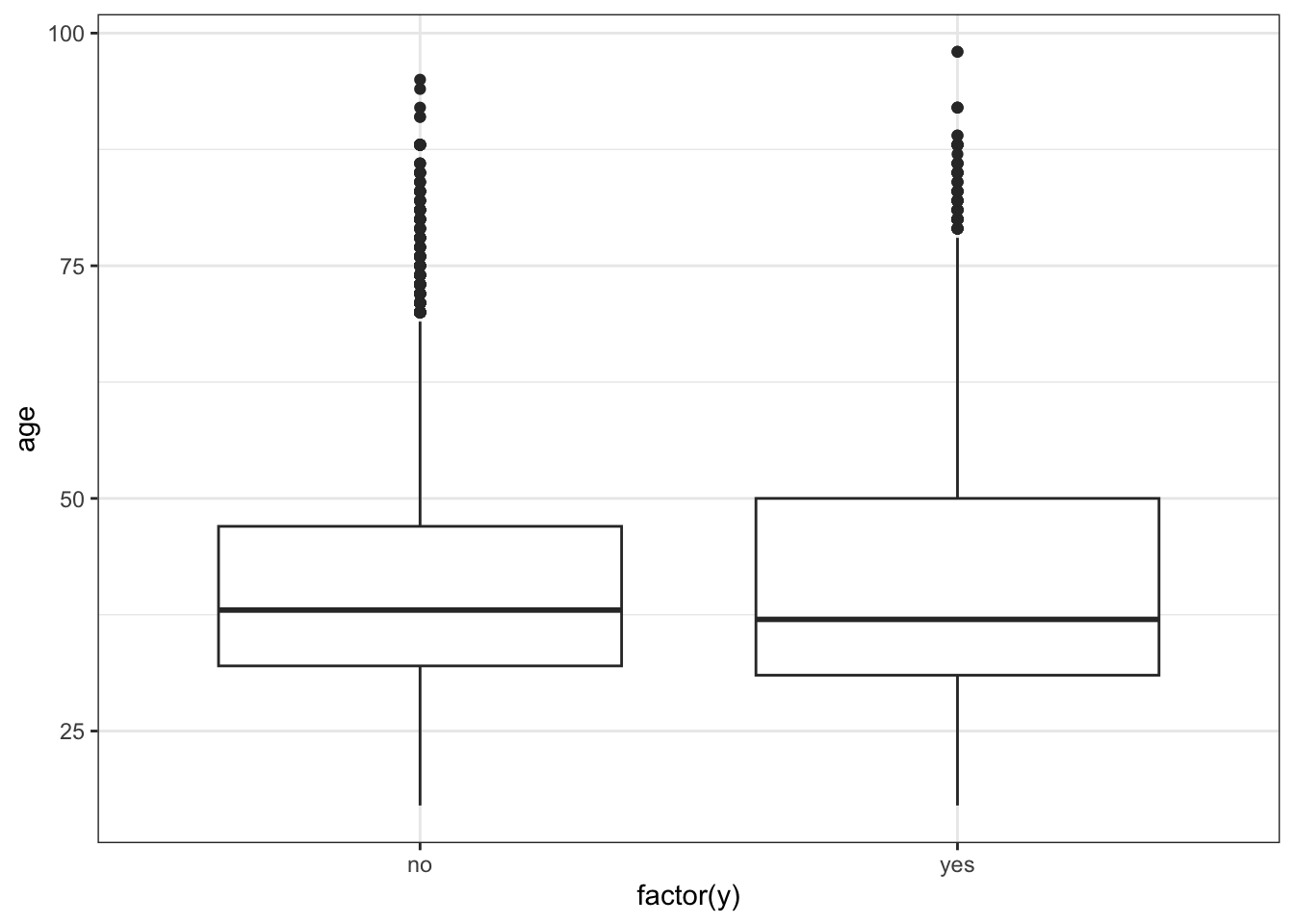

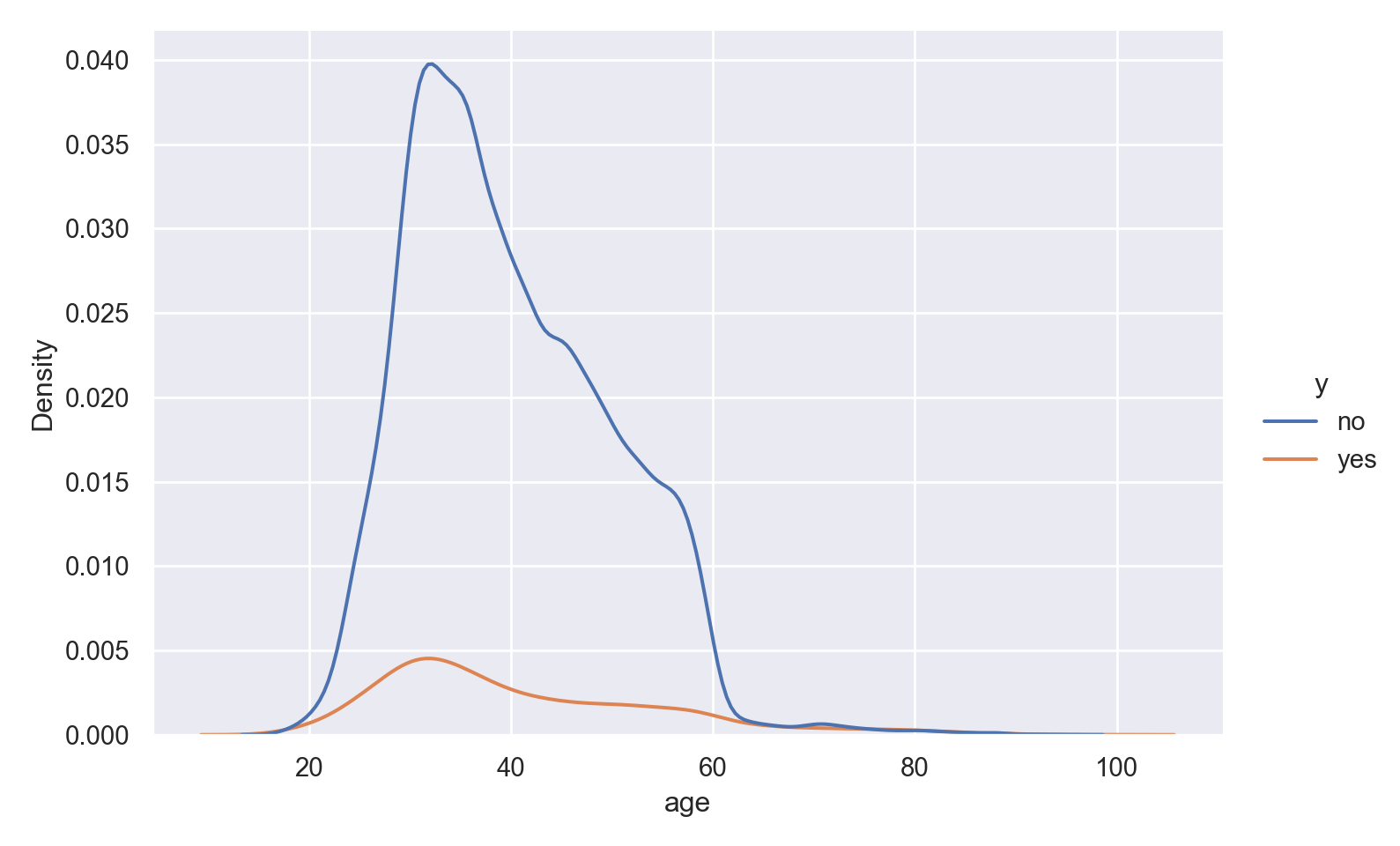

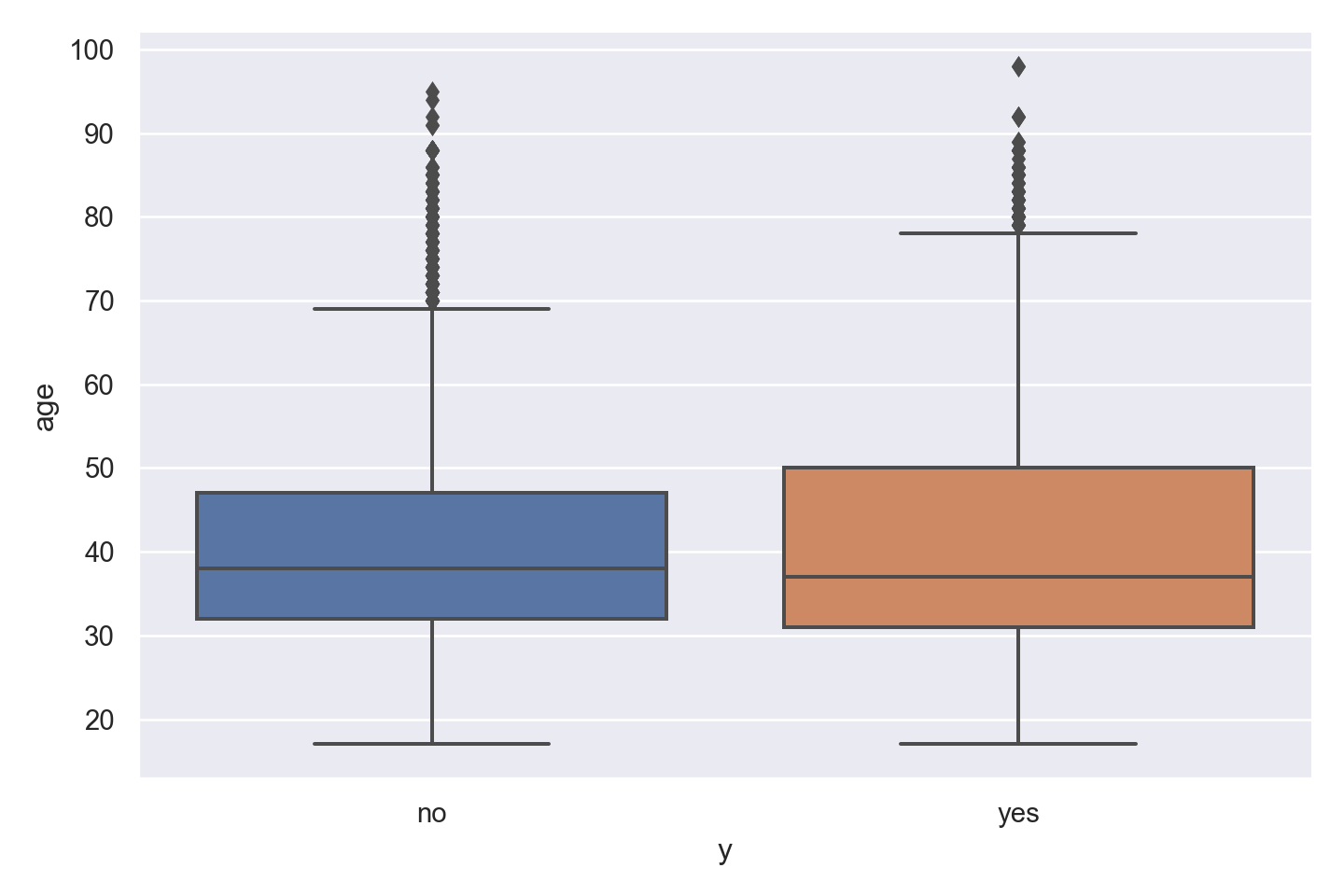

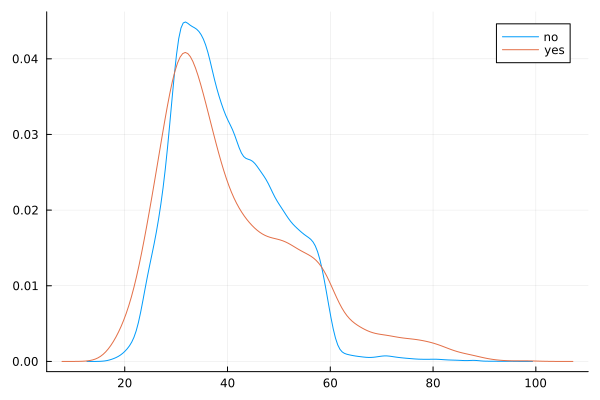

The data is right (positively) skewed, with more younger respondents.

The density curve indicates higher ‘yes’ outcome for age < 26 and age > 60, which was also seen in the numerical inspection.

The boxplot shows slightly more variation for ‘yes’ outcome, but median value of age is similar for both outcomes, with just a slightly lower age associated with ‘yes’ outcome.

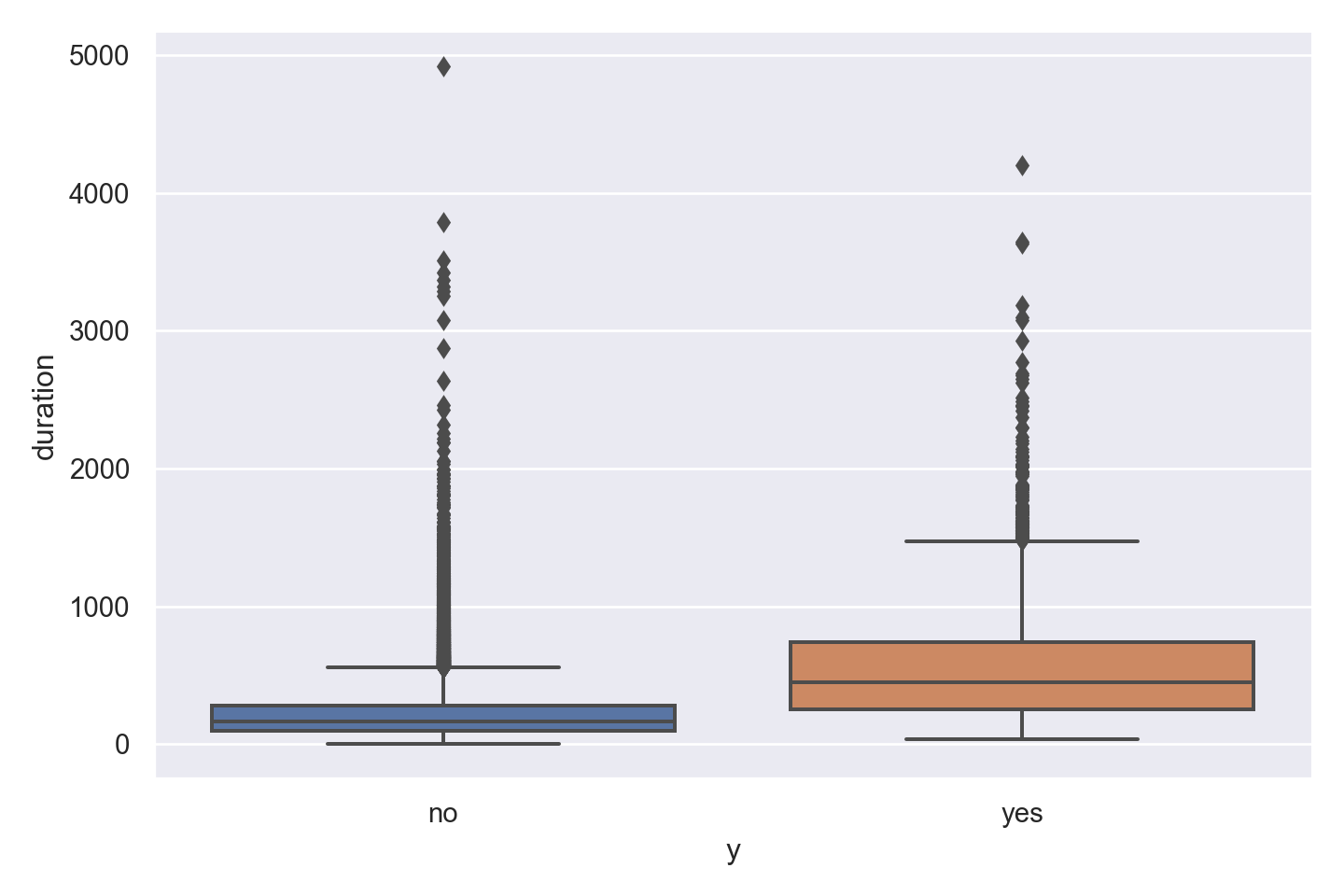

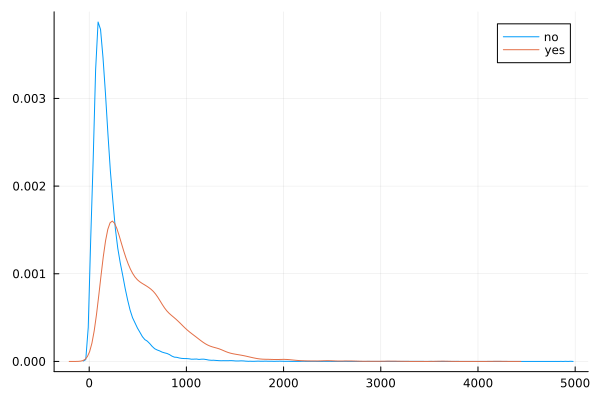

Observations

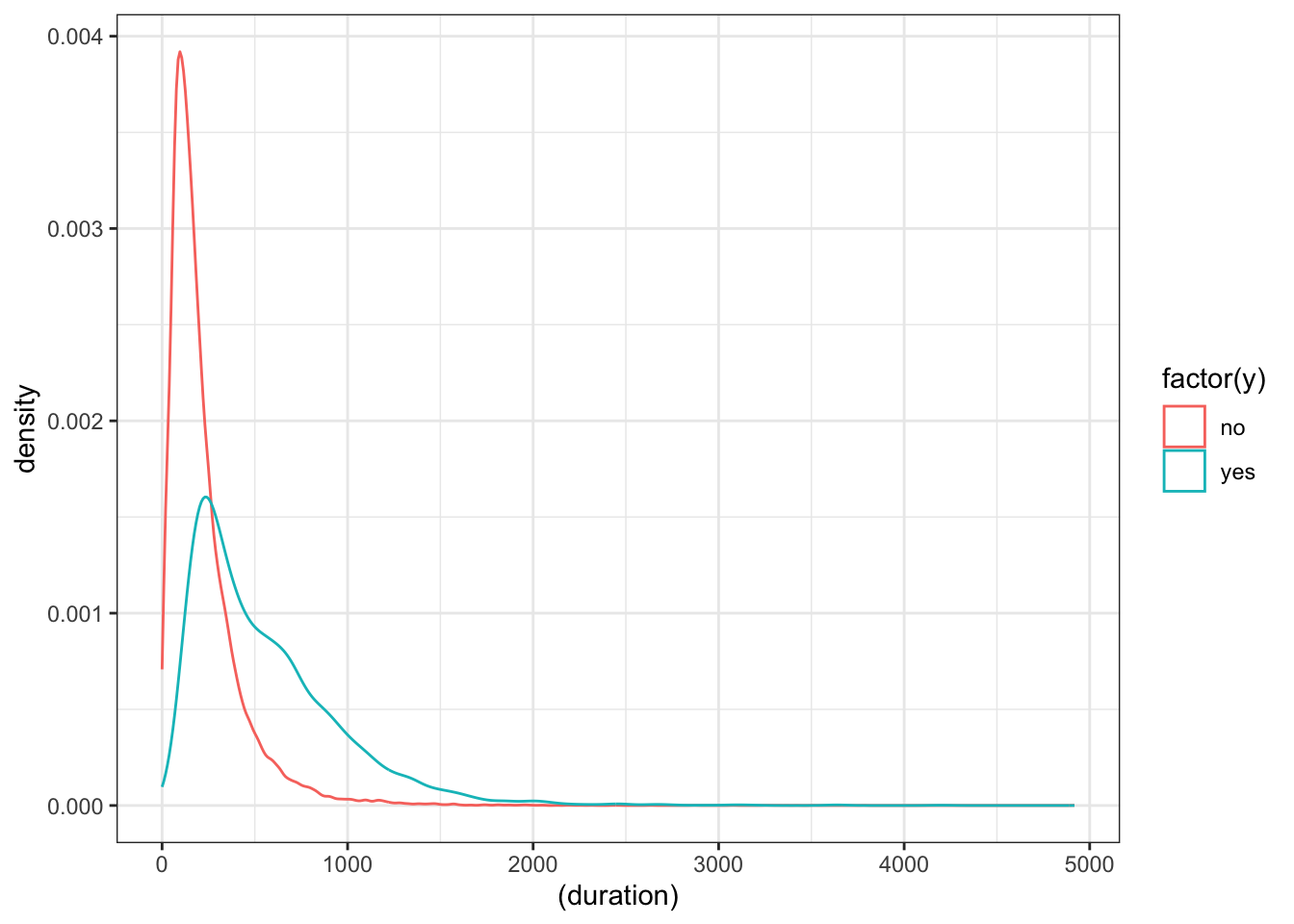

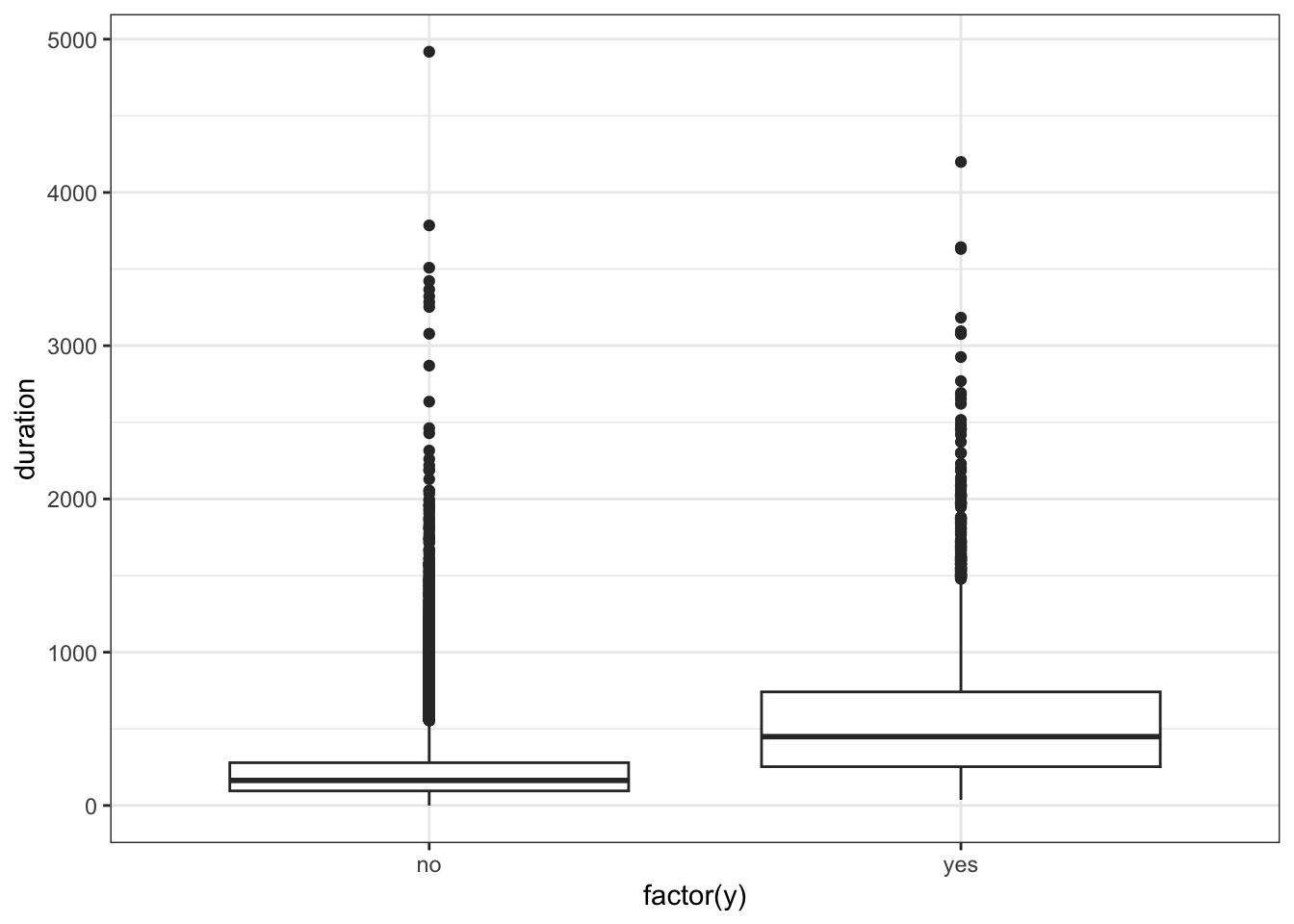

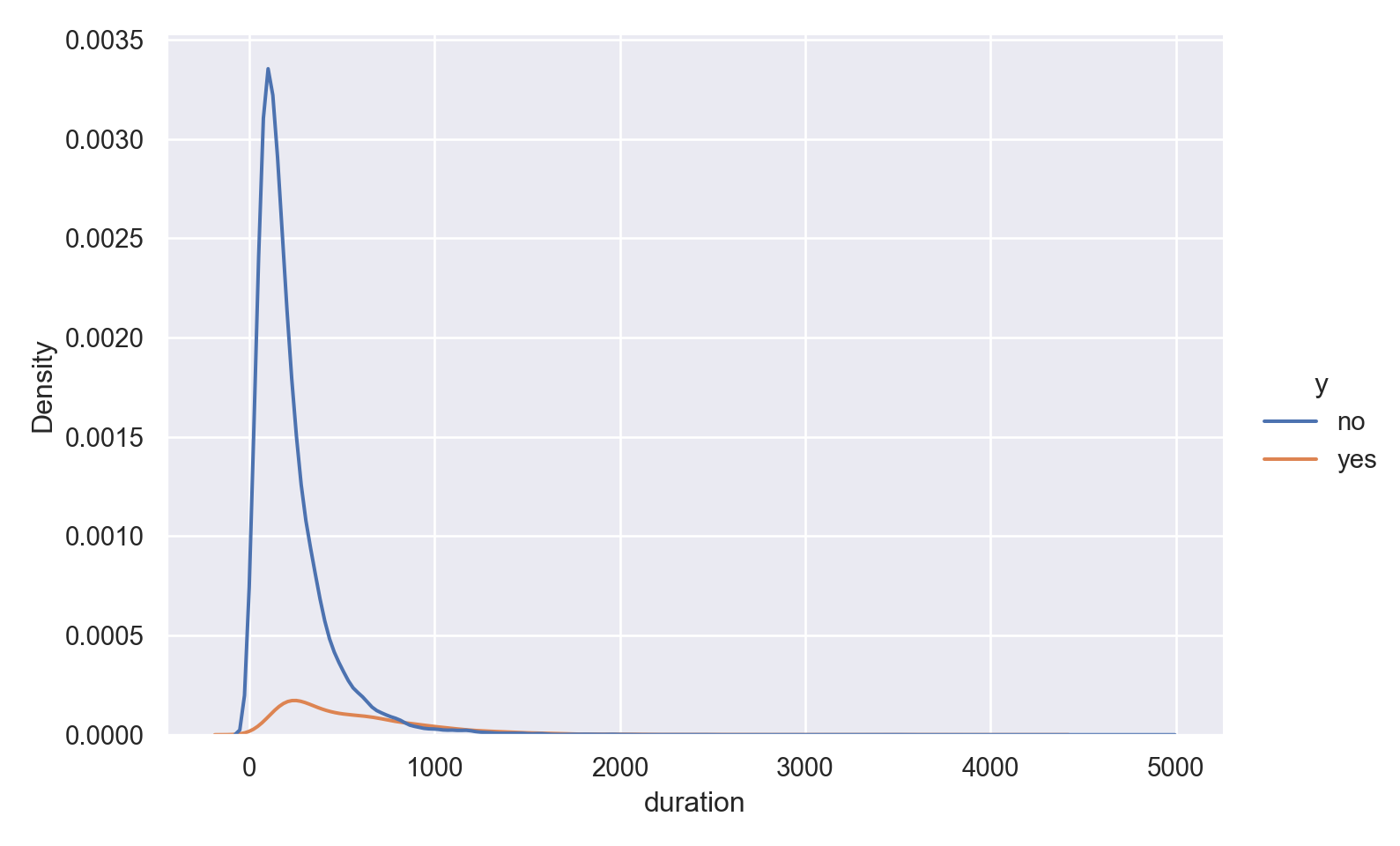

The data is heavily right (positively) skewed, towards low call duration.

As expected, the box plot indicates higher ‘yes’ outcome for higher duration, however as mentioned in the data dictionary, this will not help in predictive modelling as duration is not known before placing a call. It is the result of a ‘yes’ decision, and not its cause.

Observations

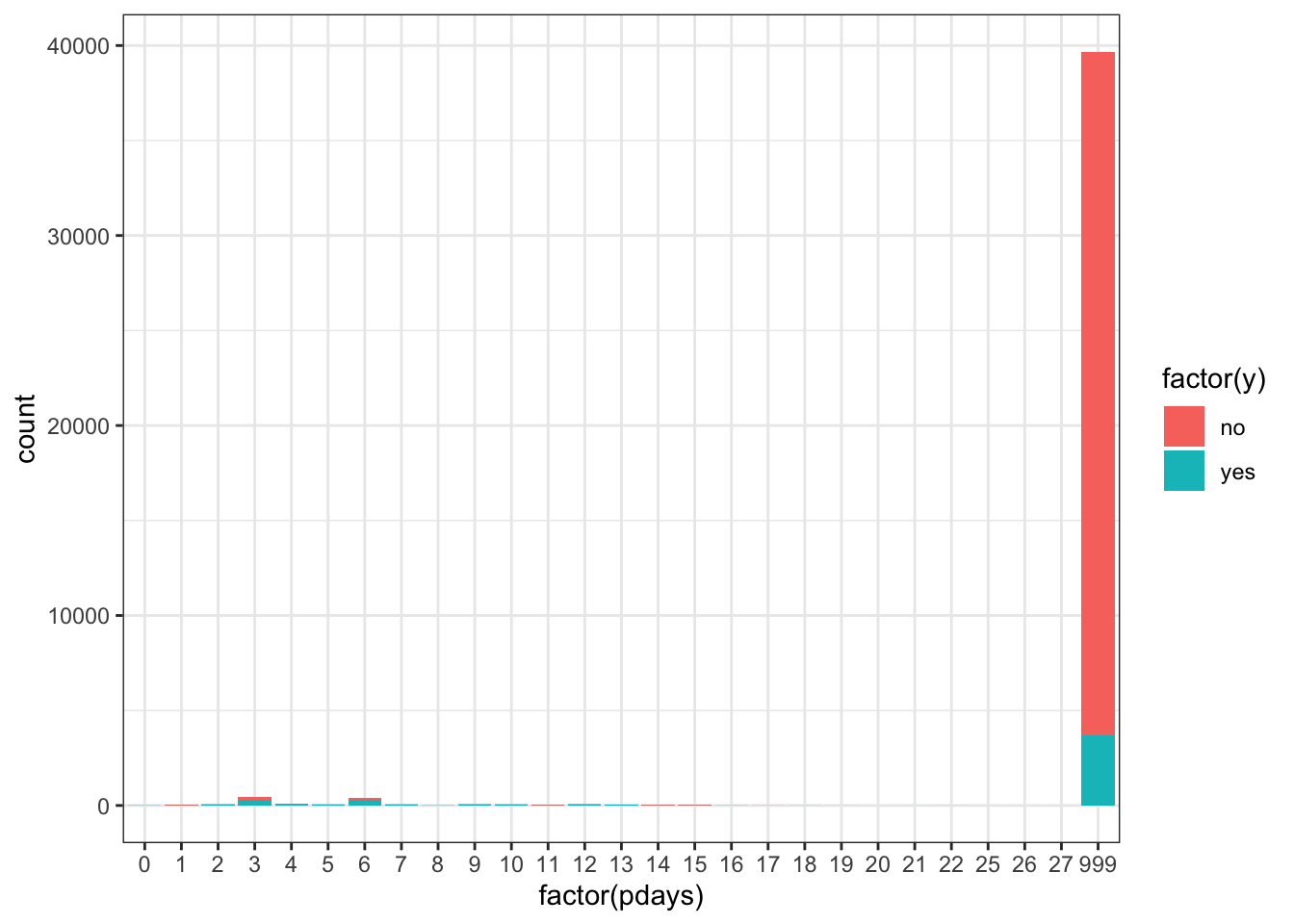

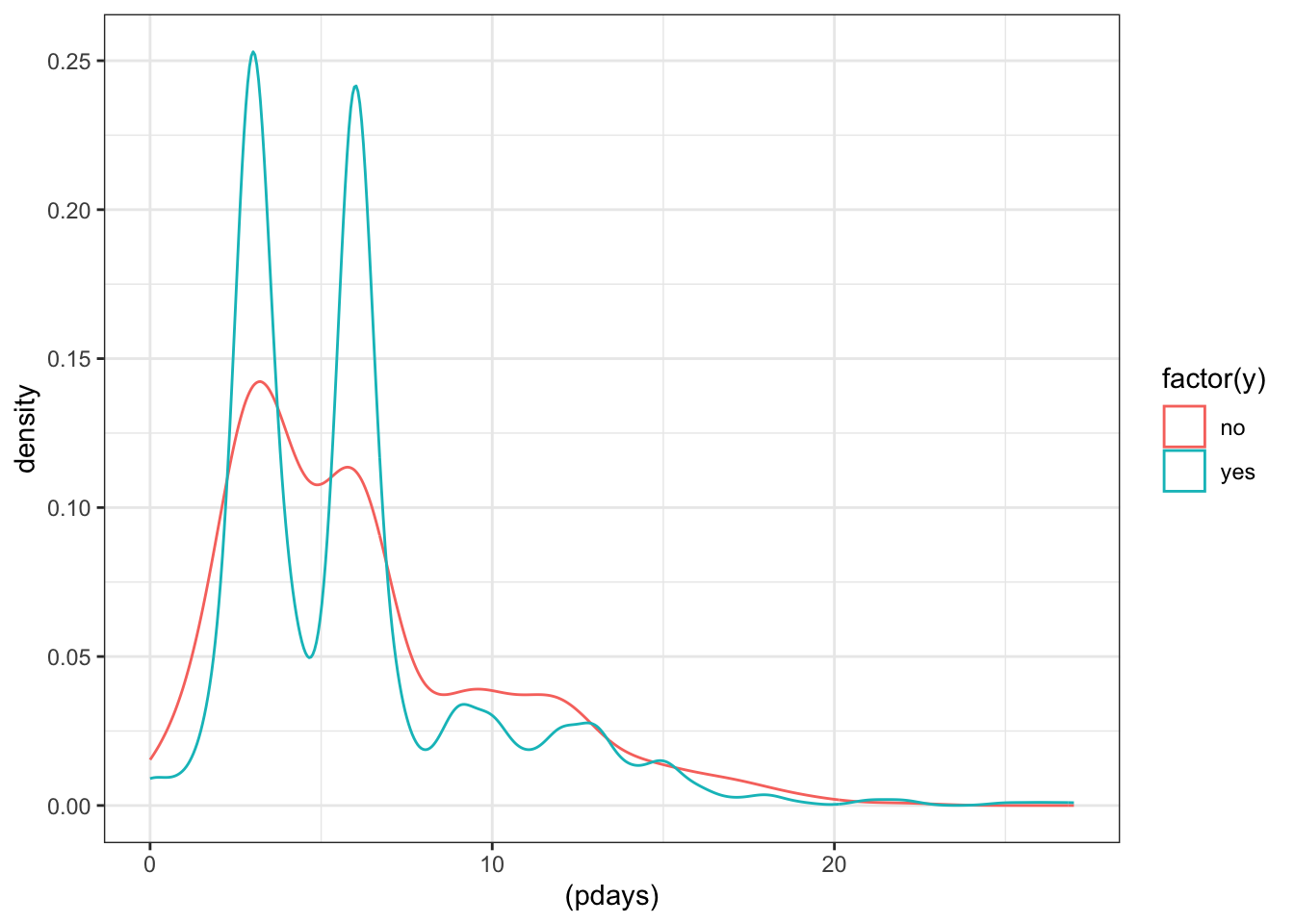

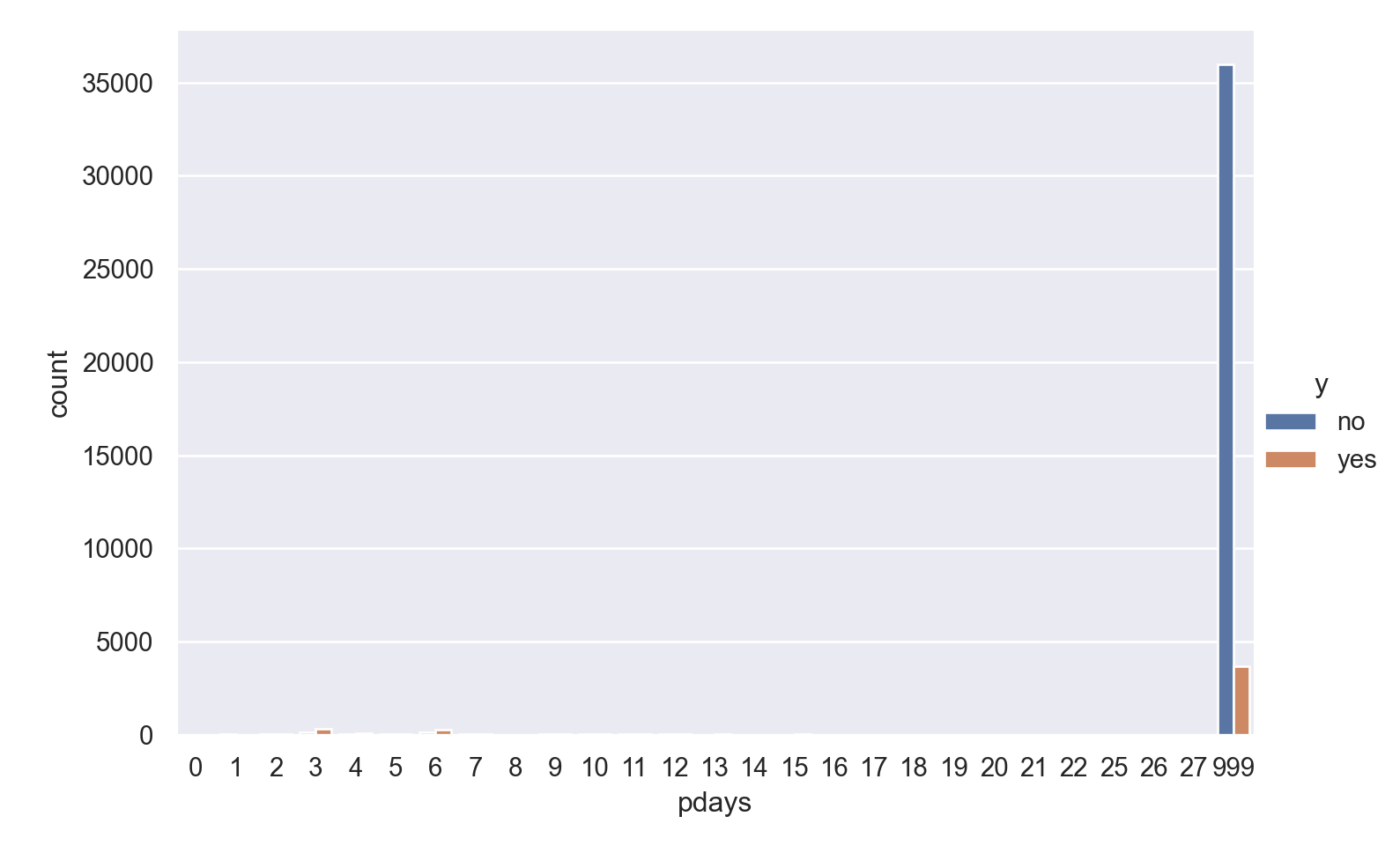

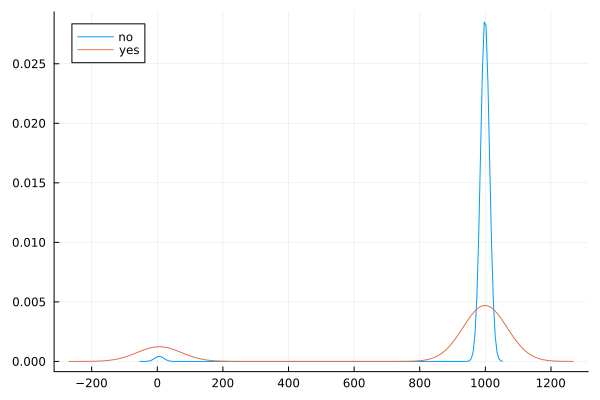

The vast majority of people were not previously contacted, so there is a very high left skew.

Filtering to only include the previously contacted people reveals a bi-modal pattern in the data, especially for respondents with ‘yes’ outcome.

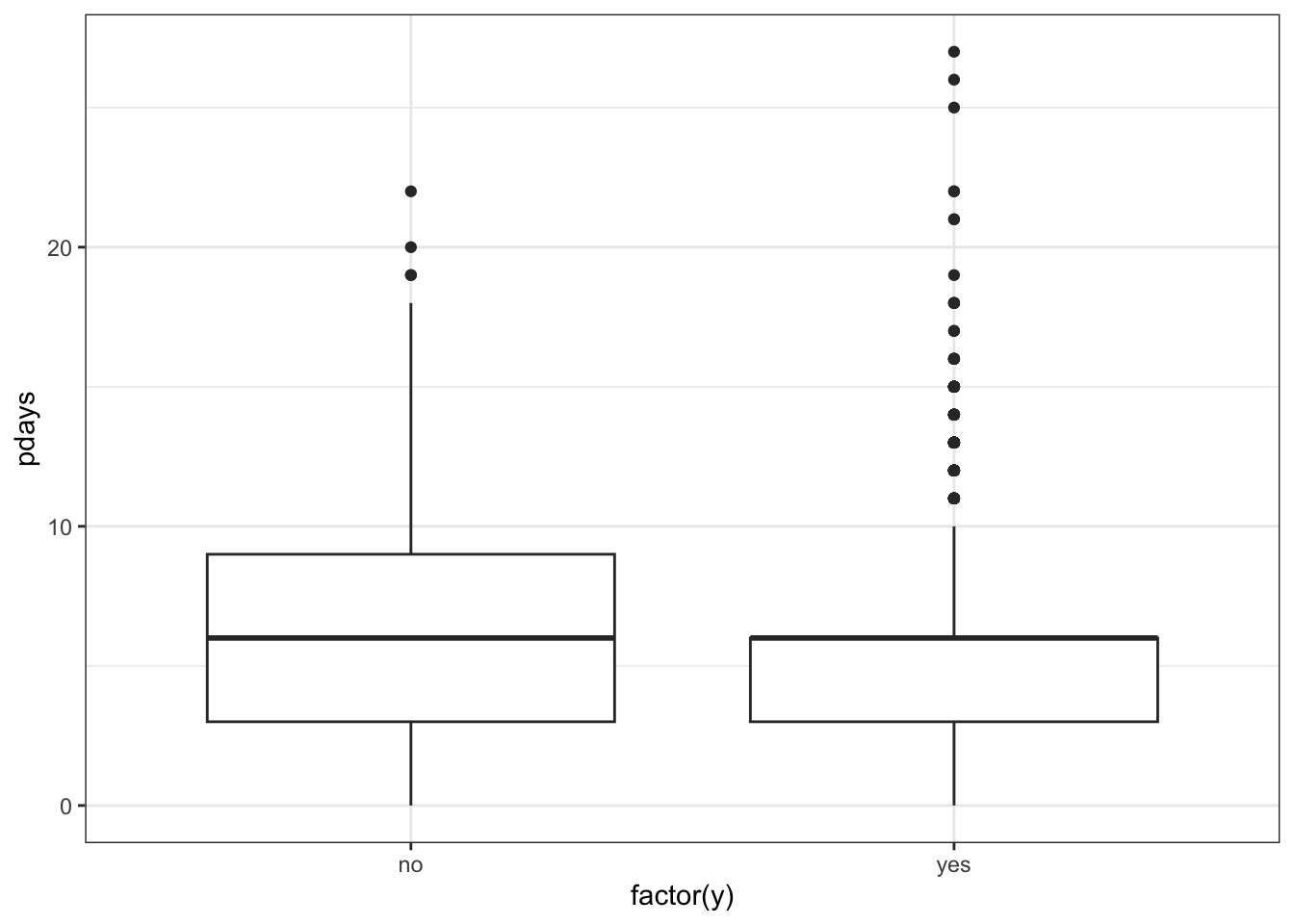

For those that were previously contacted, median value of days since previous contact is the same for both outcomes, but ‘yes’ outcome has many outliers on the higher end.

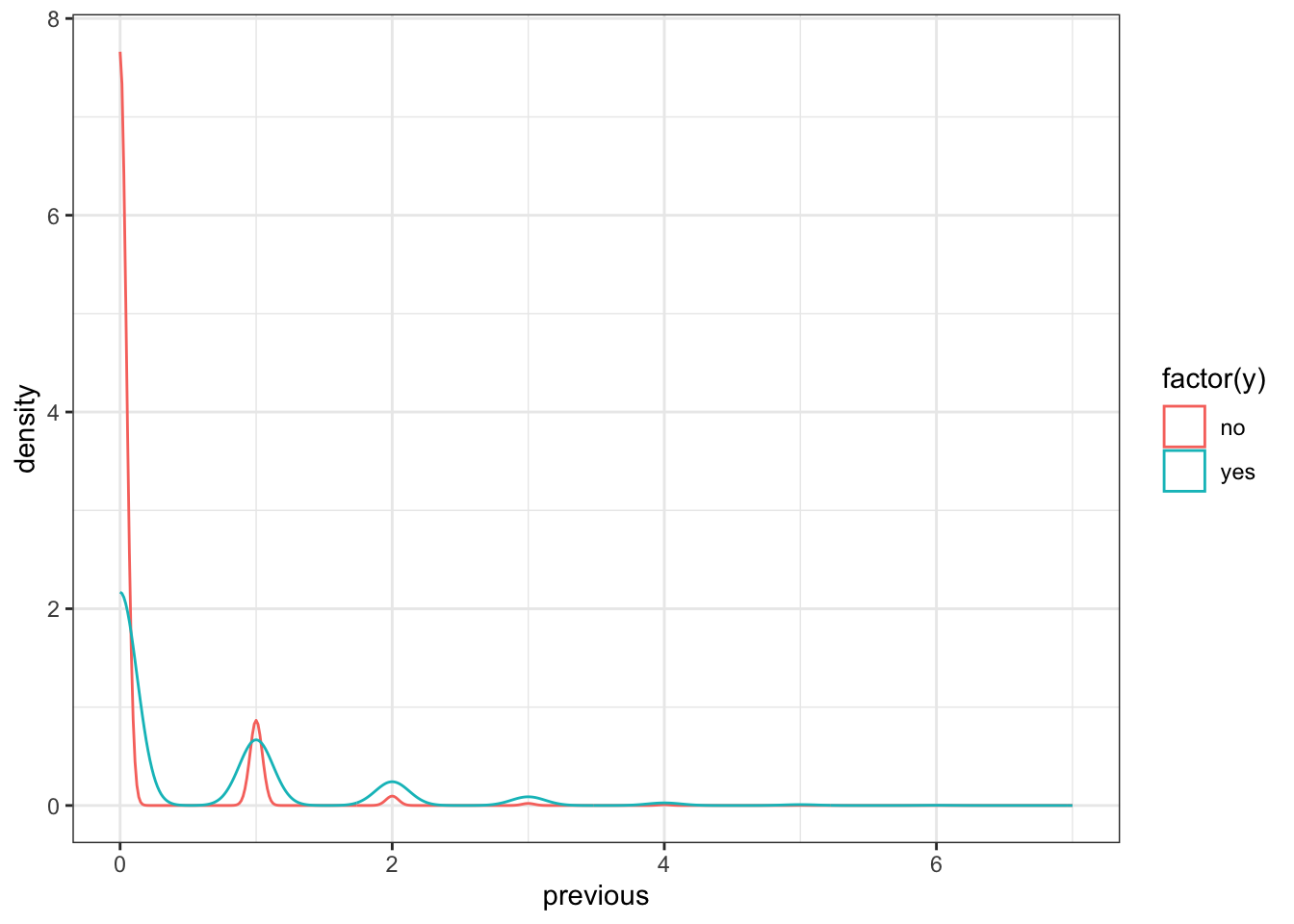

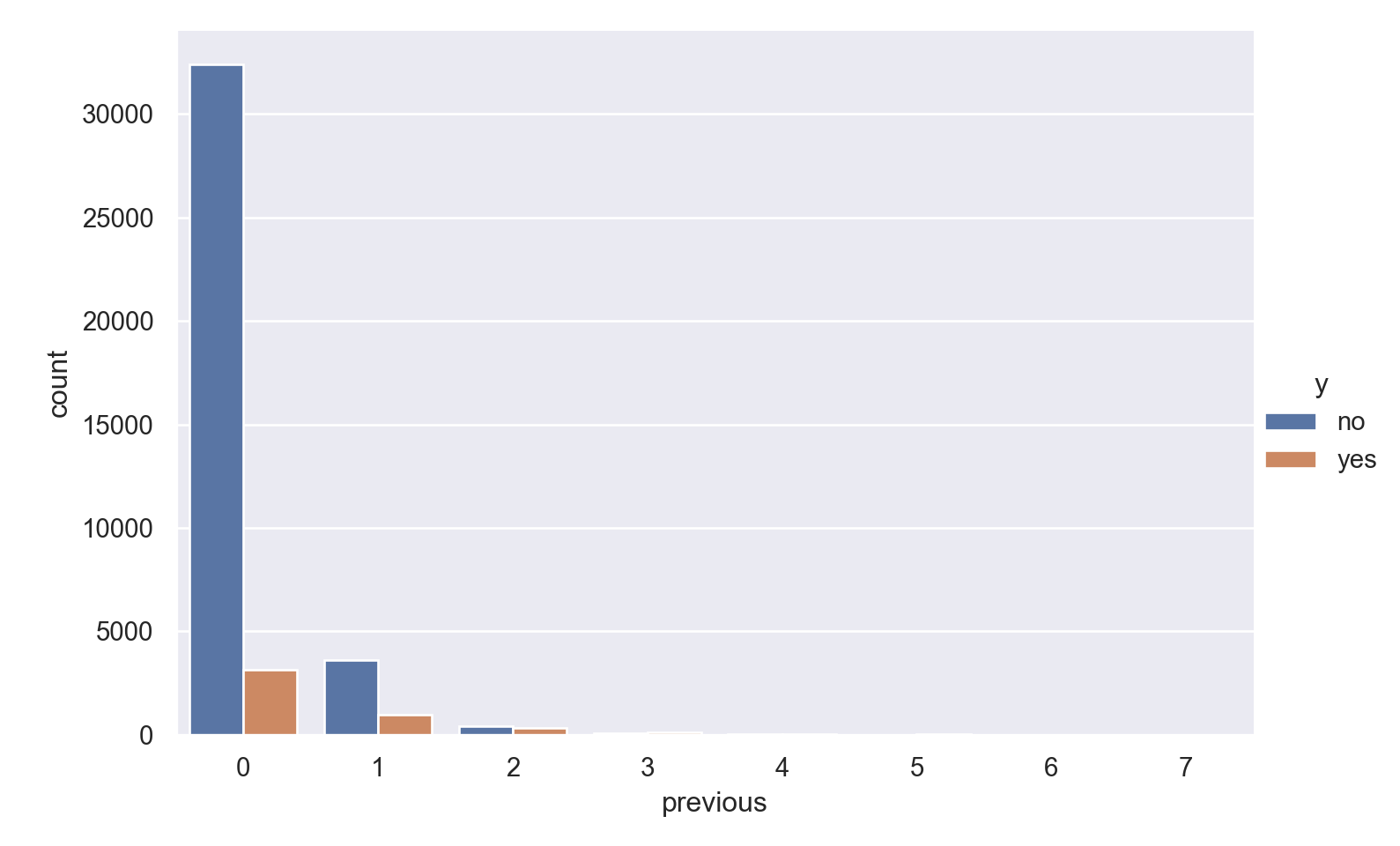

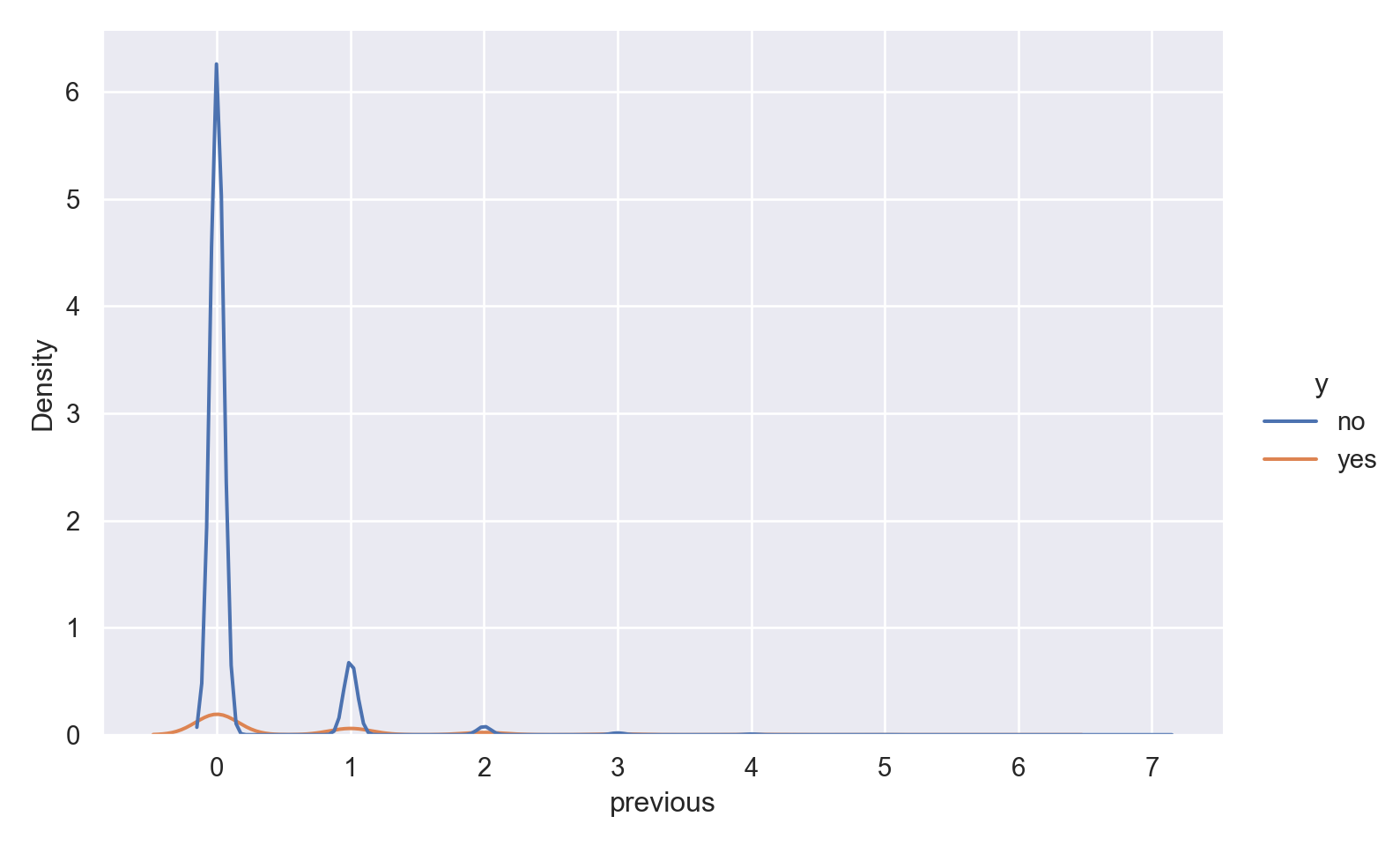

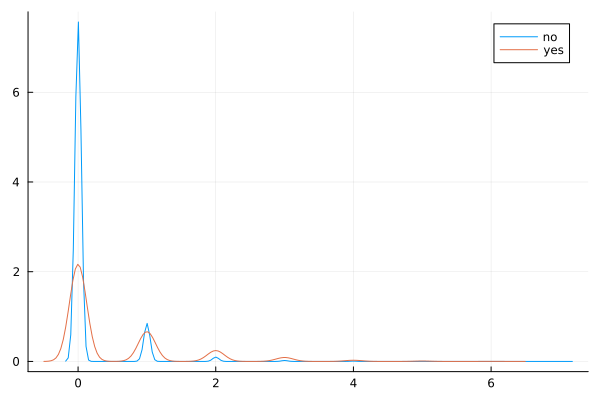

Observations

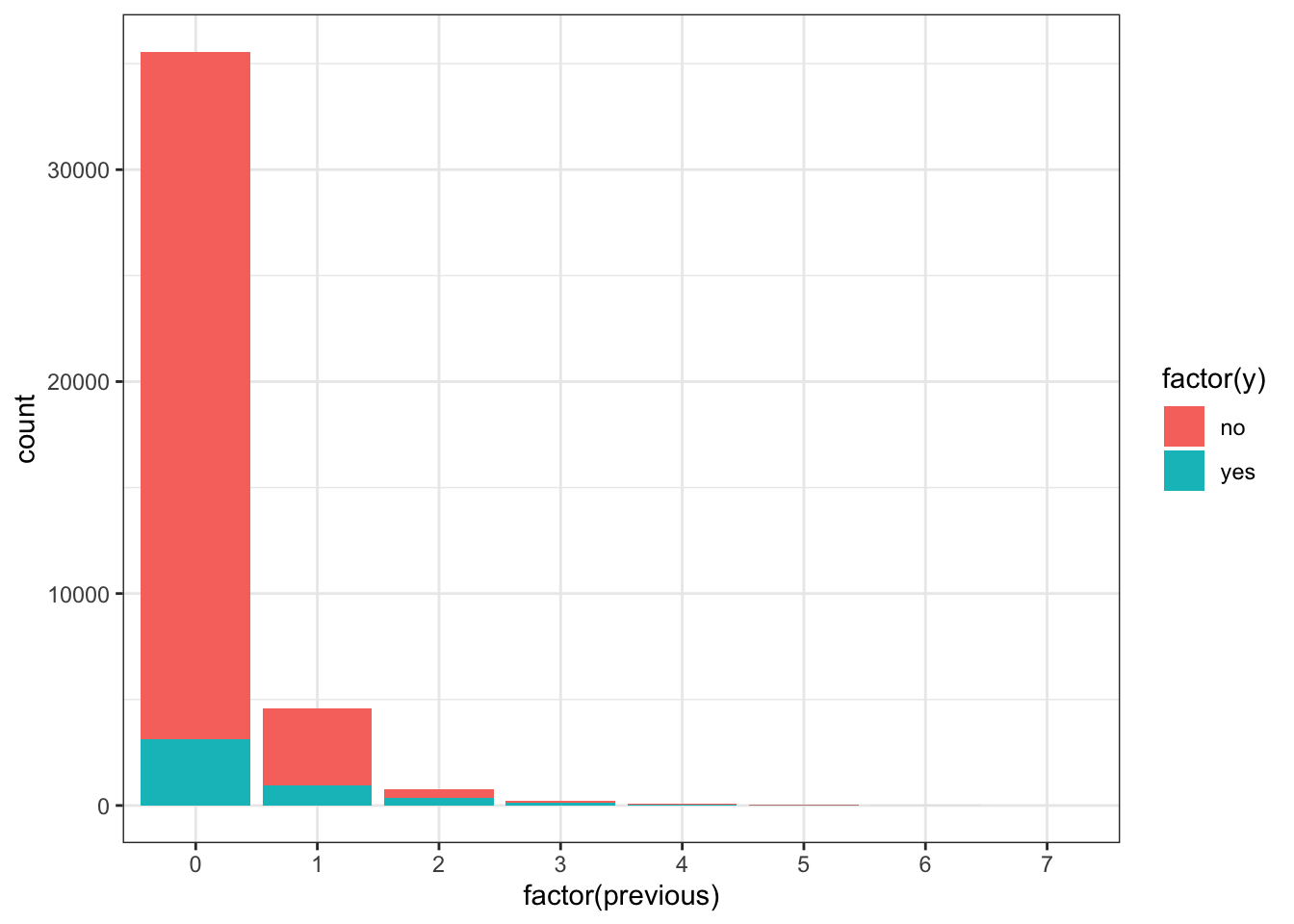

The vast majority of people were not previously contacted in the previous campaign, so there is a very high right skew.

The few people who were contacted multiple times seem to show higher ‘yes’ outcome for the current campaign.

Observations

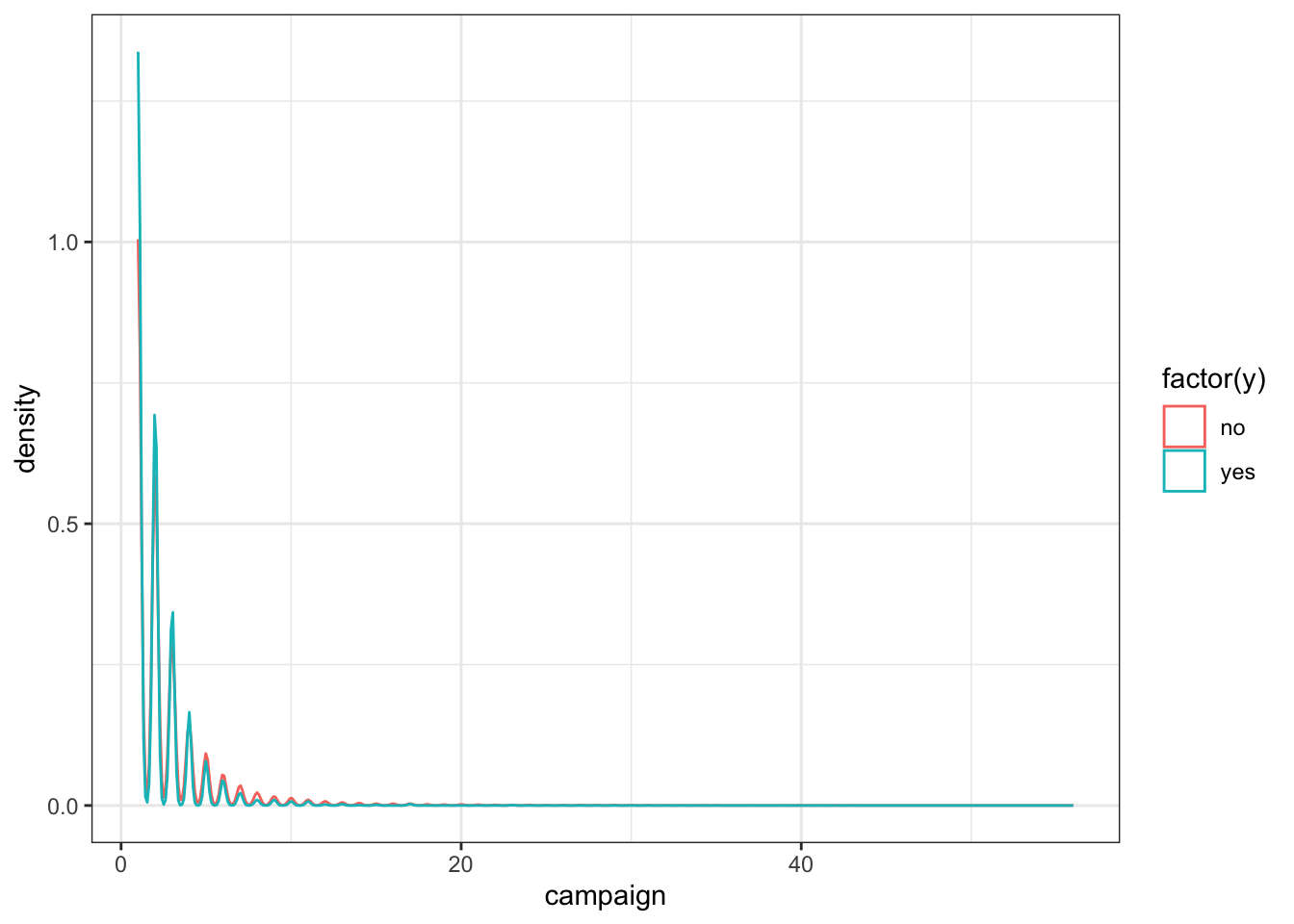

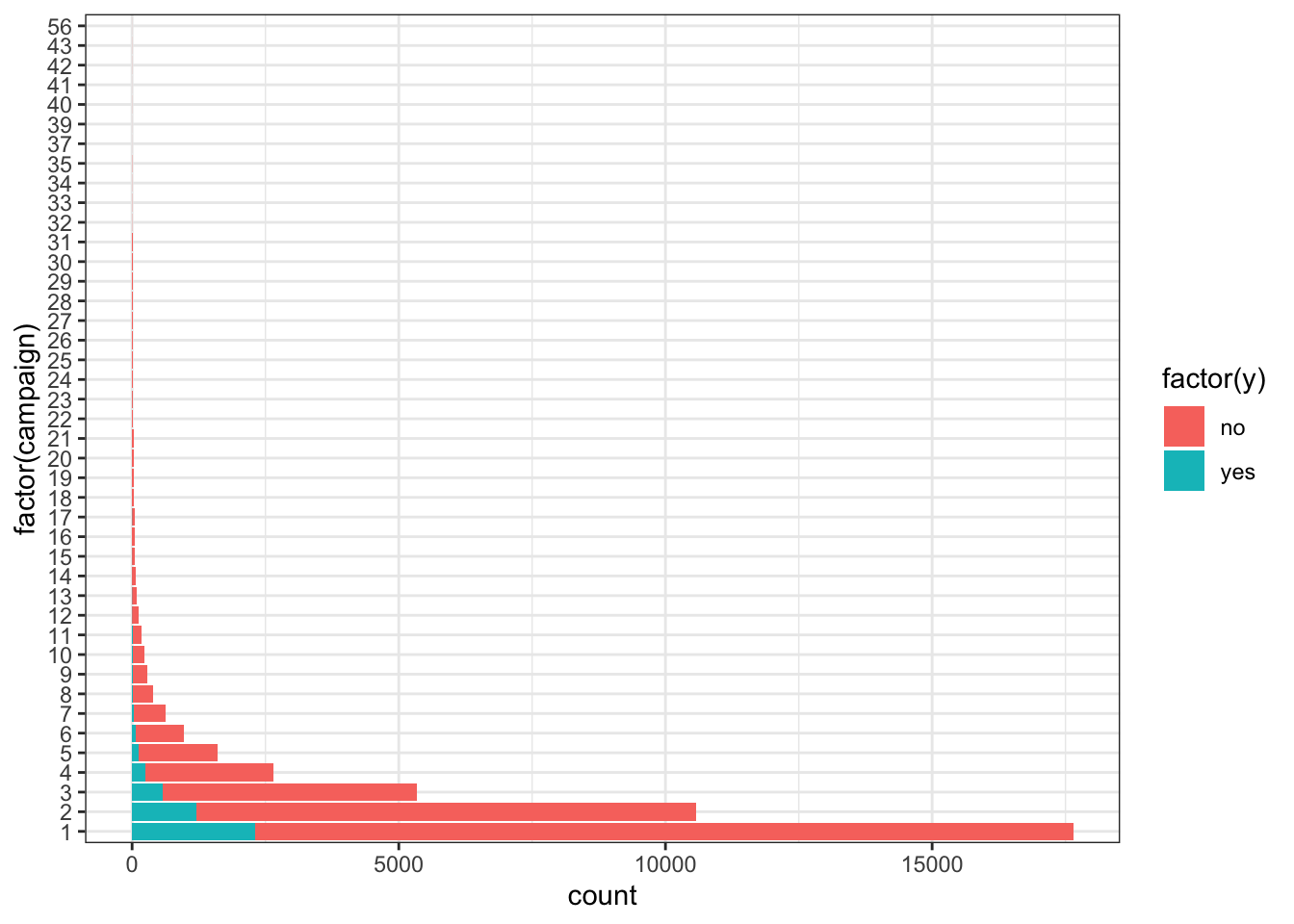

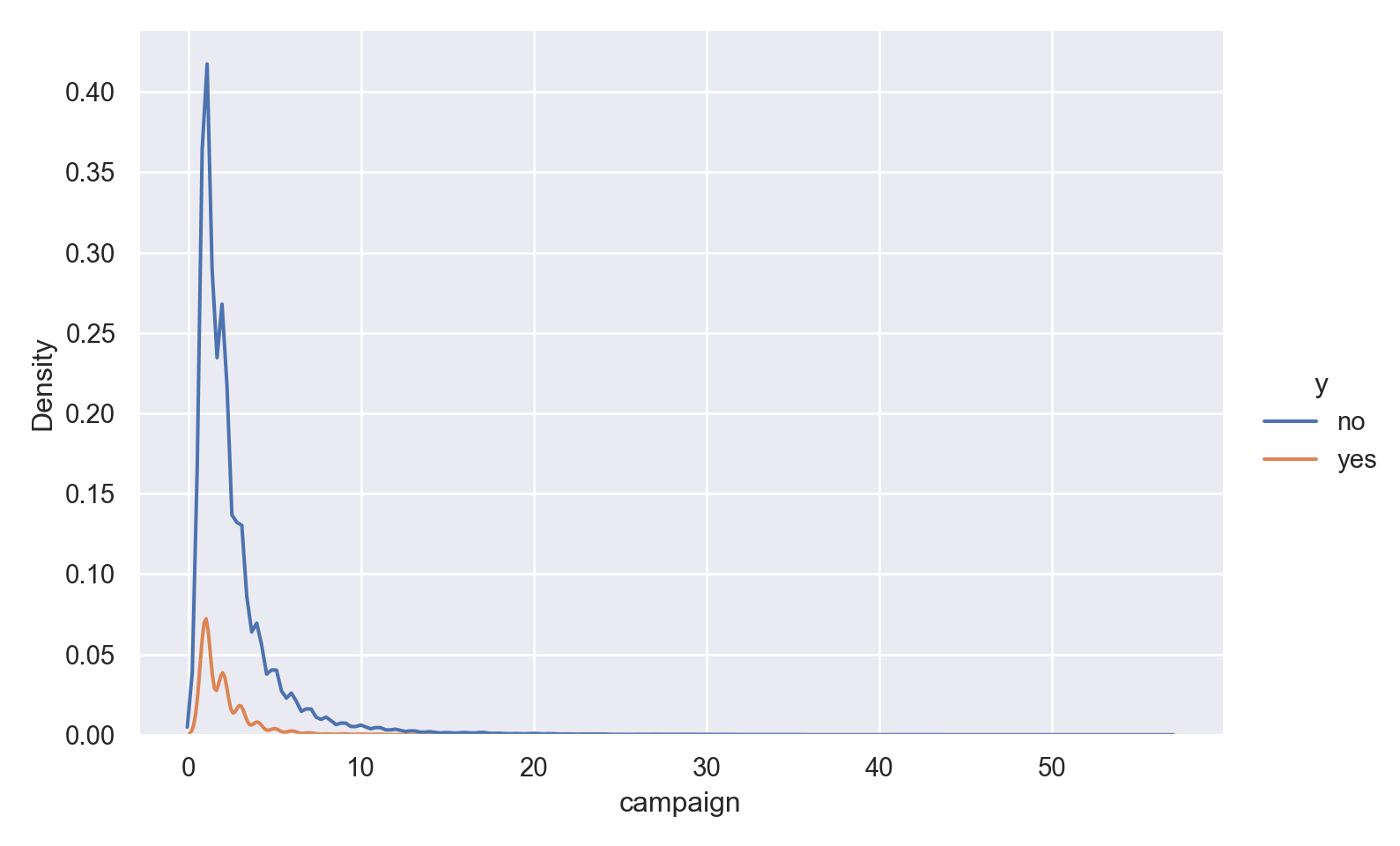

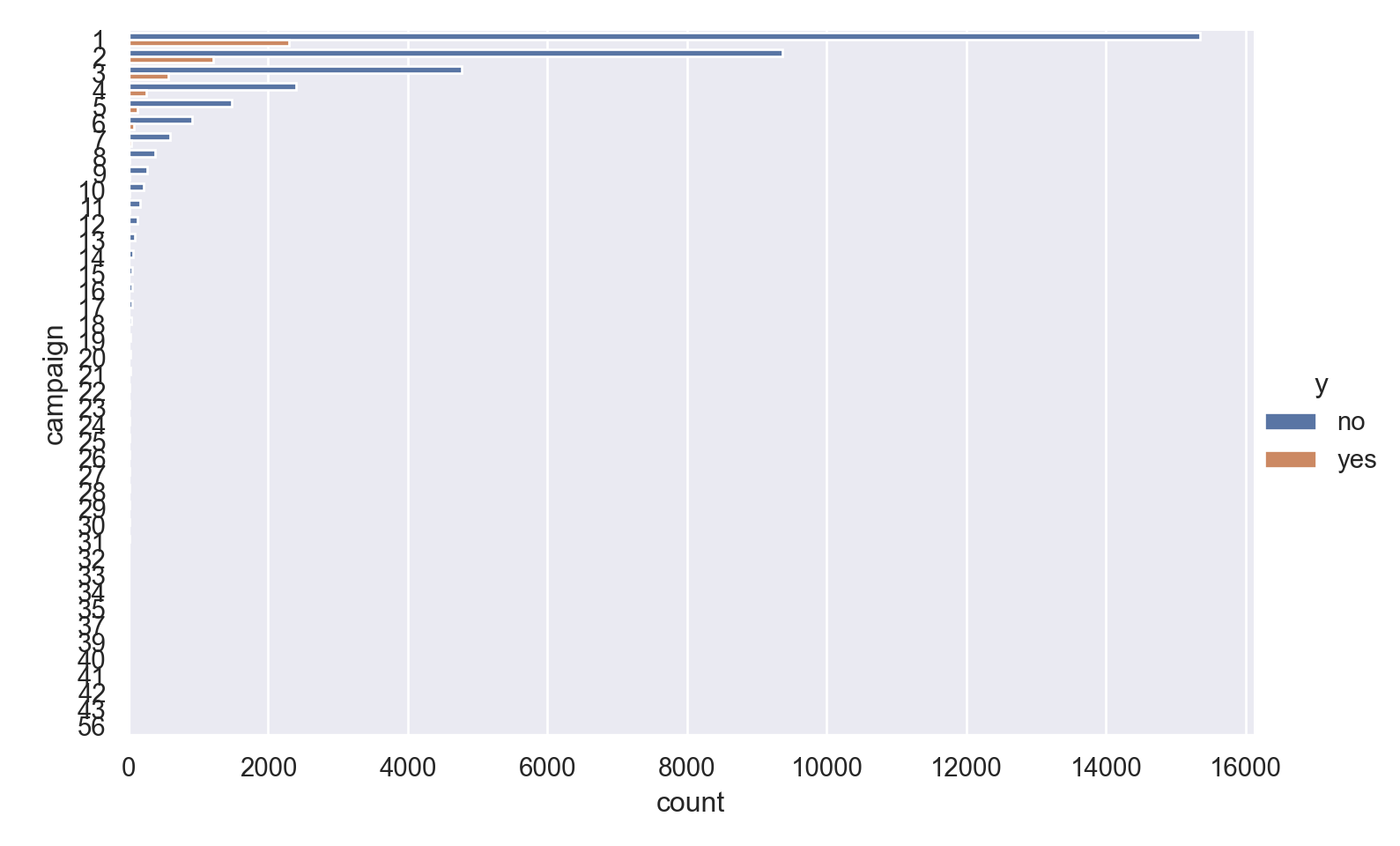

The vast majority of people were contacted only once in the current campaign, so there is a very high right skew.

The few people who were contacted multiple times seem to show higher ‘yes’ outcome.

Observations

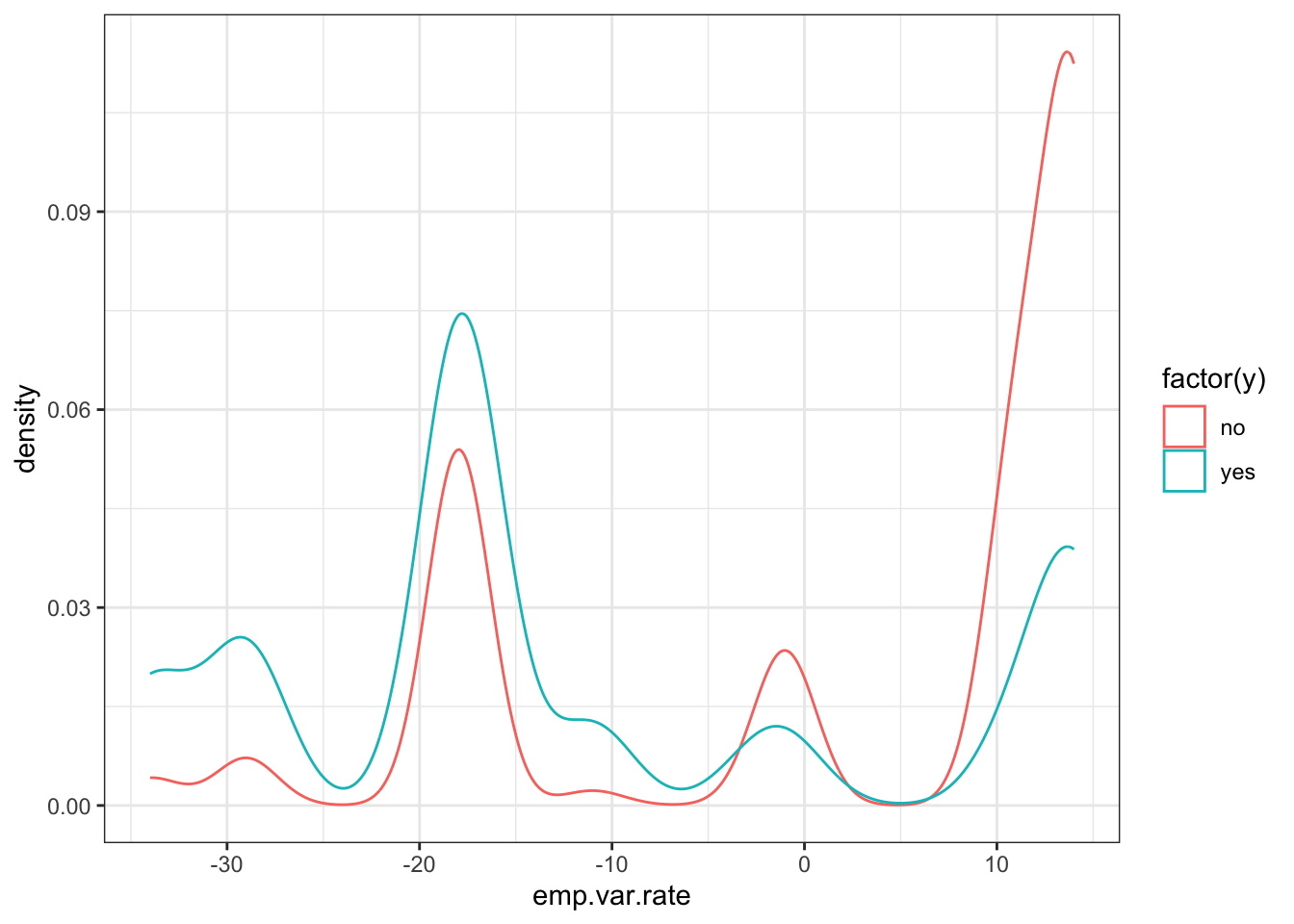

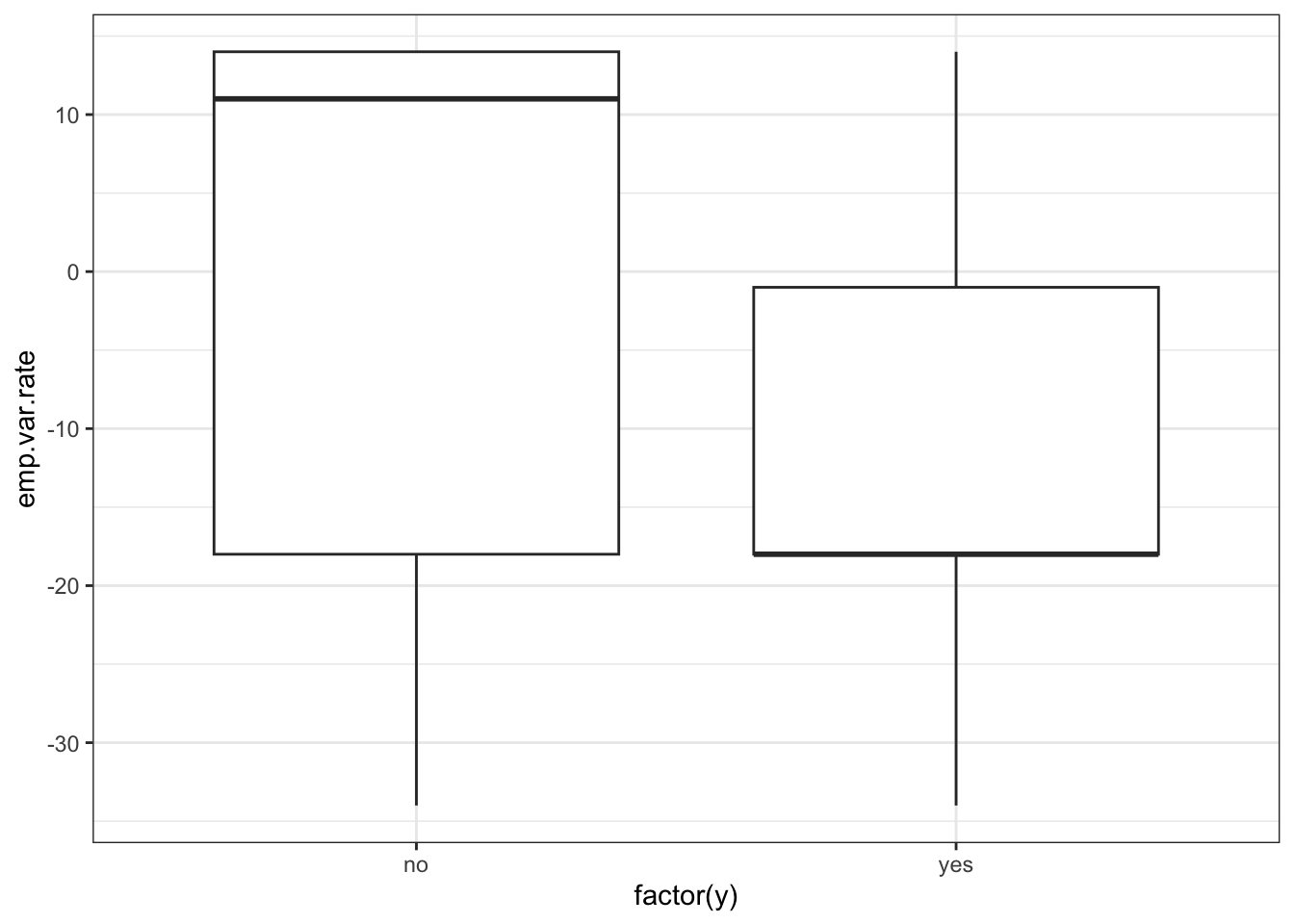

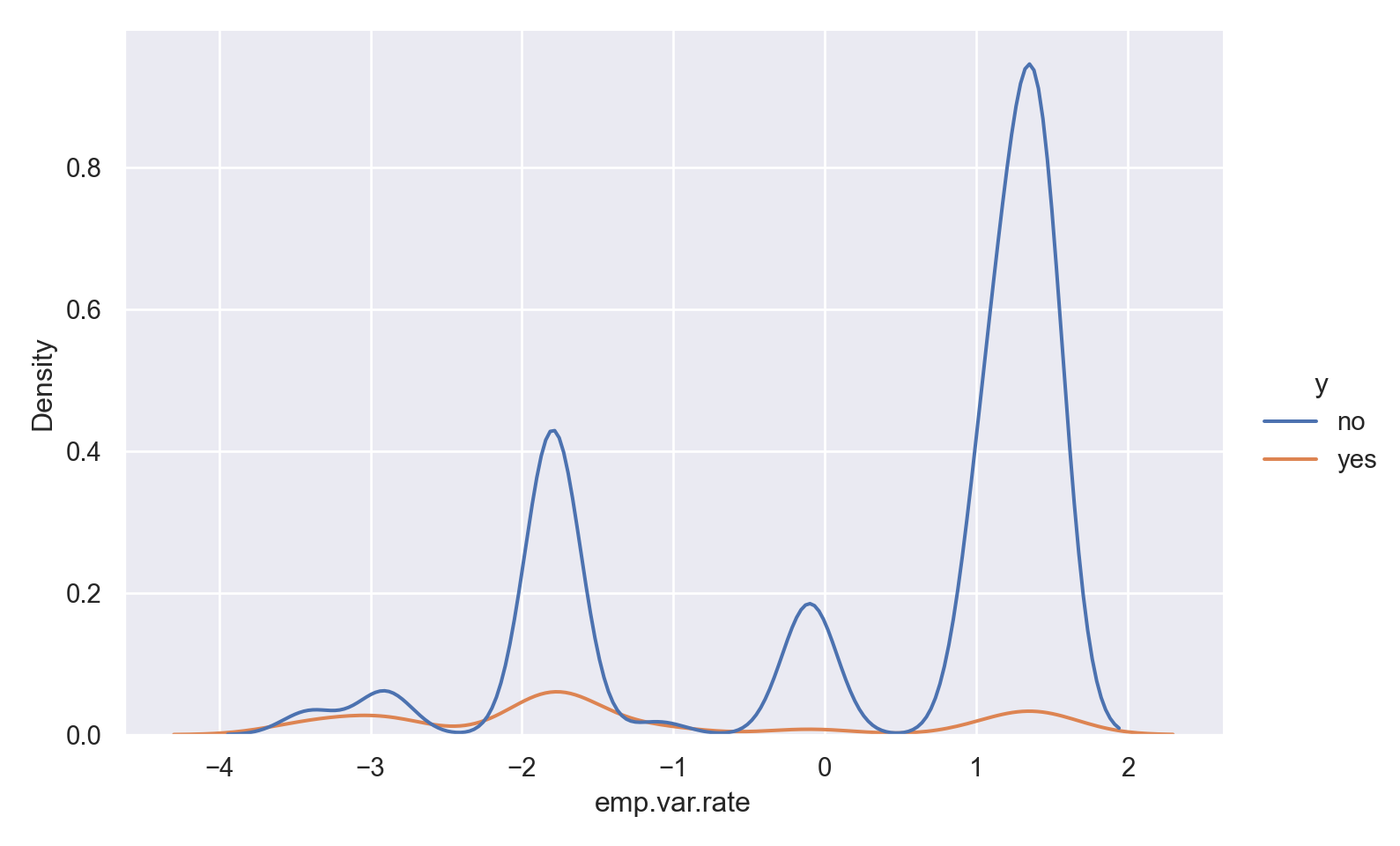

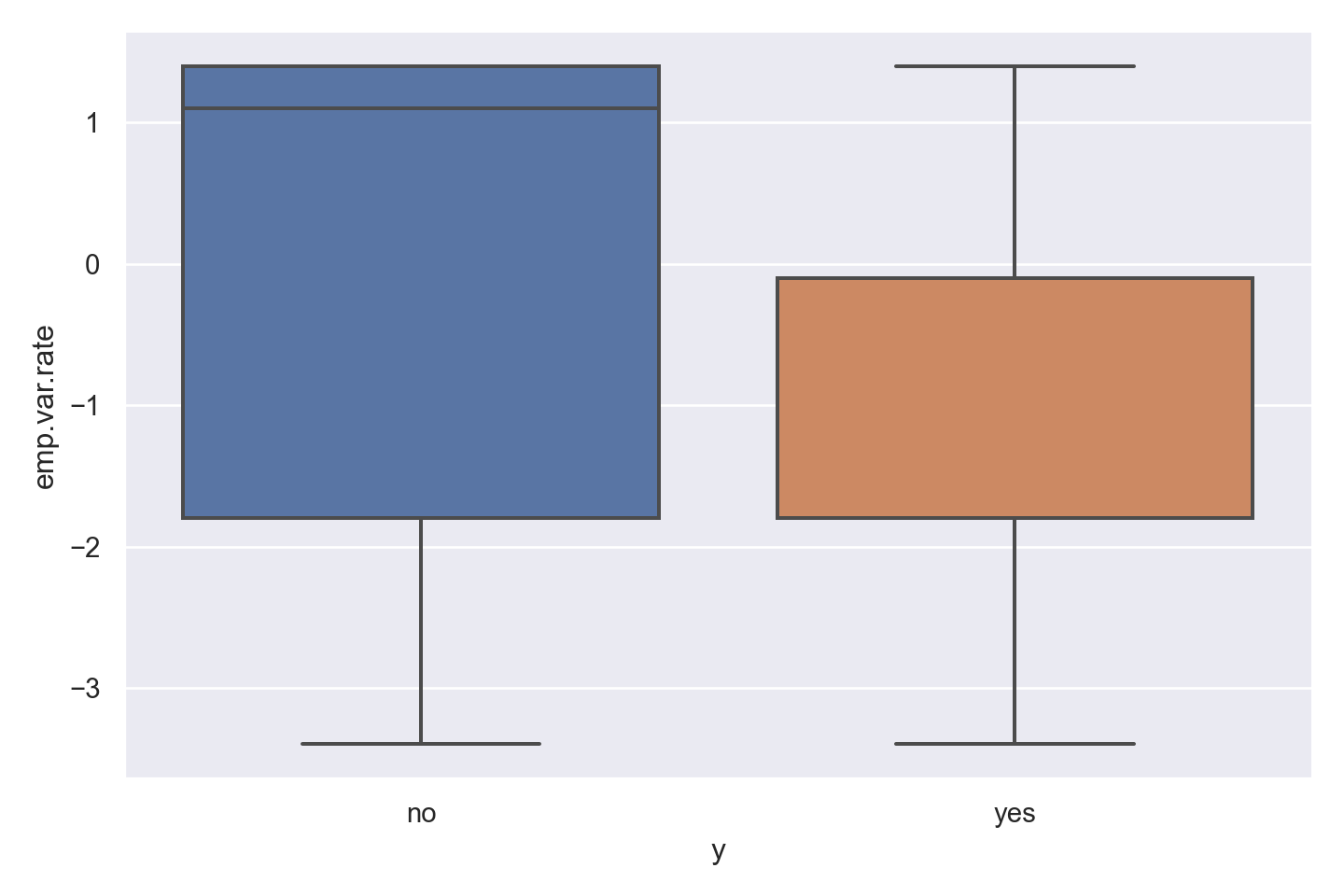

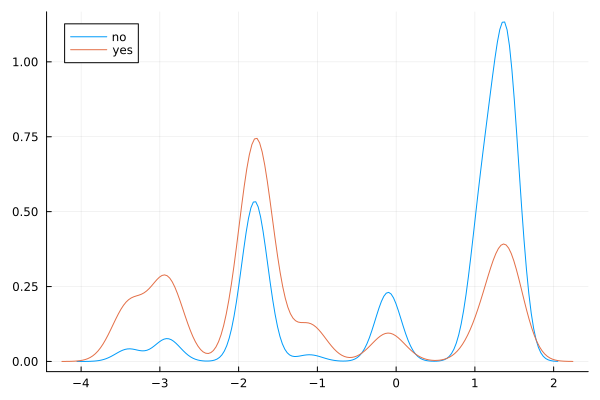

There is a striking association between employment variation rate and response - ‘yes’ outcomes show a much lower variation rate.

There is a multi-modal pattern in the data.

Observations

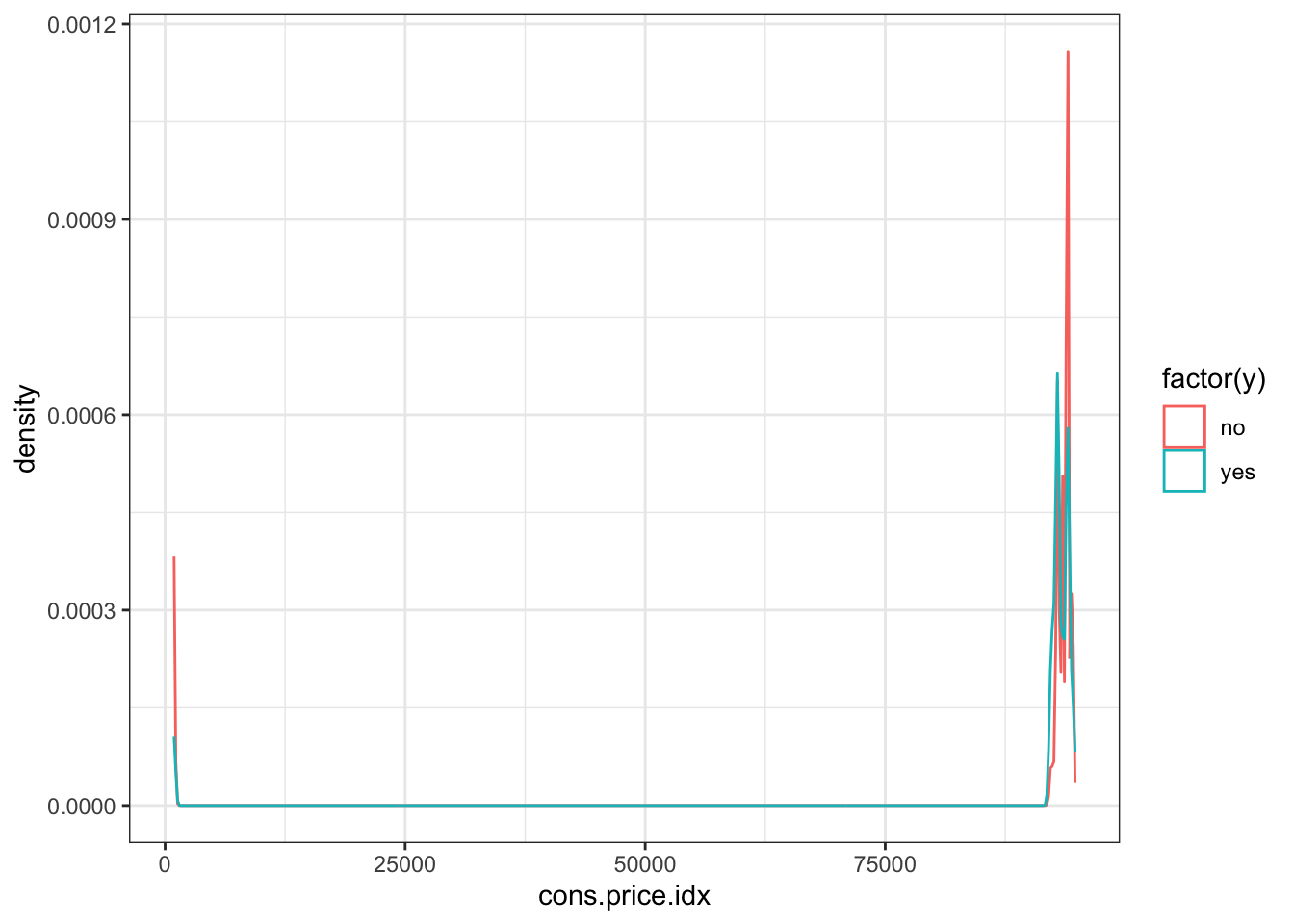

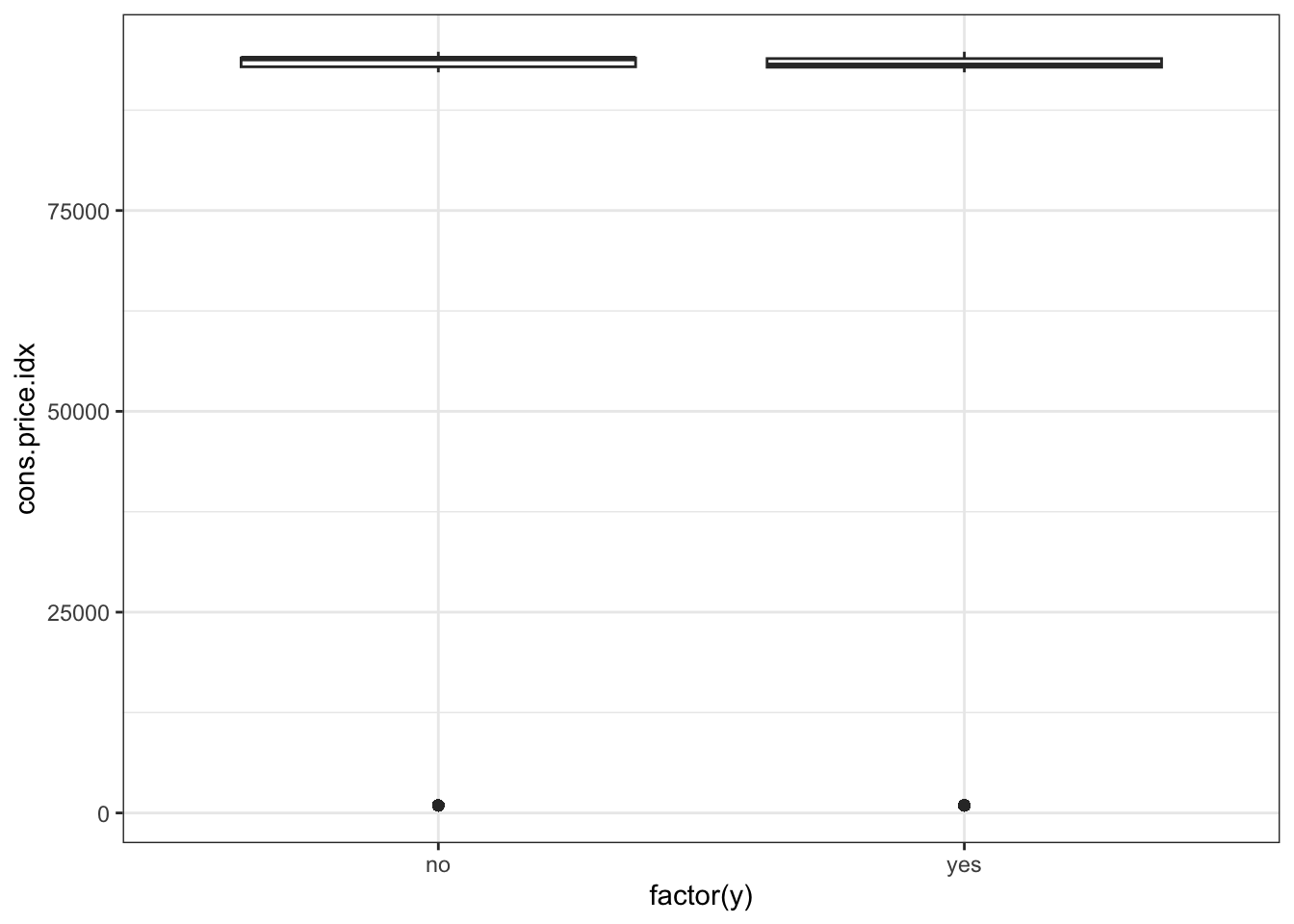

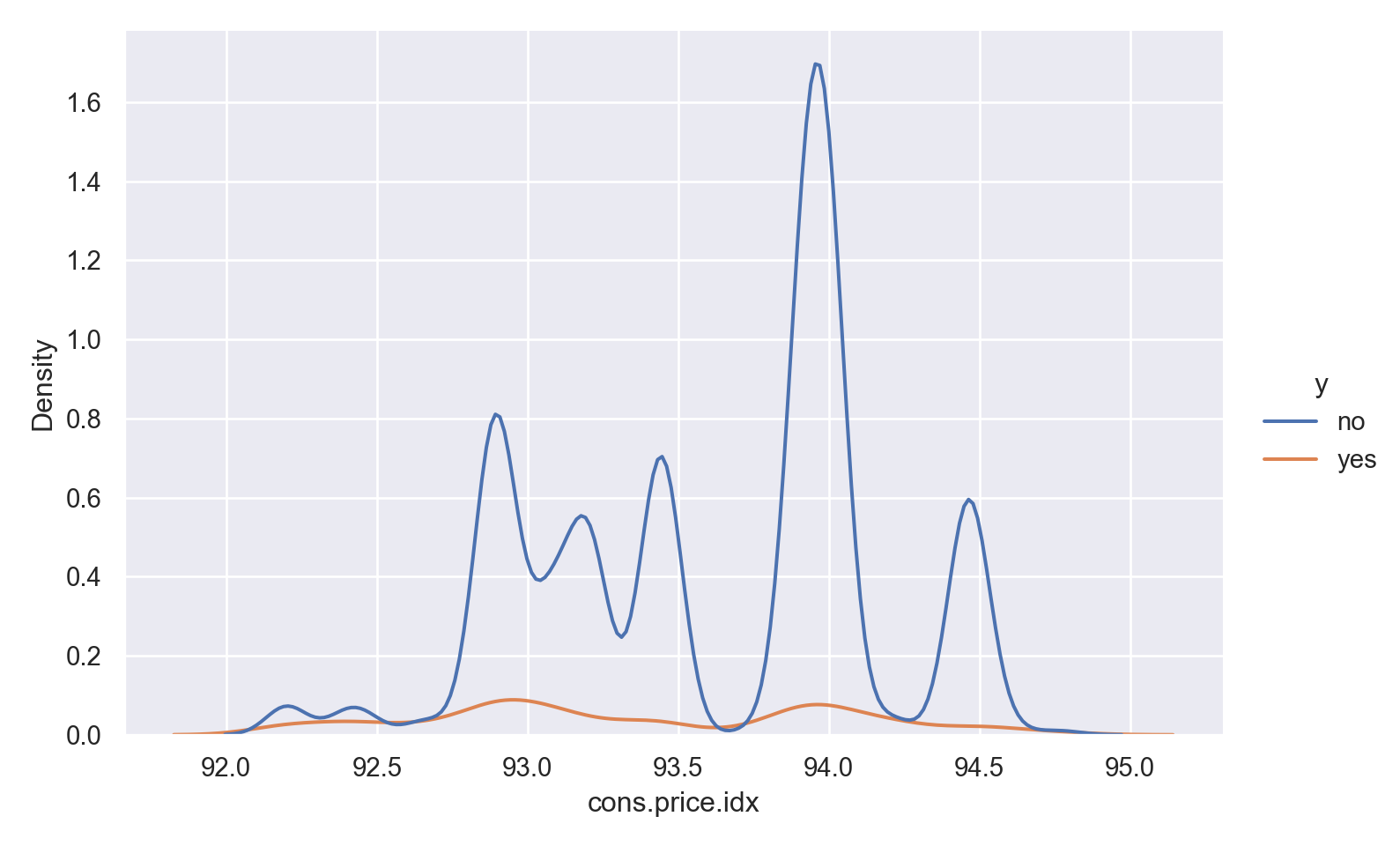

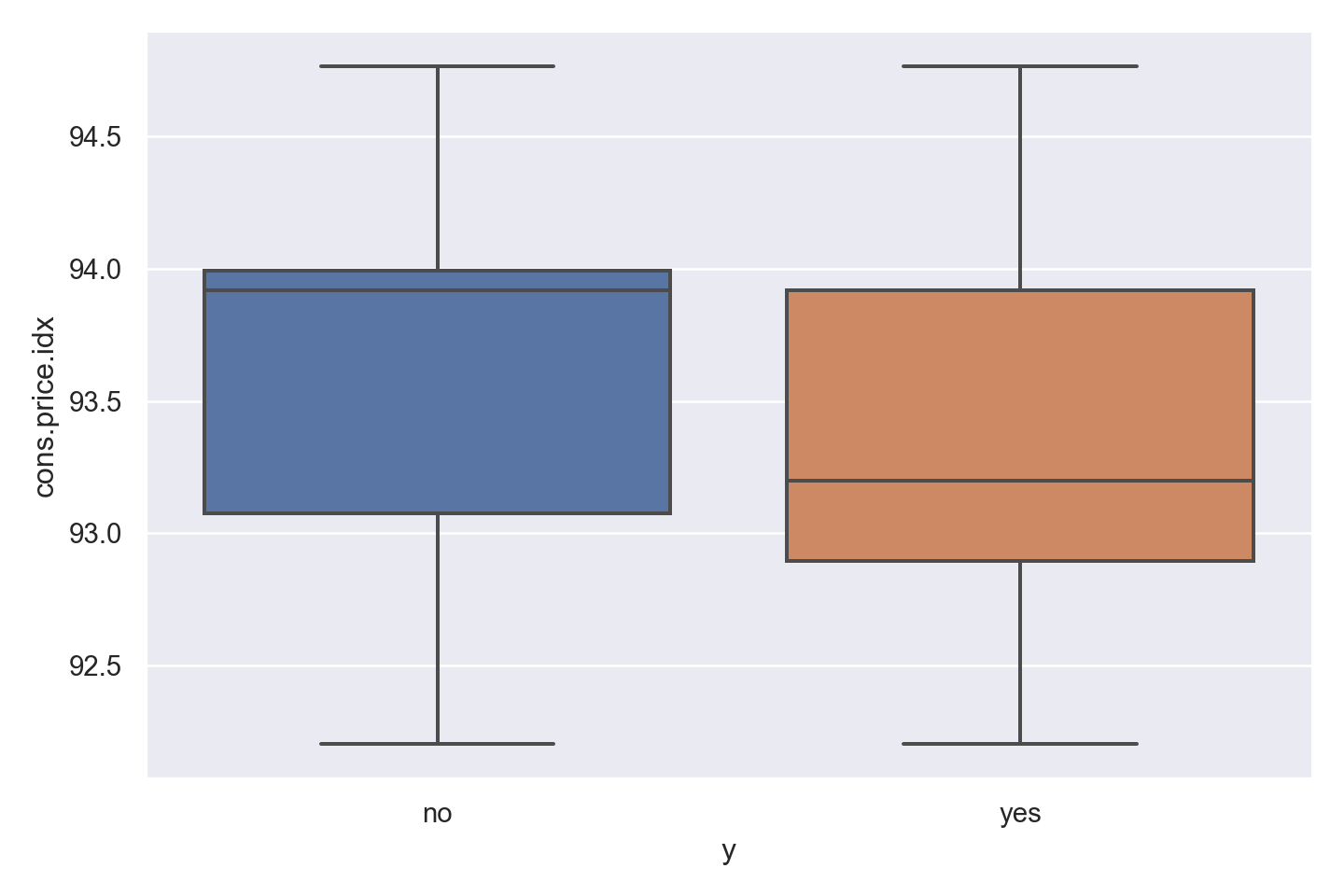

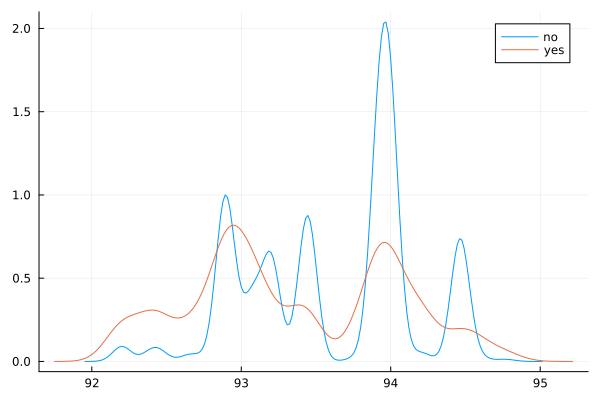

There is not much variation in the data,other than two outliers (perhaps data entry errors?)

‘yes’ outcome is associated with a slightly lower price index.

Observations

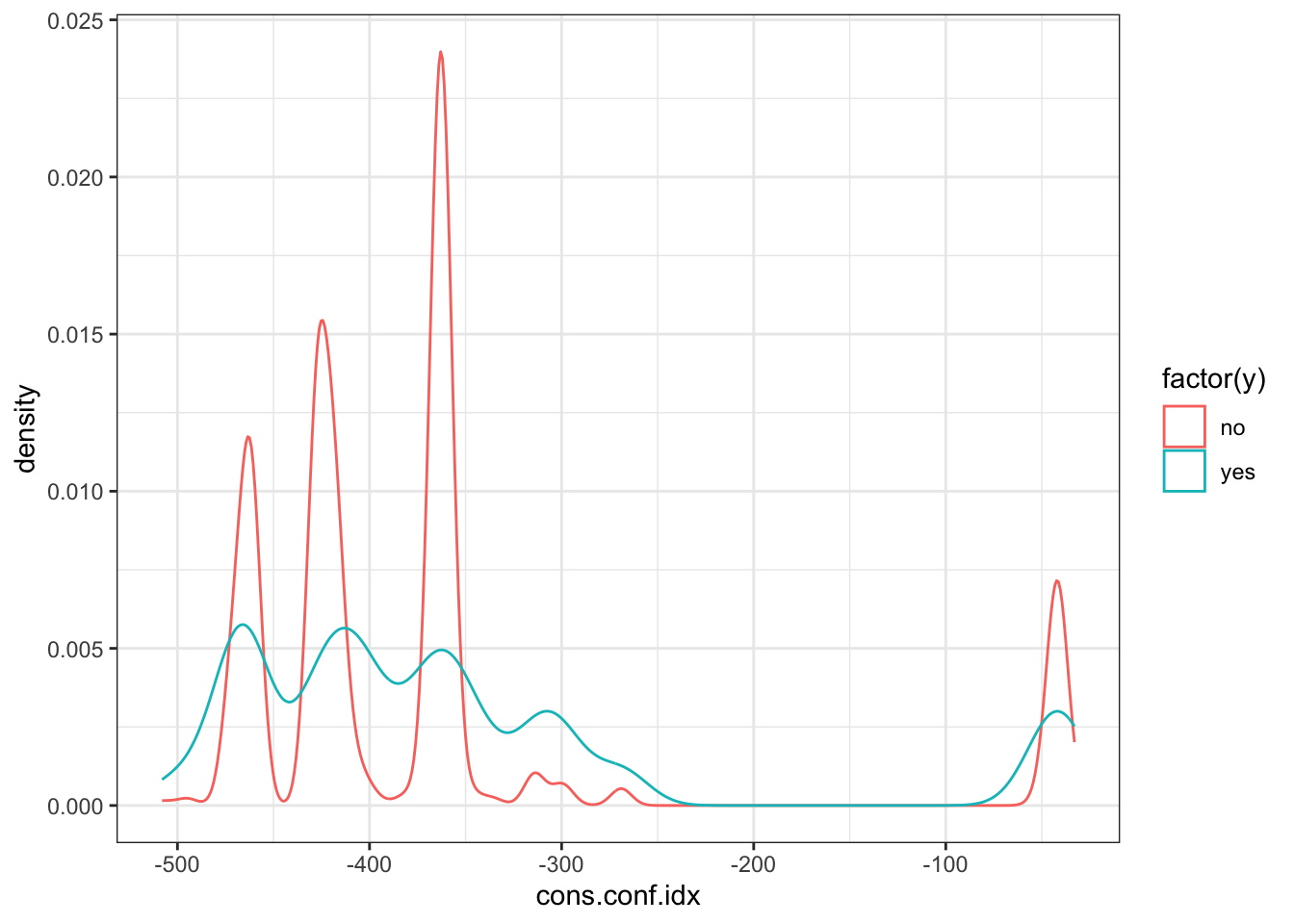

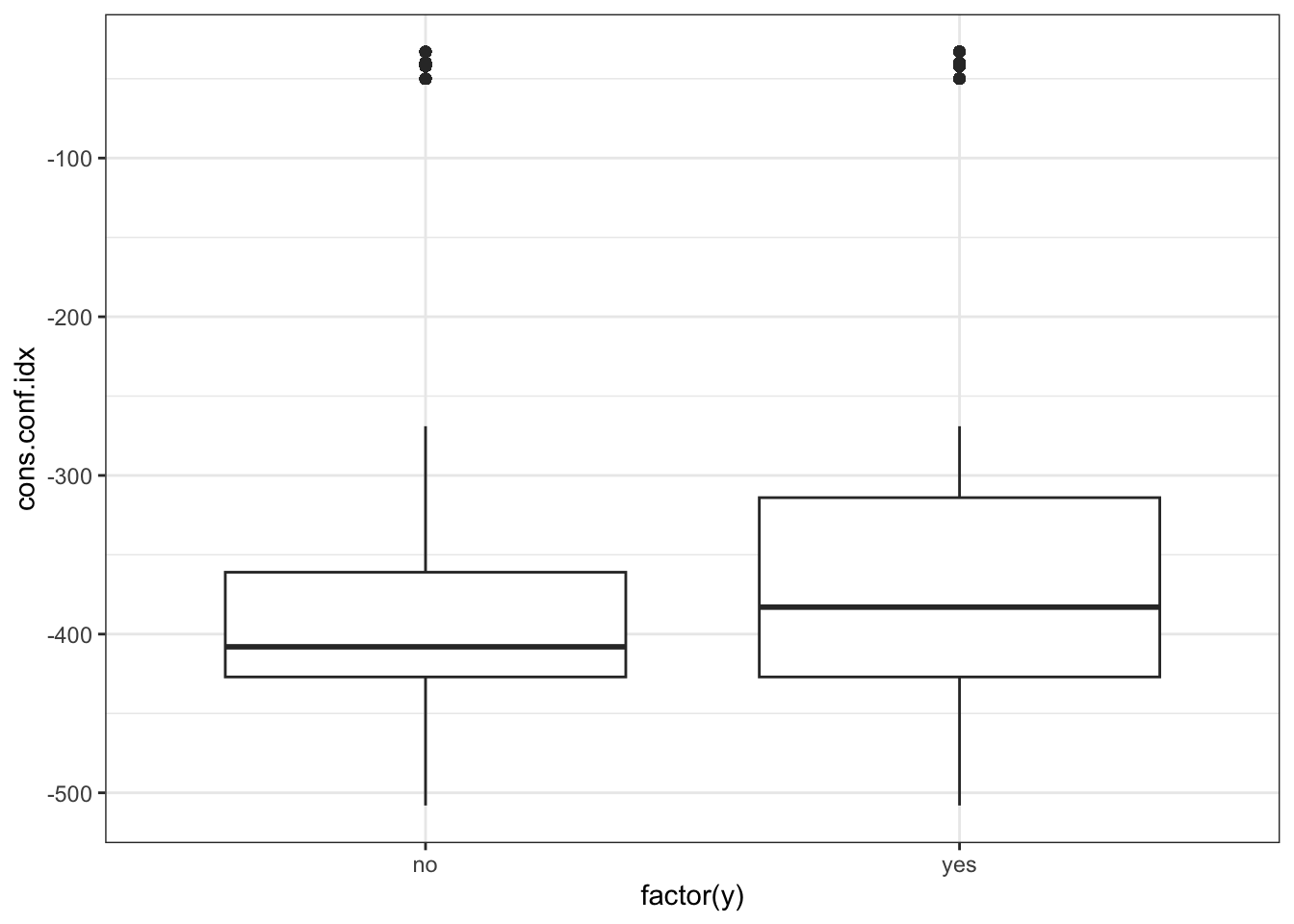

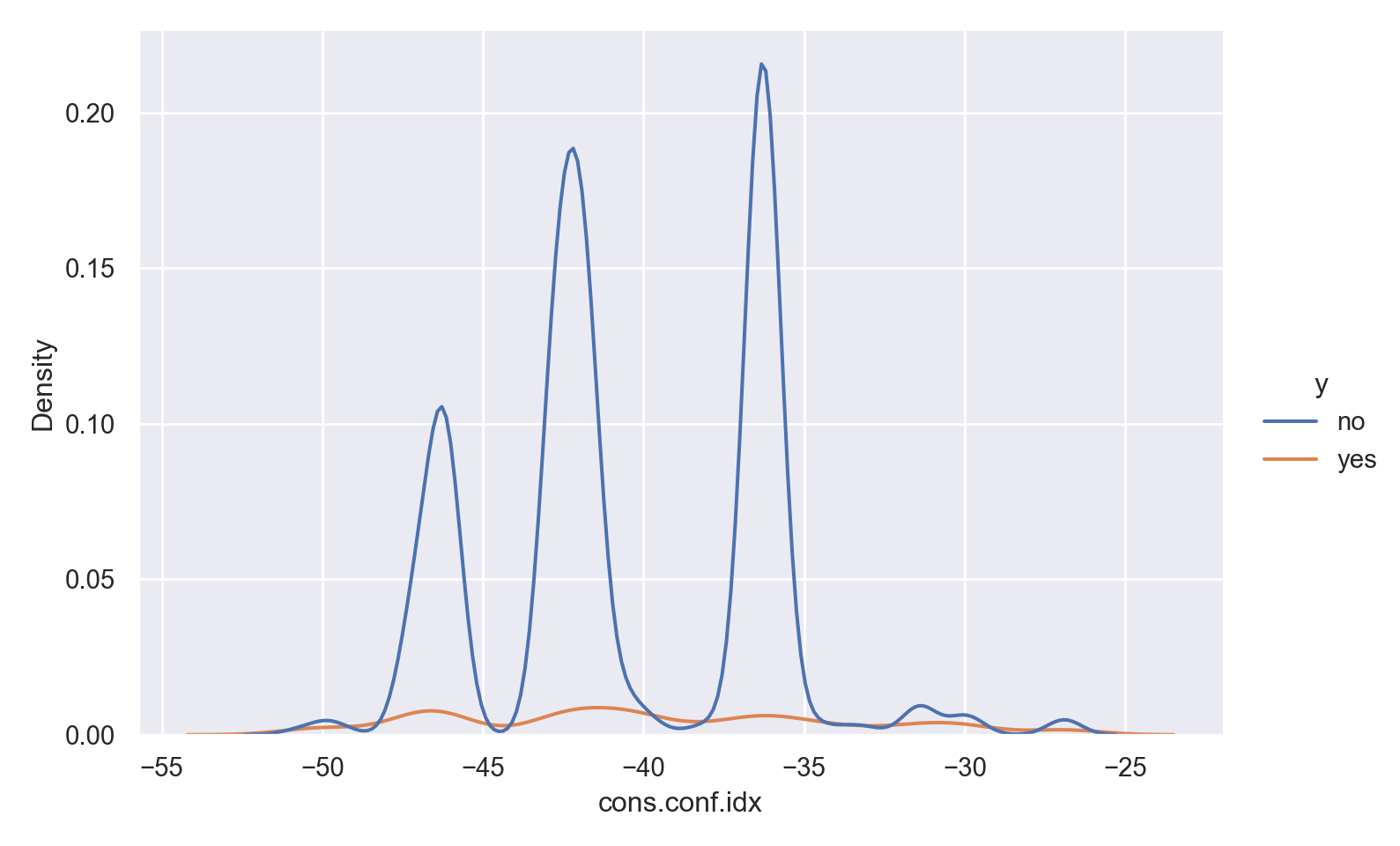

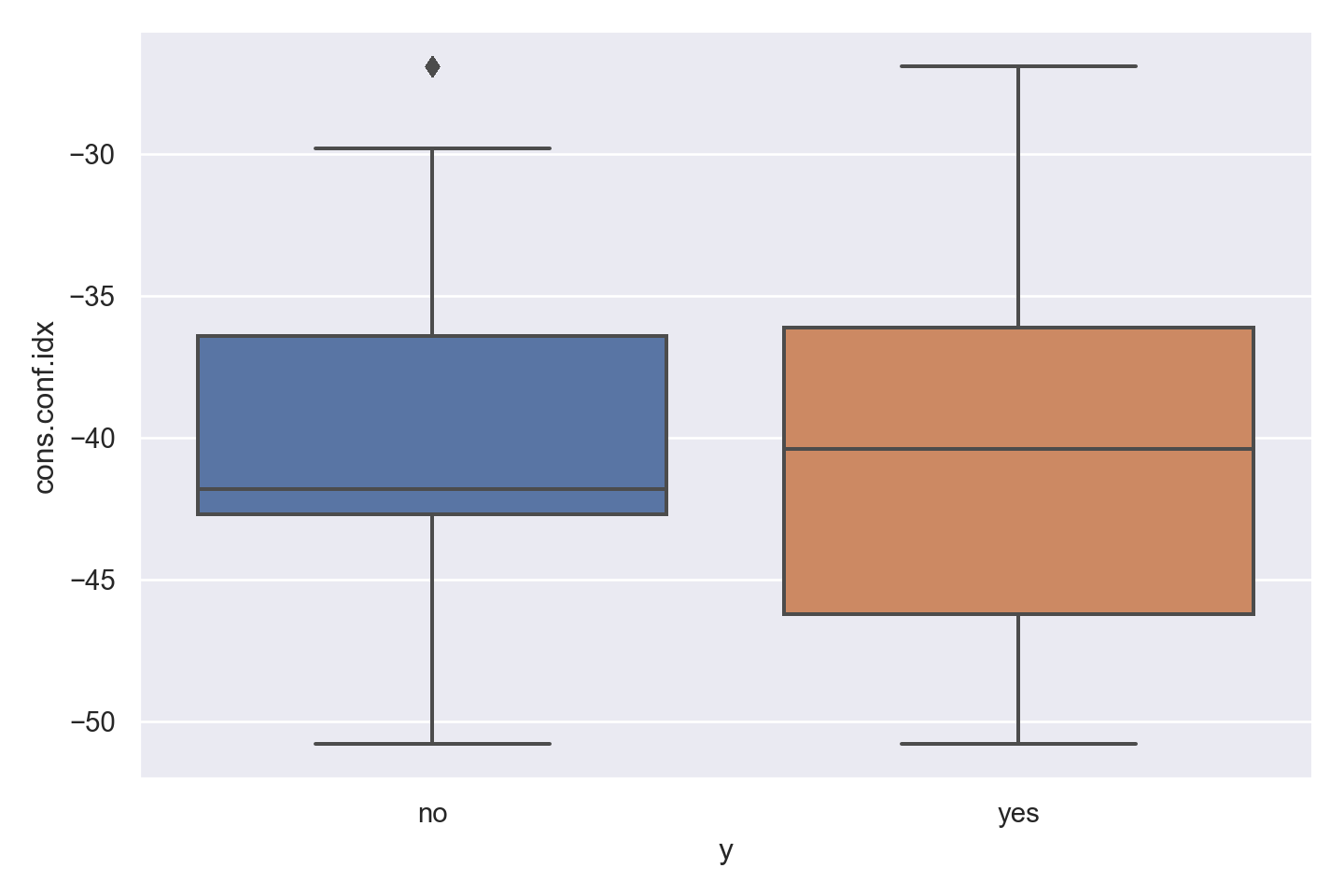

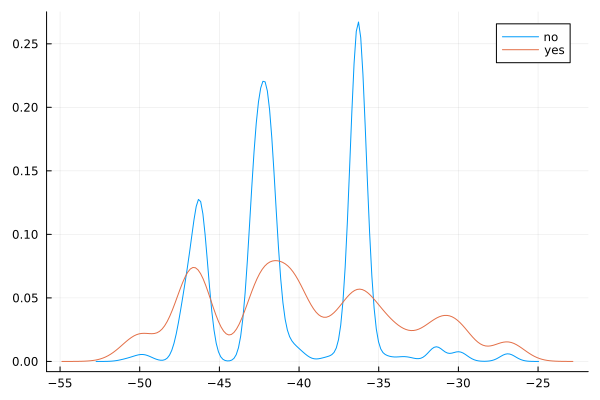

There is a strong association between confidence index and response - ‘yes’ outcomes show a higher index.

There is a multi-modal pattern in the data.

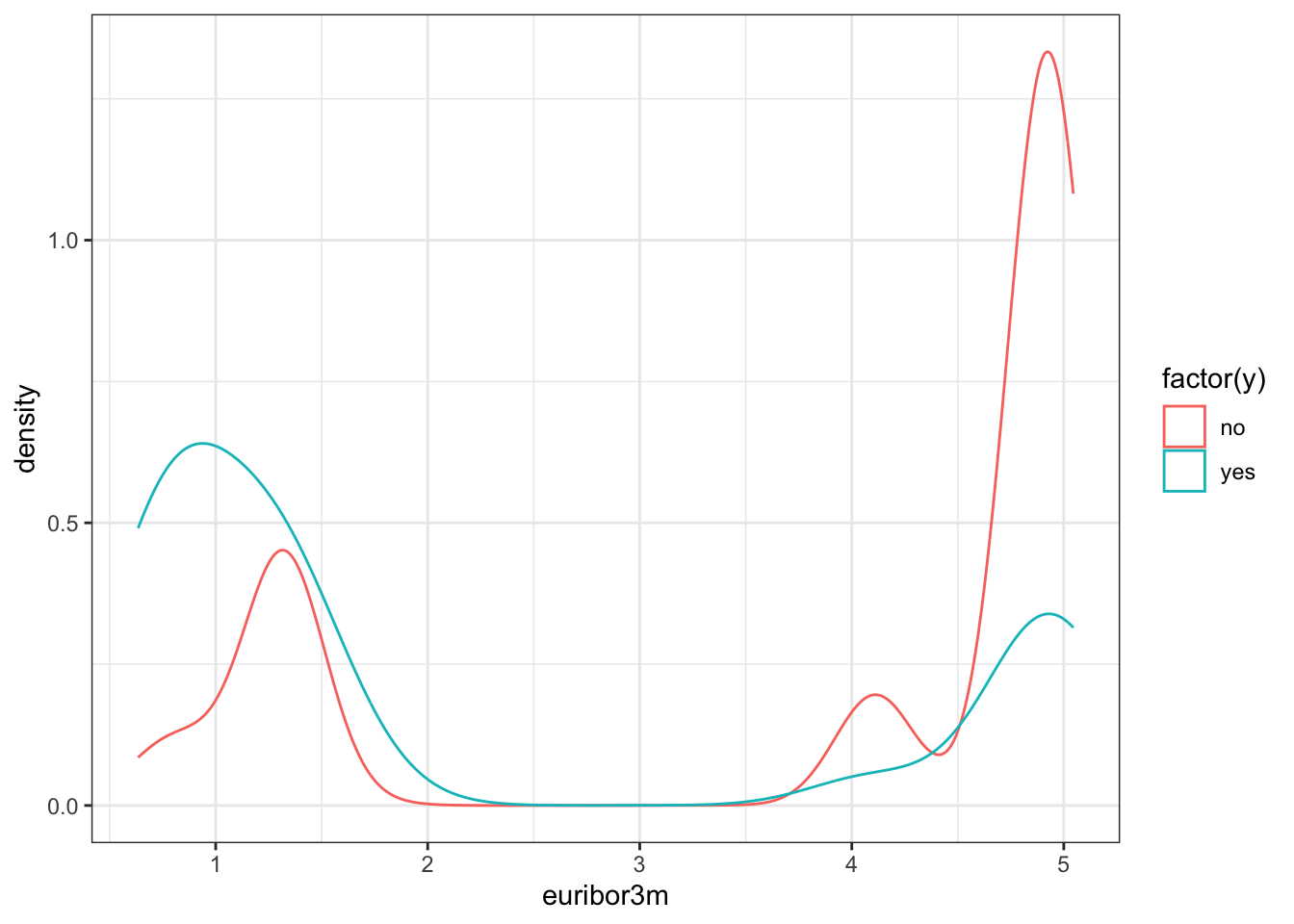

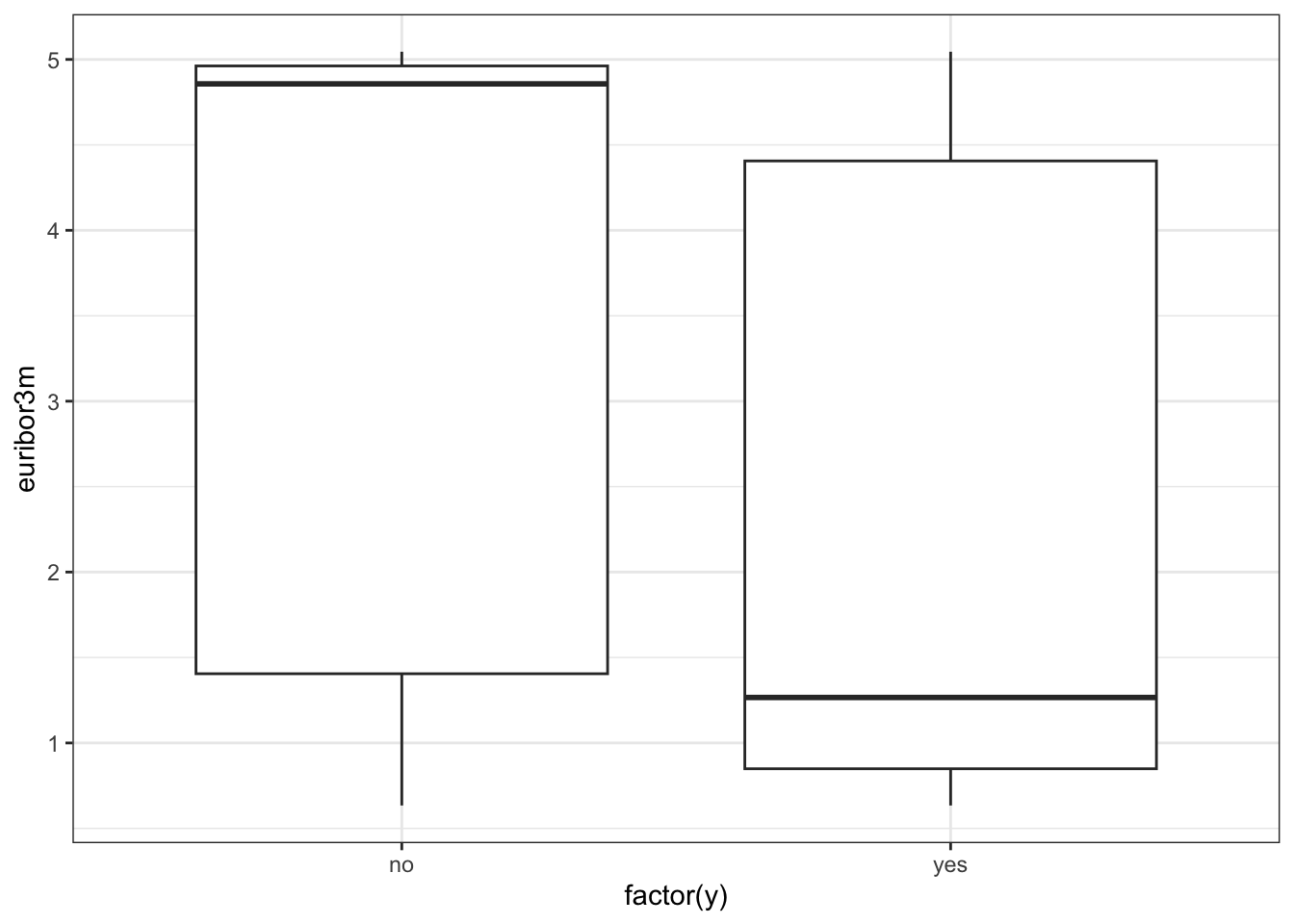

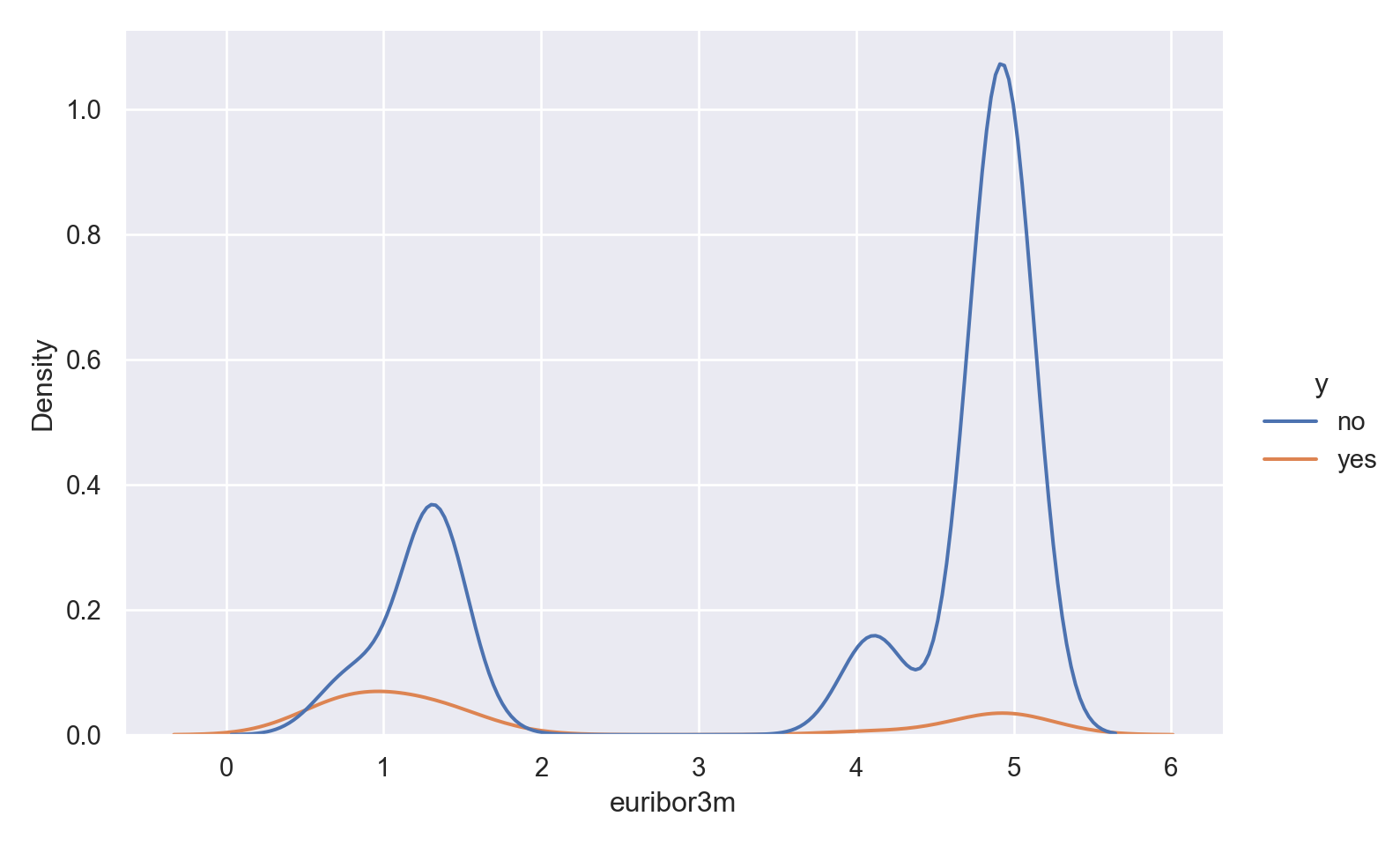

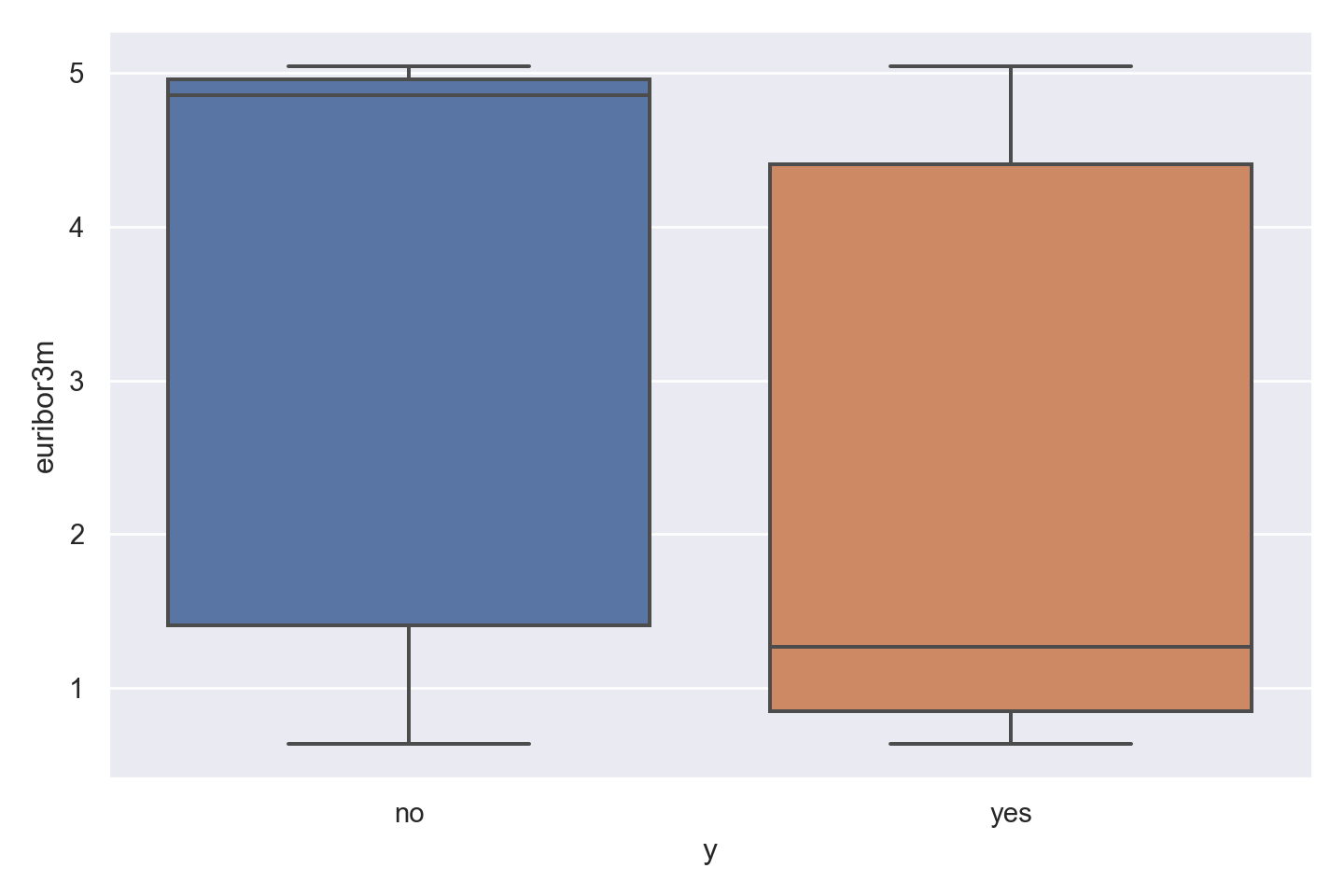

Observations

There is a striking association between employment euribor3m interest rate and response - ‘yes’ outcomes show a much lower interest rate.

There is a multi-modal pattern in the data, with more records for 1 and 5.

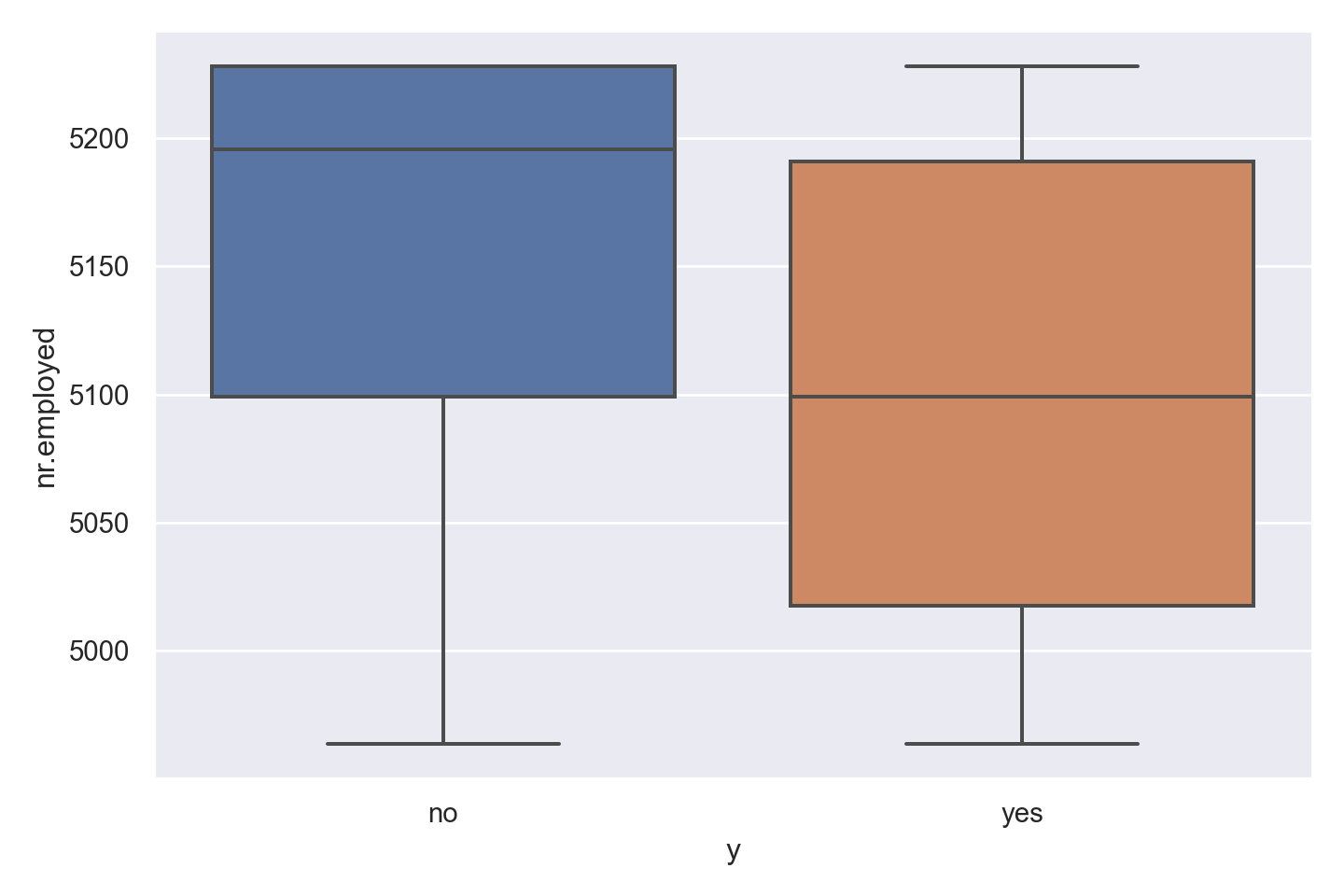

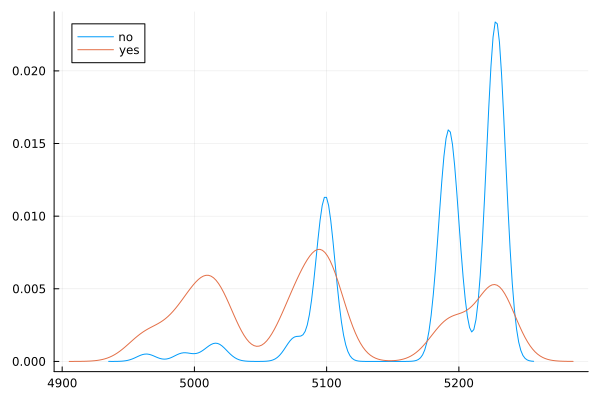

Observations

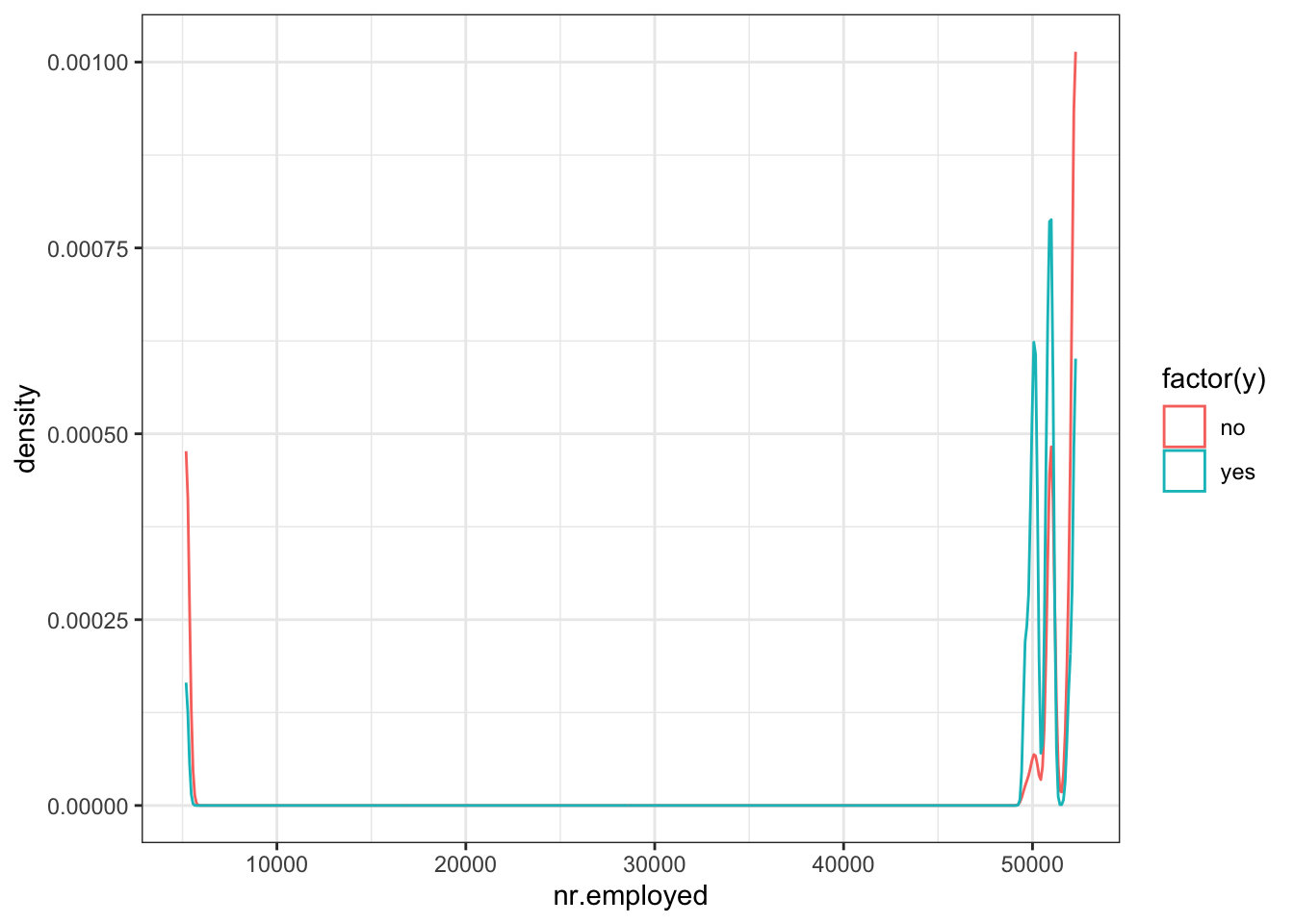

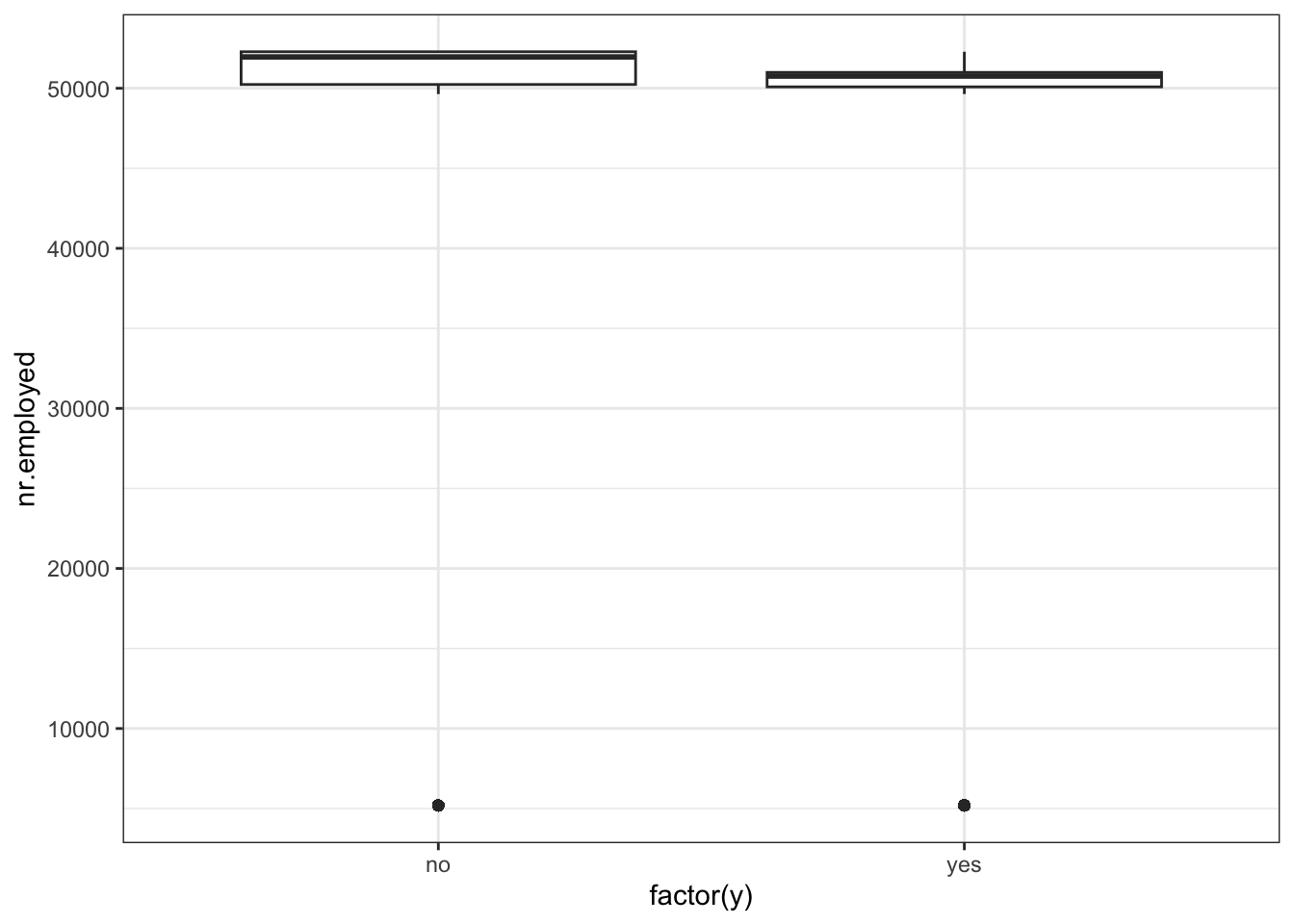

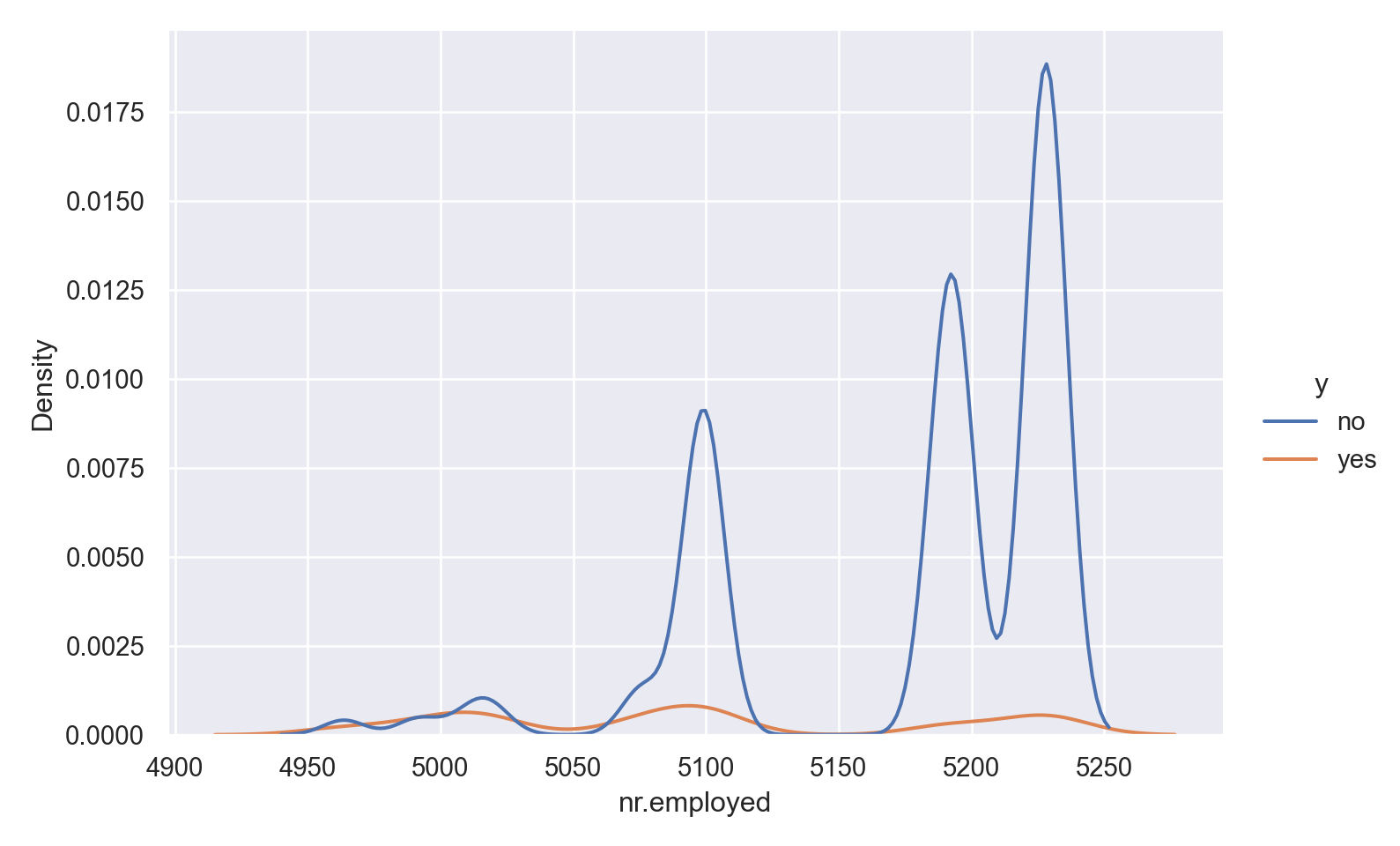

Curiously, ‘yes’ outcome is associated with a lower employment number.

There are two outliers in the data.

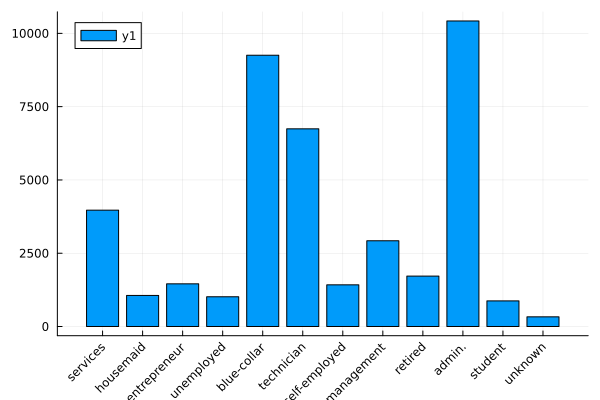

Categorical Attributes

Observations

admin, blue-collar and technicians make up the majority of the people called.

There is higher percentage of yes outcome for students and retired persons, but the overall proportion of these categories is low (without being insignificant)

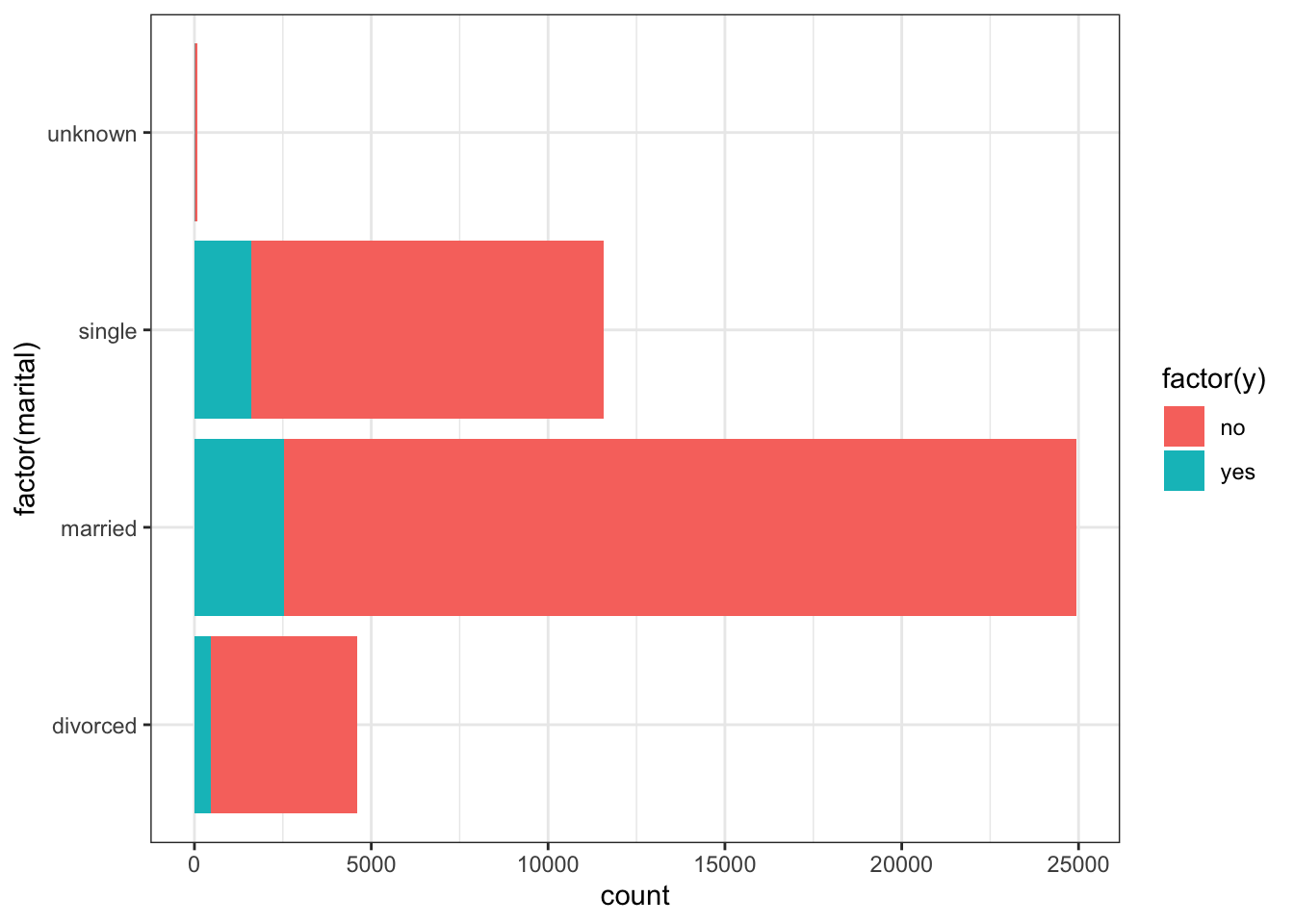

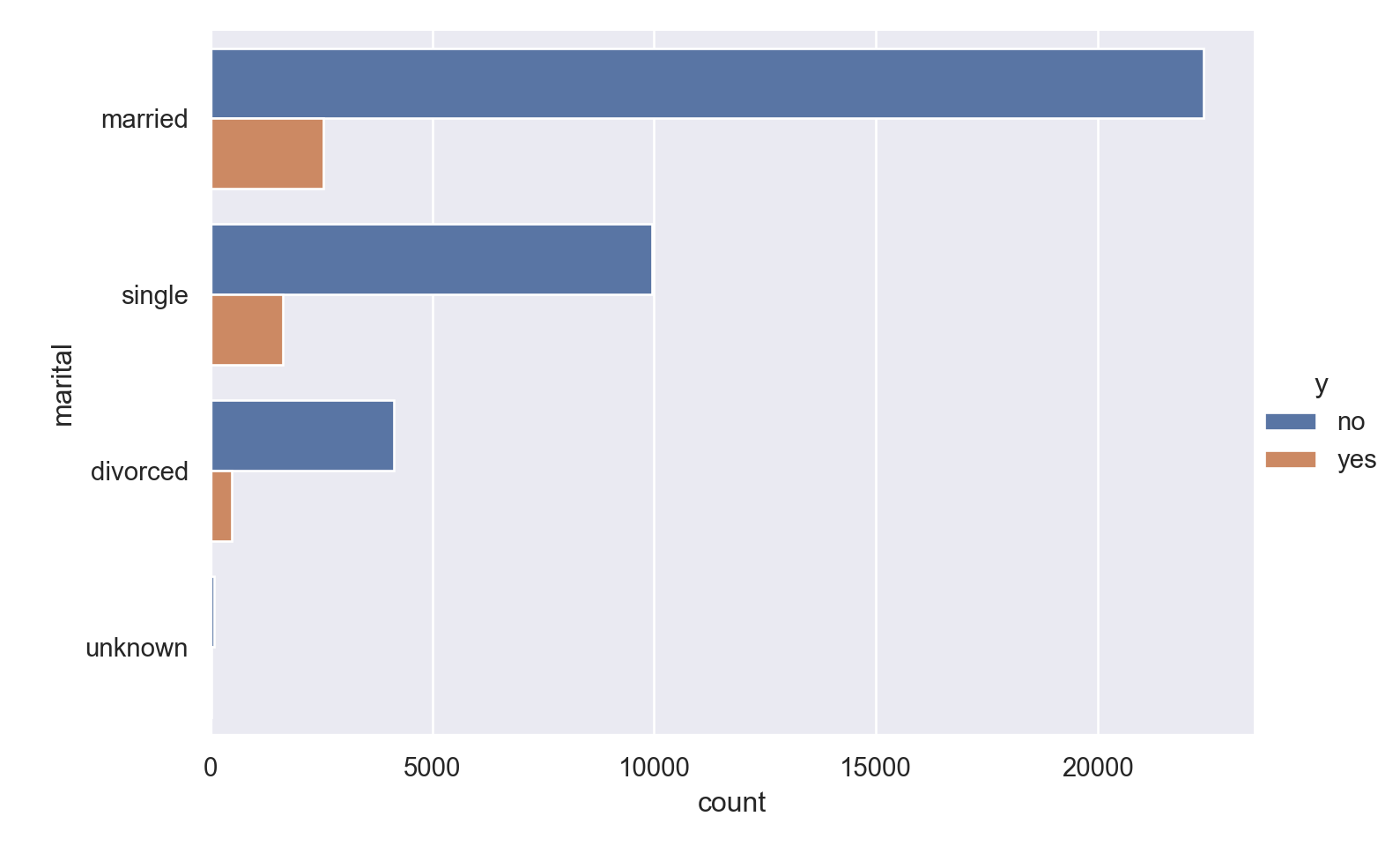

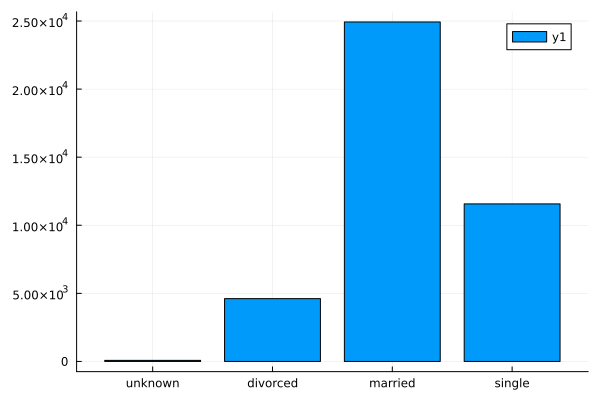

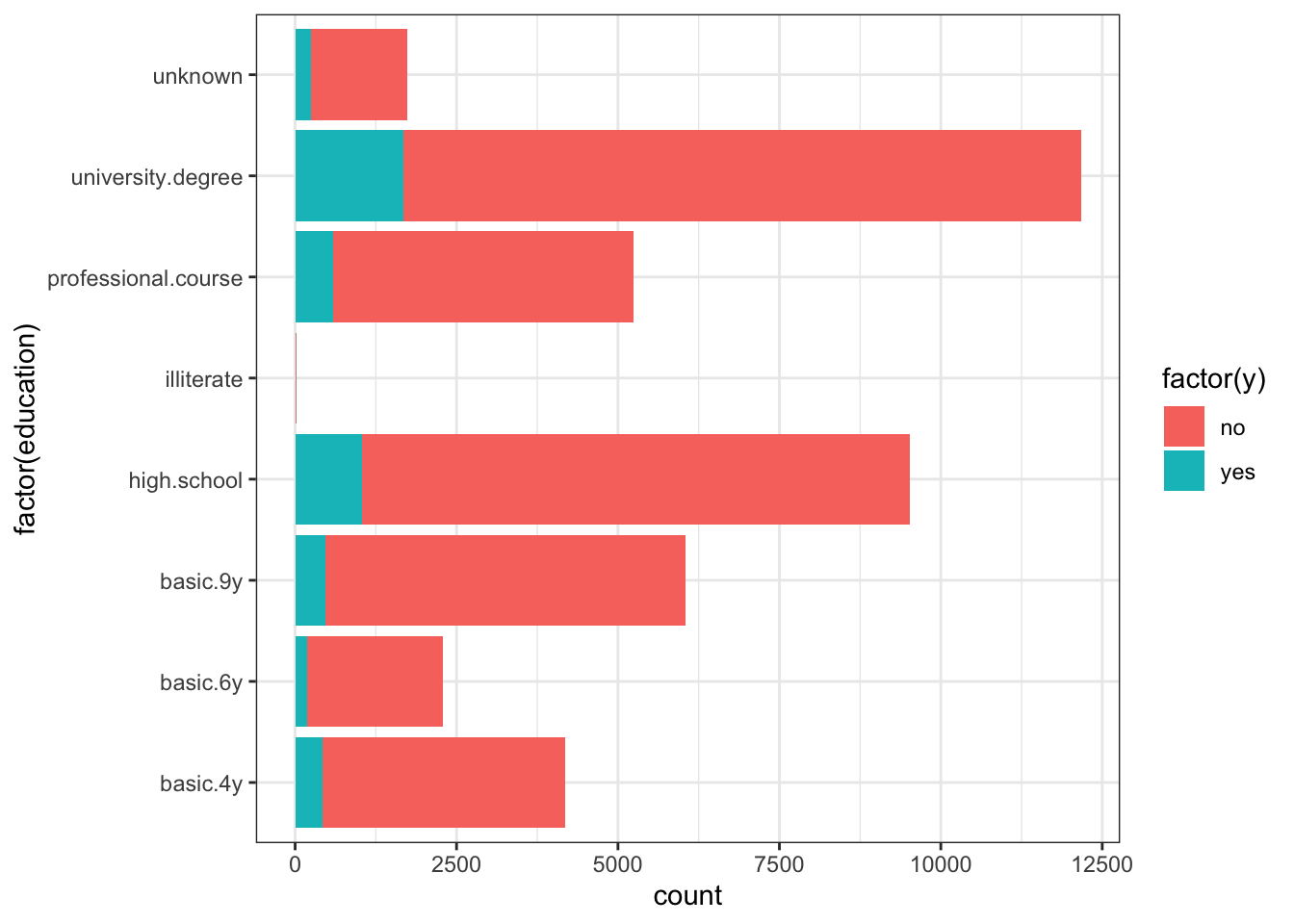

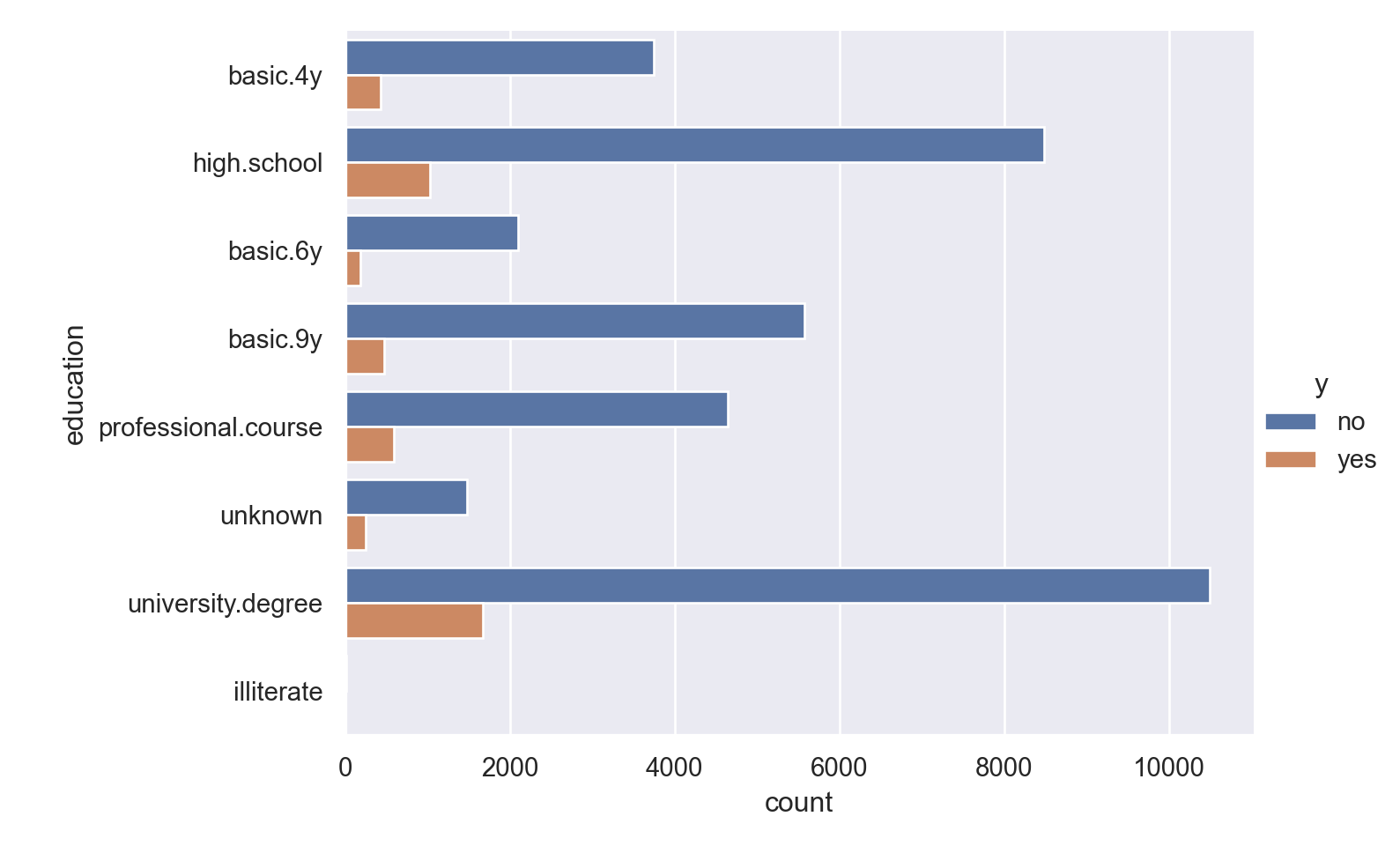

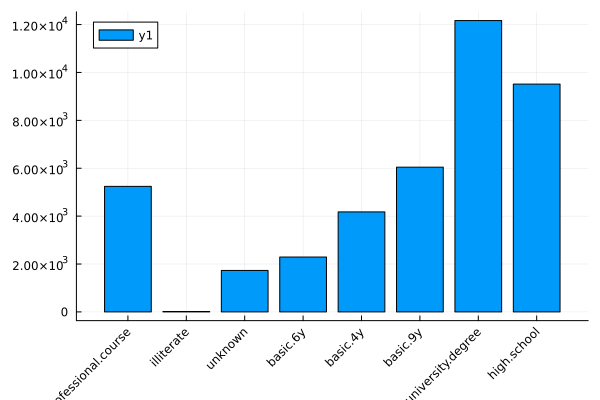

Observations

More of the people are married.

People who are single (and not divorced) have a higher proportion of ‘yes’ response.

Observations

Most people called have 9 years or more education; many have a university degree.

Those with university degree show a slightly higher proportion of ‘yes’ outcome (confirmed by the numerical inspection).

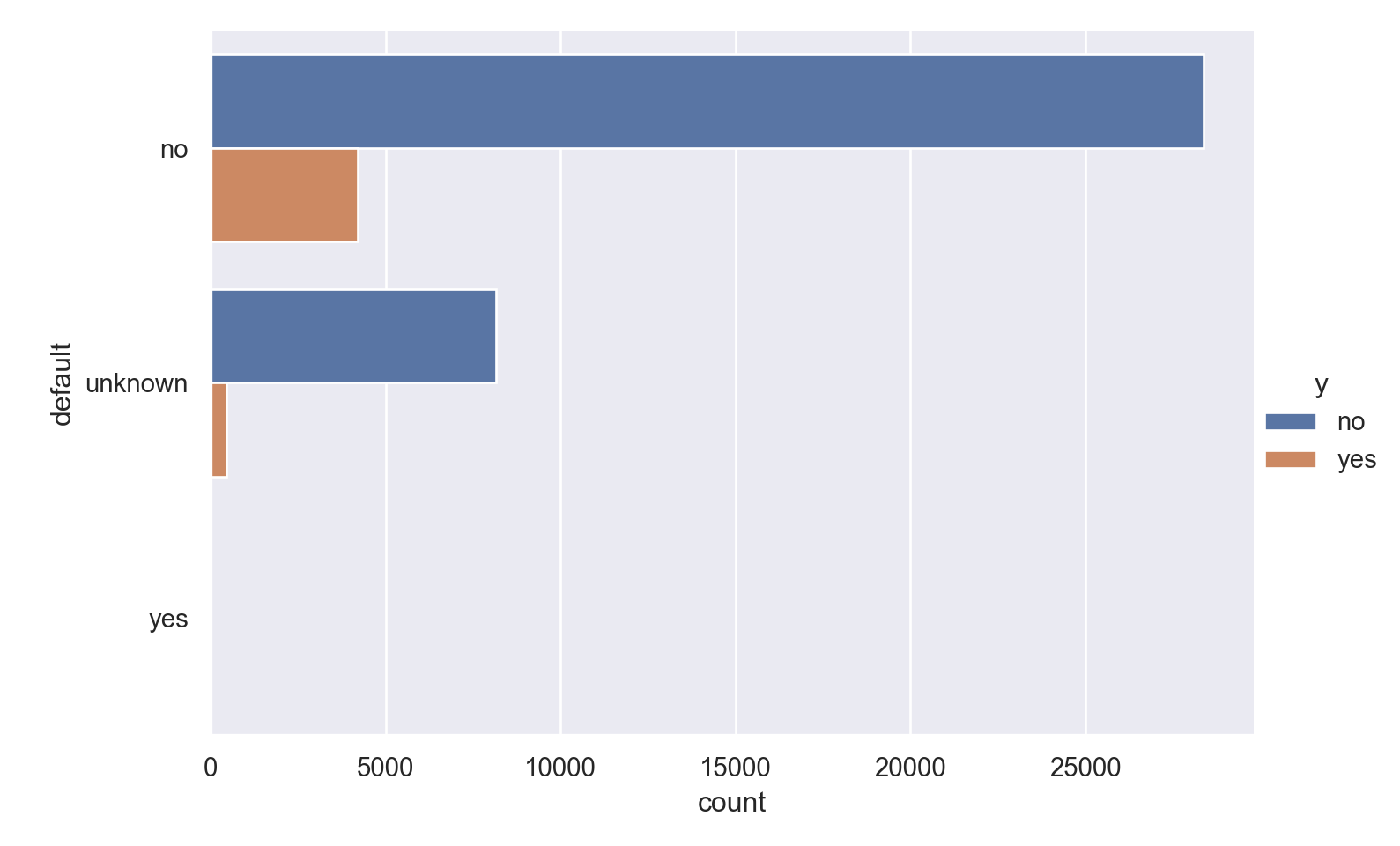

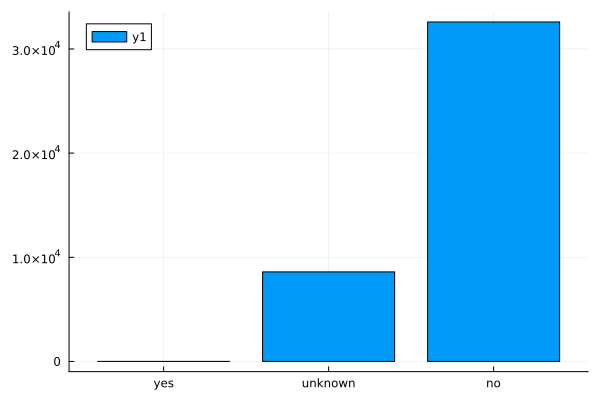

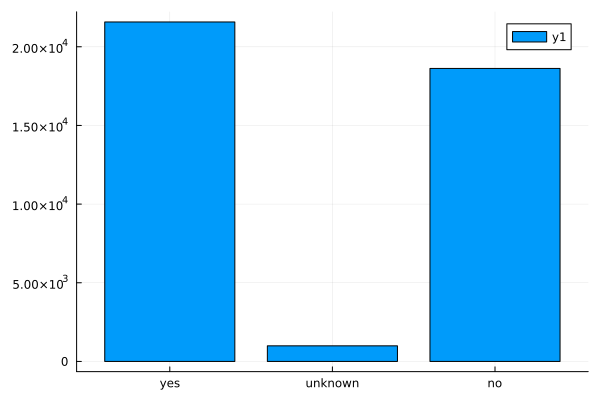

Observations

- A minuscule number of the people called have a loan default.

Observations

- Those contacted on cellular phones have a significantly higher possibility of subscribing to the deposit.

Observations

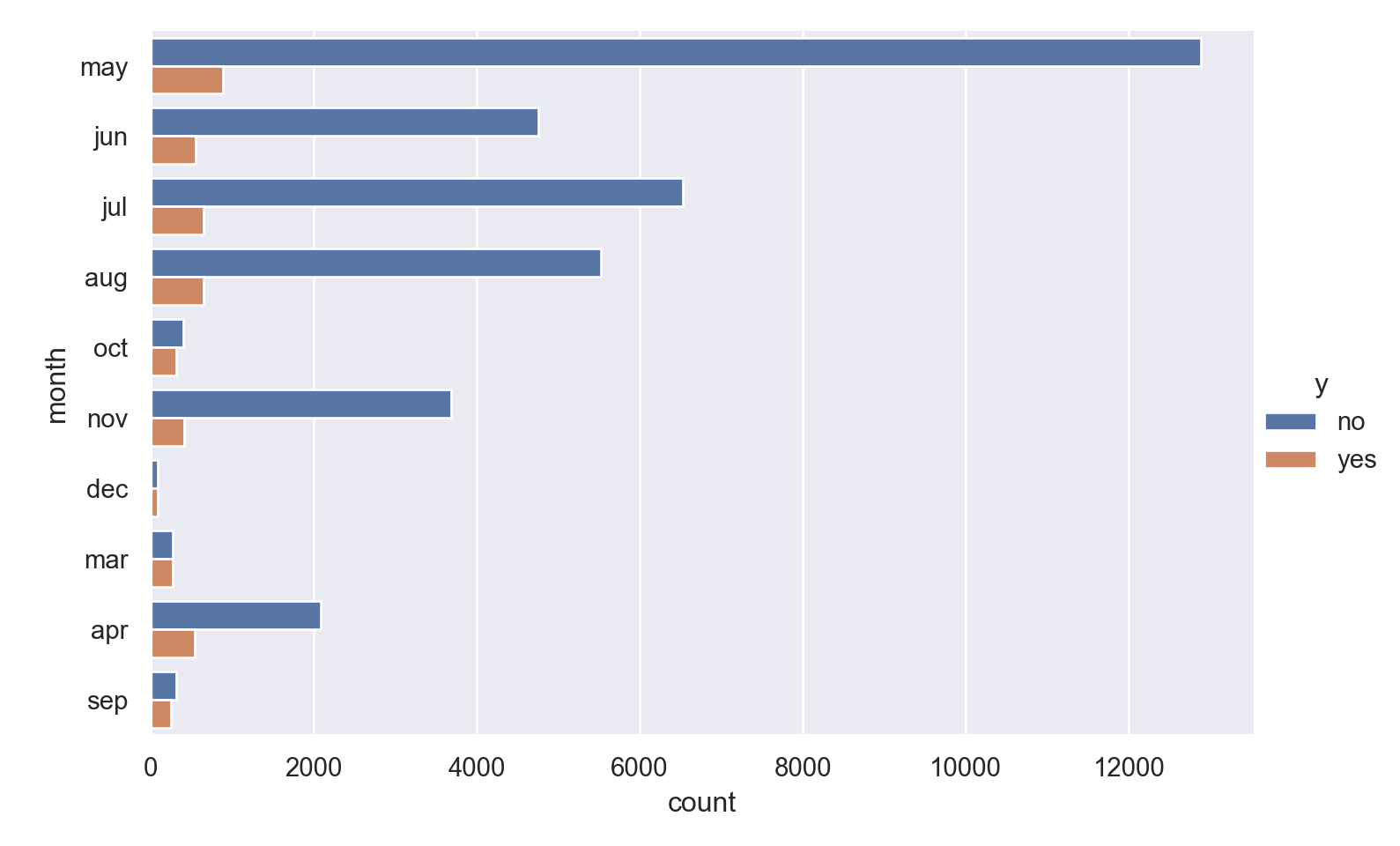

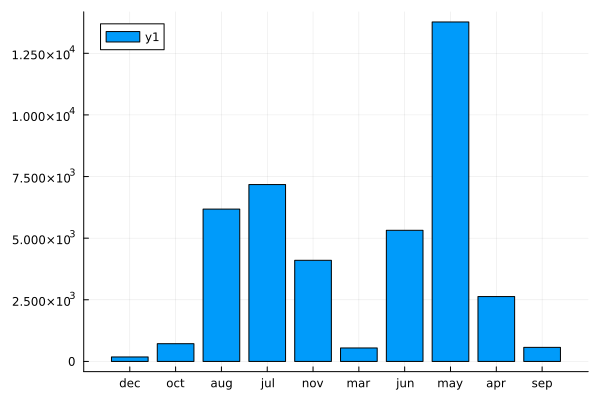

Most calls are placed in May.

The months where there were much fewer calls have a much larger chance of subscribing for the loan.

Observations

People with successful outcome in the previous campaign are much more like to have the same outcome in the current campaign.

Most people were not contacted in previous campaigns.

set.seed(1001)

data_bank_marketing=data_bank_marketing %>% mutate(cons.conf.idx = cons.conf.idx + 509) %>% mutate(emp.var.rate = emp.var.rate + 34) %>% mutate(previous = previous + 1) %>% mutate(euribor3m = as.numeric(euribor3m))

data_bank_marketing_split = initial_split(data_bank_marketing, strata = y)

data_bank_marketing_train = training(data_bank_marketing_split)

data_bank_marketing_test = testing(data_bank_marketing_split)

data_folds = vfold_cv(data_bank_marketing_train, strata = y)

# Global modifications applied before train\test split for effective pre-processing

data_bank_marketing["cons.conf.idx"] = data_bank_marketing["cons.conf.idx"] + 509

data_bank_marketing["emp.var.rate"] = data_bank_marketing["emp.var.rate"] + 34

data_bank_marketing["previous"] = data_bank_marketing["previous"] + 1

y = data_bank_marketing["y"]

data_bank_marketing.drop('y', axis=1, inplace=True)

data_bank_marketing.drop('duration', axis=1, inplace=True)

data_bank_marketing_train, data_bank_marketing_test, y_train, y_test = train_test_split(data_bank_marketing, y, random_state=0)

numerical_cols = data_bank_marketing_train.select_dtypes(include=['int64', 'float64']).columns

categorical_cols = data_bank_marketing_train.select_dtypes(include=['object', 'bool']).columns

log_tranform_cols = ['age', 'campaign', 'previous']

cols_index = [data_bank_marketing_train.columns.get_loc(col) for col in log_tranform_cols]

#power_transform_cols = ['cons.conf.idx', 'cons.price.idx', 'nr.employed', 'emp.var.rate', 'euribor3m']

#power_cols_index = [data_bank_marketing_train.columns.get_loc(col) for col in power_transform_cols]

#dummy_cols = ['age', 'duration', 'campaign', 'pdays', 'previous', 'emp.var.rate', 'cons.price.idx', 'cons.conf.idx', 'euribor3m', 'nr.employed']

interact_cols = ['age', 'job']

interact_cols_index = [data_bank_marketing_train.columns.get_loc(col) for col in interact_cols]

# set up the log transformer

log_transform = ColumnTransformer(

transformers=[

('log', FunctionTransformer(np.log1p), cols_index),

],

verbose_feature_names_out=False, # if True, "log_" will be prefixed to the column names that have been transformed

remainder='passthrough' # this allows columns not being transformed to pass through unchanged

)

# this ensures that the transform outputs a DataFrame, so that the column names are available for the next step.

log_transform.set_output(transform='pandas')

# power = ColumnTransformer(

# transformers=[

# ('power', FunctionTransformer(np.square), power_cols_index),

# ],

# verbose_feature_names_out=False,

# remainder='passthrough'

# )

# power.set_output(transform='pandas')ColumnTransformer(remainder='passthrough',

transformers=[('log',

FunctionTransformer(func=<ufunc 'log1p'>),

[0, 10, 12])],

verbose_feature_names_out=False)In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook. On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

ColumnTransformer(remainder='passthrough',

transformers=[('log',

FunctionTransformer(func=<ufunc 'log1p'>),

[0, 10, 12])],

verbose_feature_names_out=False)[0, 10, 12]

FunctionTransformer(func=<ufunc 'log1p'>)

passthrough

dummy = ColumnTransformer(

transformers=[

('dummy', OneHotEncoder(drop='first', sparse=False), categorical_cols),

],

verbose_feature_names_out=False,

remainder='passthrough'

)

dummy.set_output(transform='pandas')

# interact = ColumnTransformer(

# transformers=[

# ('interact', PolynomialFeatures(interaction_only=True), interact_cols_index),

# ],

# verbose_feature_names_out=False,

# remainder='passthrough'

# )

#

# interact.set_output(transform='pandas')ColumnTransformer(remainder='passthrough',

transformers=[('dummy',

OneHotEncoder(drop='first', sparse=False),

Index(['job', 'marital', 'education', 'default', 'housing', 'loan', 'contact', 'month', 'day_of_week', 'poutcome'], dtype='object'))],

verbose_feature_names_out=False)In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook. On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

ColumnTransformer(remainder='passthrough',

transformers=[('dummy',

OneHotEncoder(drop='first', sparse=False),

Index(['job', 'marital', 'education', 'default', 'housing', 'loan', 'contact', 'month', 'day_of_week', 'poutcome'], dtype='object'))],

verbose_feature_names_out=False)Index(['job', 'marital', 'education', 'default', 'housing', 'loan', 'contact', 'month', 'day_of_week', 'poutcome'], dtype='object')

OneHotEncoder(drop='first', sparse=False)

passthrough

steps=[

("dummy", dummy),

("normalize", MinMaxScaler()),

("zv", VarianceThreshold()),

]

pipe = Pipeline(steps)

X_trans_train = pipe.fit_transform(data_bank_marketing_train, y_train)

X_trans_test = pipe.fit_transform(data_bank_marketing_test, y_test)

# transform y

label_encoder = LabelEncoder()

y_trans_train = label_encoder.fit_transform(y_train)

y_trans_test = label_encoder.fit_transform(y_test)coerce!(data, Textual => Multiclass);

coerce!(data, :y => OrderedFactor);

schema(data) |> DataFrames.DataFrame |> pretty_table┌────────────────┬──────────────────┬────────────────────────────────────┐

│ names │ scitypes │ types │

│ Symbol │ DataType │ DataType │

├────────────────┼──────────────────┼────────────────────────────────────┤

│ age │ Count │ Int64 │

│ job │ Multiclass{12} │ CategoricalValue{String15, UInt32} │

│ marital │ Multiclass{4} │ CategoricalValue{String15, UInt32} │

│ education │ Multiclass{8} │ CategoricalValue{String31, UInt32} │

│ default │ Multiclass{3} │ CategoricalValue{String7, UInt32} │

│ housing │ Multiclass{3} │ CategoricalValue{String7, UInt32} │

│ loan │ Multiclass{3} │ CategoricalValue{String7, UInt32} │

│ contact │ Multiclass{2} │ CategoricalValue{String15, UInt32} │

│ month │ Multiclass{10} │ CategoricalValue{String3, UInt32} │

│ day_of_week │ Multiclass{5} │ CategoricalValue{String3, UInt32} │

│ duration │ Count │ Int64 │

│ campaign │ Count │ Int64 │

│ pdays │ Count │ Int64 │

│ previous │ Count │ Int64 │

│ poutcome │ Multiclass{3} │ CategoricalValue{String15, UInt32} │

│ emp.var.rate │ Continuous │ Float64 │

│ cons.price.idx │ Continuous │ Float64 │

│ cons.conf.idx │ Continuous │ Float64 │

│ euribor3m │ Continuous │ Float64 │

│ nr_employed │ Continuous │ Float64 │

│ y │ OrderedFactor{2} │ CategoricalValue{String3, UInt32} │

└────────────────┴──────────────────┴────────────────────────────────────┘- Log and square transforms applied to numeric predictors.

- Dummy transform needed for categorical predictors.

- Interactions defined for age with job and education.

base_rec = recipe(y ~ ., data = data_bank_marketing_train) %>% step_rm(duration) #%>% step_zv(all_numeric_predictors()) %>% step_normalize(all_numeric_predictors()) %>% step_pca(all_numeric_predictors())

trfm_rec = base_rec %>% step_log(c(age, campaign, previous)) %>% step_poly(c(pdays, cons.conf.idx, cons.price.idx, nr.employed, emp.var.rate, euribor3m)) %>% step_dummy(all_nominal_predictors()) %>% step_interact(terms =~ age:starts_with("job") + age:starts_with("education"))

trfm_data = prep(trfm_rec, data_bank_marketing_train) %>% bake(new_data = NULL)

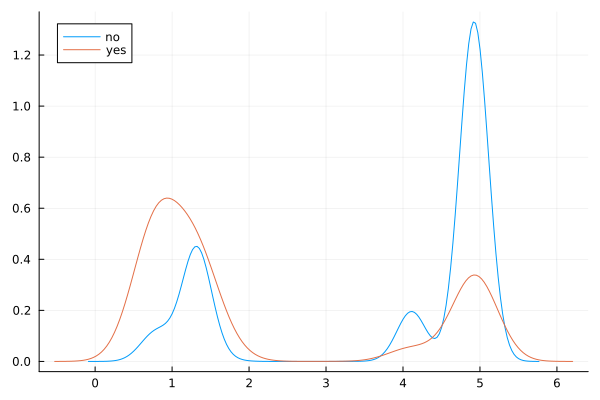

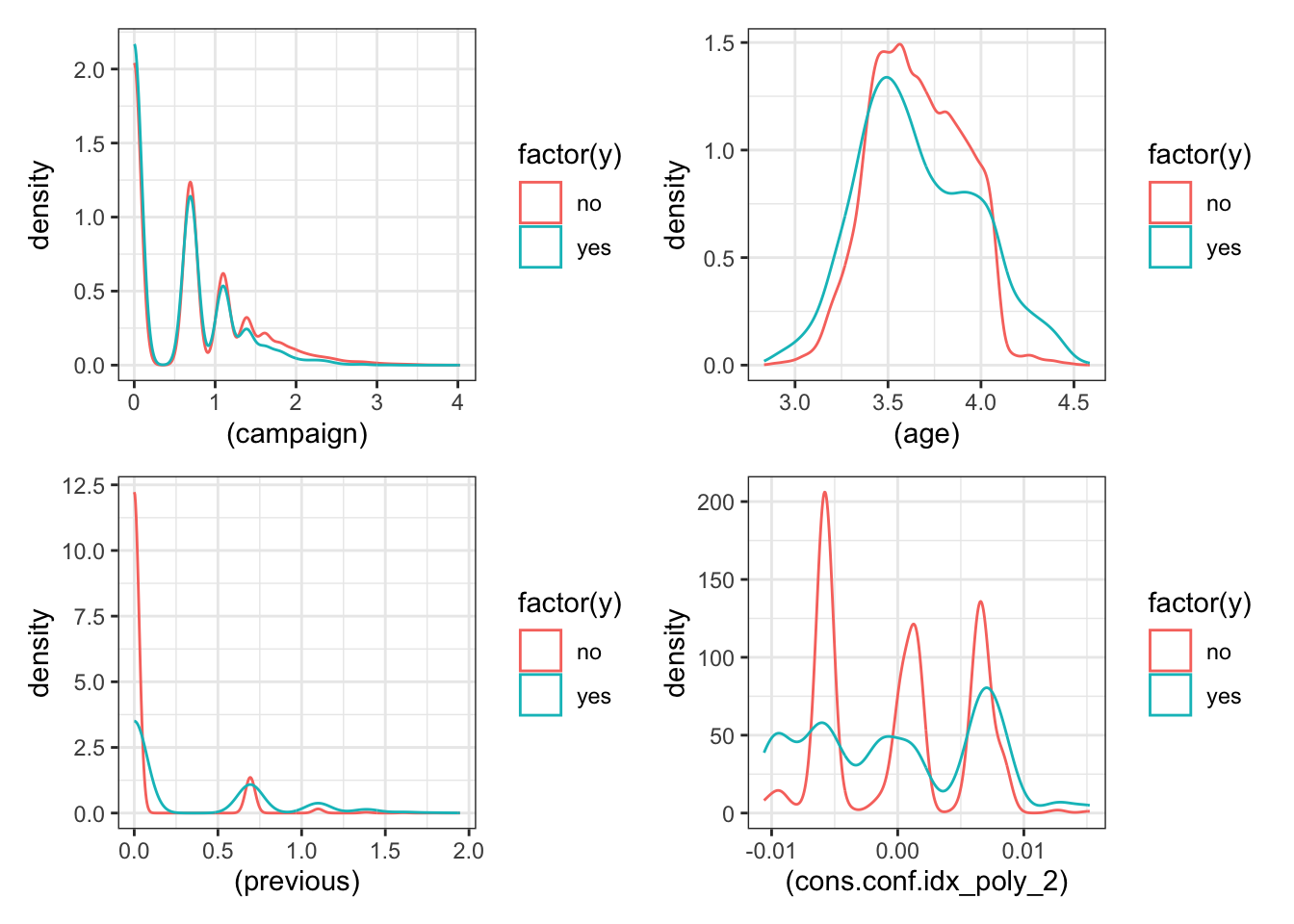

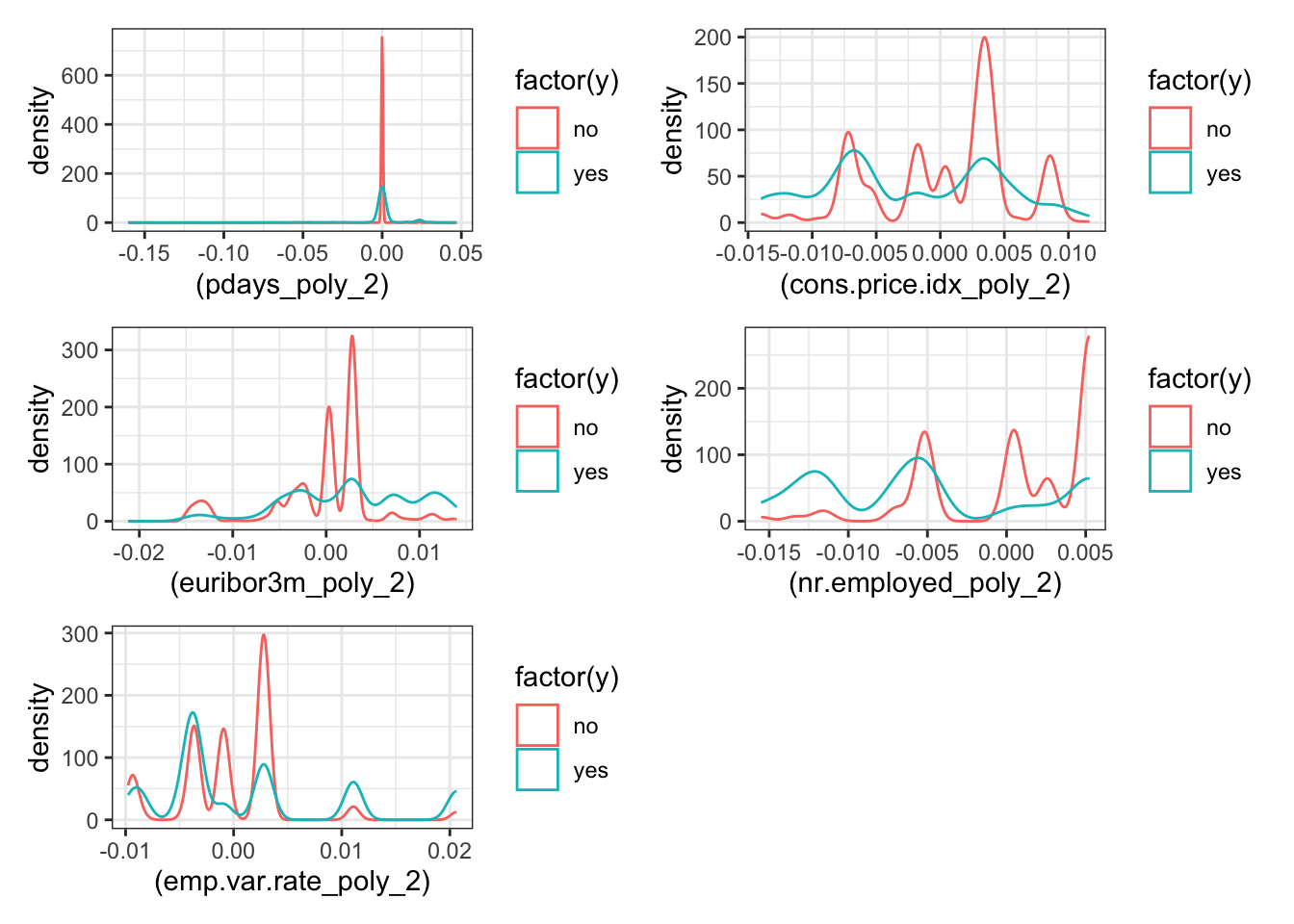

p1 = ggplot(trfm_data) + geom_density(aes(x=(campaign), color=factor(y)))

p2 = ggplot(trfm_data) + geom_density(aes(x=(age), color=factor(y)))

p3 = ggplot(trfm_data) + geom_density(aes(x=(previous), color=factor(y)))

p4 = ggplot(trfm_data) + geom_density(aes(x=(cons.conf.idx_poly_2), color=factor(y)))

p5 = ggplot(trfm_data) + geom_density(aes(x=(pdays_poly_2), color=factor(y)))

p6 = ggplot(trfm_data) + geom_density(aes(x=(cons.price.idx_poly_2), color=factor(y)))

p7 = ggplot(trfm_data) + geom_density(aes(x=(euribor3m_poly_2), color=factor(y)))

p8 = ggplot(trfm_data) + geom_density(aes(x=(nr.employed_poly_2), color=factor(y)))

p9 = ggplot(trfm_data) + geom_density(aes(x=(emp.var.rate_poly_2), color=factor(y)))

p1+p2+p3+p4 + plot_layout(ncol = 2)

numerical_cols = data_bank_marketing_train.select_dtypes(include=['int64', 'float64']).columns

categorical_cols = data_bank_marketing_train.select_dtypes(include=['object', 'bool']).columns

log_tranform_cols = ['age', 'campaign', 'previous']

cols_index = [data_bank_marketing_train.columns.get_loc(col) for col in log_tranform_cols]

#power_transform_cols = ['cons.conf.idx', 'cons.price.idx', 'nr.employed', 'emp.var.rate', 'euribor3m']

#power_cols_index = [data_bank_marketing_train.columns.get_loc(col) for col in power_transform_cols]

#dummy_cols = ['age', 'duration', 'campaign', 'pdays', 'previous', 'emp.var.rate', 'cons.price.idx', 'cons.conf.idx', 'euribor3m', 'nr.employed']

interact_cols = ['age', 'job']

interact_cols_index = [data_bank_marketing_train.columns.get_loc(col) for col in interact_cols]

# set up the log transformer

log_transform = ColumnTransformer(

transformers=[

('log', FunctionTransformer(np.log1p), cols_index),

],

verbose_feature_names_out=False, # if True, "log_" will be prefixed to the column names that have been transformed

remainder='passthrough' # this allows columns not being transformed to pass through unchanged

)

# this ensures that the transform outputs a DataFrame, so that the column names are available for the next step.

log_transform.set_output(transform='pandas')

# power = ColumnTransformer(

# transformers=[

# ('power', FunctionTransformer(np.square), power_cols_index),

# ],

# verbose_feature_names_out=False,

# remainder='passthrough'

# )

# power.set_output(transform='pandas')ColumnTransformer(remainder='passthrough',

transformers=[('log',

FunctionTransformer(func=<ufunc 'log1p'>),

[0, 10, 12])],

verbose_feature_names_out=False)In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook. On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

ColumnTransformer(remainder='passthrough',

transformers=[('log',

FunctionTransformer(func=<ufunc 'log1p'>),

[0, 10, 12])],

verbose_feature_names_out=False)[0, 10, 12]

FunctionTransformer(func=<ufunc 'log1p'>)

passthrough

dummy = ColumnTransformer(

transformers=[

('dummy', OneHotEncoder(drop='first', sparse=False), categorical_cols),

],

verbose_feature_names_out=False,

remainder='passthrough'

)

dummy.set_output(transform='pandas')

# interact = ColumnTransformer(

# transformers=[

# ('interact', PolynomialFeatures(interaction_only=True), interact_cols_index),

# ],

# verbose_feature_names_out=False,

# remainder='passthrough'

# )

#

# interact.set_output(transform='pandas')ColumnTransformer(remainder='passthrough',

transformers=[('dummy',

OneHotEncoder(drop='first', sparse=False),

Index(['job', 'marital', 'education', 'default', 'housing', 'loan', 'contact', 'month', 'day_of_week', 'poutcome'], dtype='object'))],

verbose_feature_names_out=False)In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook. On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

ColumnTransformer(remainder='passthrough',

transformers=[('dummy',

OneHotEncoder(drop='first', sparse=False),

Index(['job', 'marital', 'education', 'default', 'housing', 'loan', 'contact', 'month', 'day_of_week', 'poutcome'], dtype='object'))],

verbose_feature_names_out=False)Index(['job', 'marital', 'education', 'default', 'housing', 'loan', 'contact', 'month', 'day_of_week', 'poutcome'], dtype='object')

OneHotEncoder(drop='first', sparse=False)

passthrough

Observations

- Some of the predictors have a reduction in the skew after the transformation.

glmnet_recipe <-

recipe(formula = y ~ ., data = data_bank_marketing_train) %>%

step_rm(duration) %>%

step_log(c(age, campaign, previous)) %>%

#step_poly(c(pdays, cons.conf.idx, cons.price.idx, nr.employed, emp.var.rate, euribor3m)) %>%

## For modeling, it is preferred to encode qualitative data as factors

## (instead of character).

step_string2factor(one_of("job", "marital", "education", "default", "housing",

"loan", "contact", "month", "day_of_week", "poutcome", "y")) %>%

step_novel(all_nominal_predictors()) %>%

## This model requires the predictors to be numeric. The most common

## method to convert qualitative predictors to numeric is to create

## binary indicator variables (aka dummy variables) from these

## predictors.

step_dummy(all_nominal_predictors()) %>%

## Regularization methods sum up functions of the model slope

## coefficients. Because of this, the predictor variables should be on

## the same scale. Before centering and scaling the numeric predictors,

## any predictors with a single unique value are filtered out.

step_zv(all_predictors()) %>%

step_normalize(all_numeric_predictors())

glmnet_spec <-

multinom_reg(penalty = tune(), mixture = tune()) %>%

set_mode("classification") %>%

set_engine("glmnet")

glmnet_workflow <-

workflow() %>%

add_recipe(glmnet_recipe) %>%

add_model(glmnet_spec)

glmnet_grid <- tidyr::crossing(penalty = 10^seq(-6, -1, length.out = 20), mixture = c(0.05,

0.2, 0.4, 0.6, 0.8, 1))

# glmnet_tune <-

# tune_grid(glmnet_workflow, resamples = data_folds, grid = glmnet_grid, control = control_grid(save_pred = TRUE), metrics = metric_set(roc_auc))

final_params <-

tibble(

penalty = 0.0000695,

mixture = 1

)

final_glmnet_wflow = glmnet_workflow %>% finalize_workflow(final_params)

final_glmnet_wflow══ Workflow ════════════════════════════════════════════════════════════════════

Preprocessor: Recipe

Model: multinom_reg()

── Preprocessor ────────────────────────────────────────────────────────────────

7 Recipe Steps

• step_rm()

• step_log()

• step_string2factor()

• step_novel()

• step_dummy()

• step_zv()

• step_normalize()

── Model ───────────────────────────────────────────────────────────────────────

Multinomial Regression Model Specification (classification)

Main Arguments:

penalty = 6.95e-05

mixture = 1

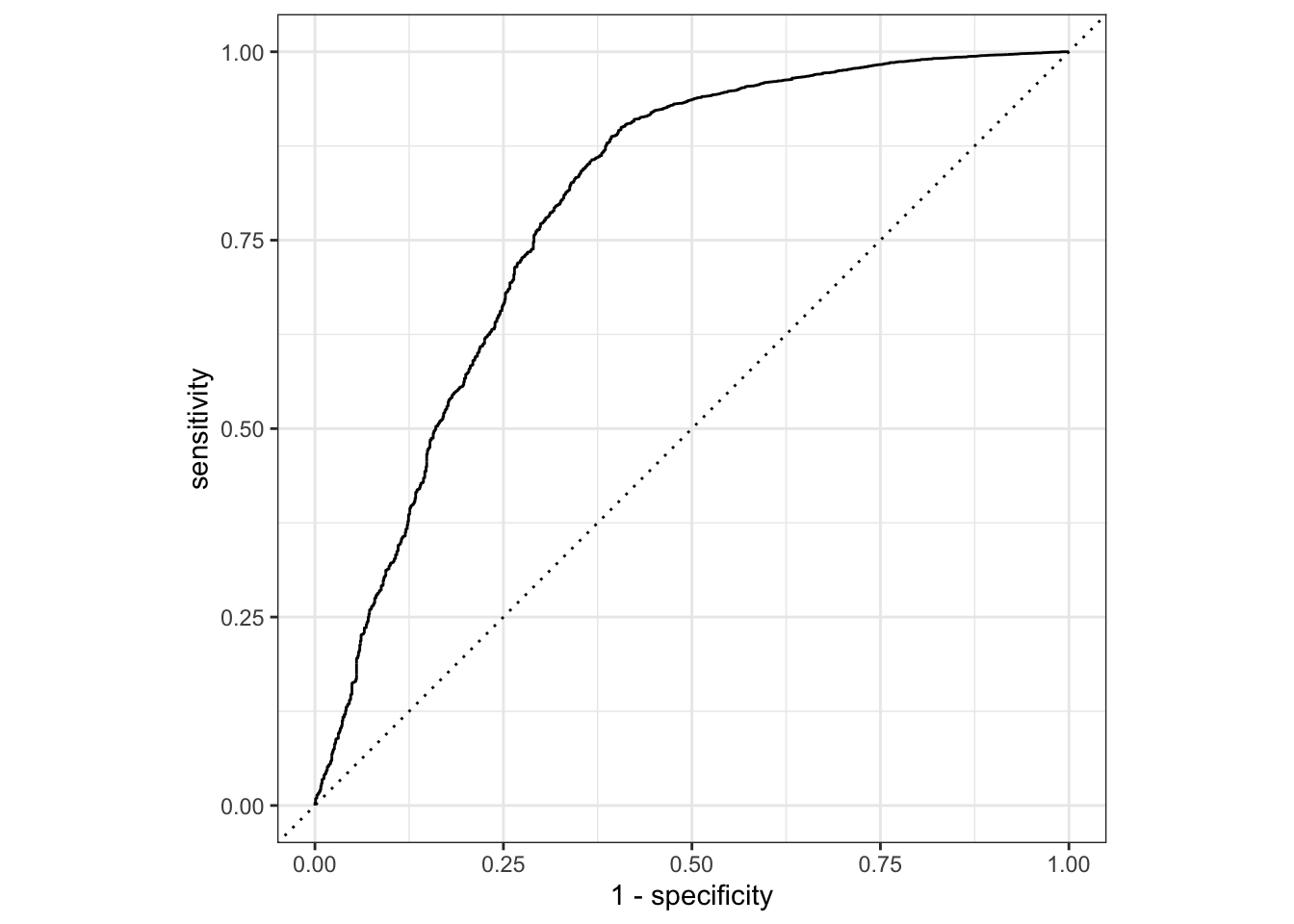

Computational engine: glmnet final_glmnet_fit = final_glmnet_wflow %>% last_fit(data_bank_marketing_split)

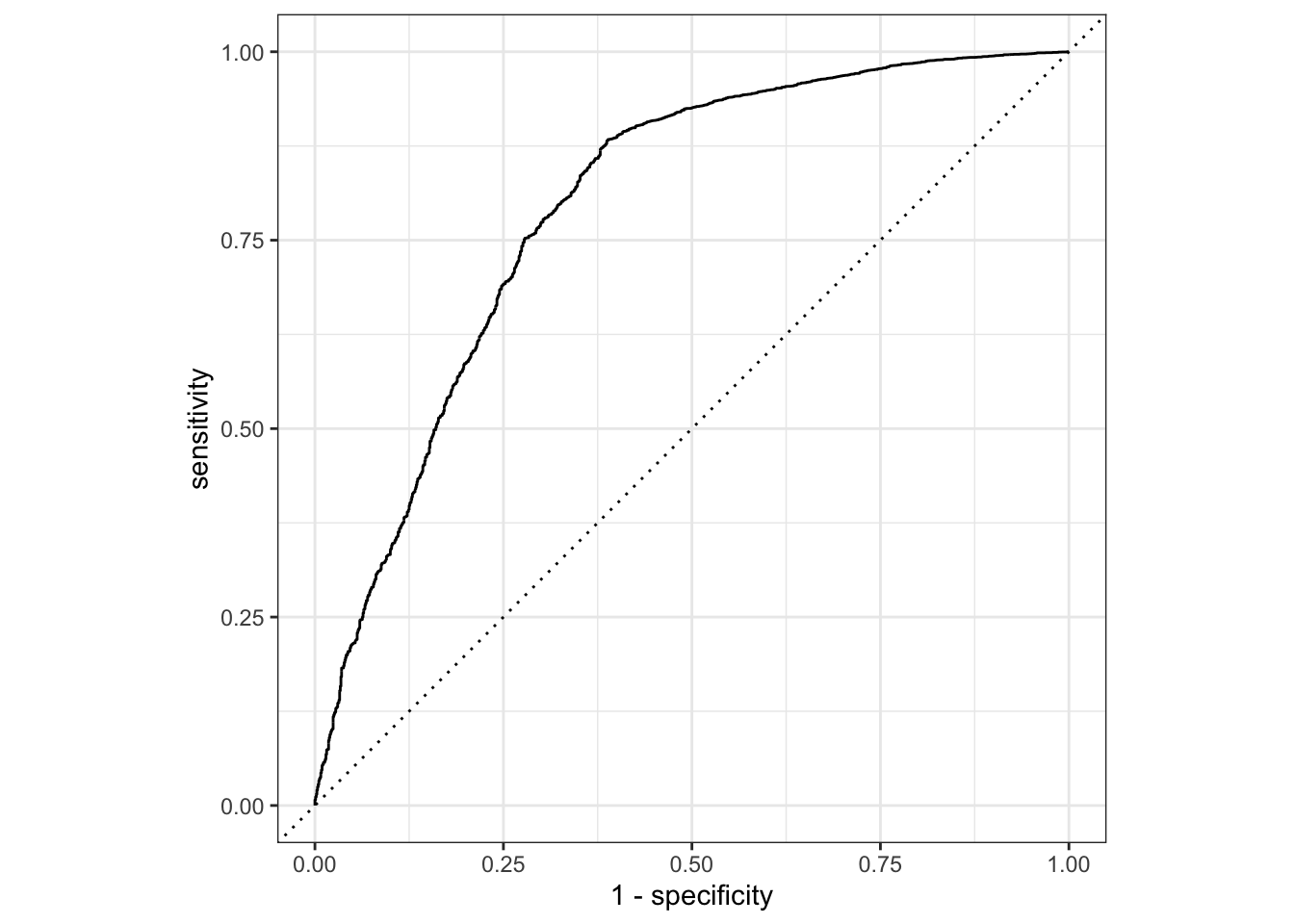

final_glmnet_fit %>% collect_metrics()# A tibble: 2 × 4

.metric .estimator .estimate .config

<chr> <chr> <dbl> <chr>

1 accuracy binary 0.901 Preprocessor1_Model1

2 roc_auc binary 0.793 Preprocessor1_Model1# A tibble: 10,297 × 7

id .pred_no .pred_yes .row .pred_class y .config

<chr> <dbl> <dbl> <int> <fct> <fct> <chr>

1 train/test split 0.970 0.0299 7 no no Preprocessor1_Mo…

2 train/test split 0.977 0.0225 18 no no Preprocessor1_Mo…

3 train/test split 0.968 0.0321 21 no no Preprocessor1_Mo…

4 train/test split 0.980 0.0201 22 no no Preprocessor1_Mo…

5 train/test split 0.970 0.0296 24 no no Preprocessor1_Mo…

6 train/test split 0.985 0.0155 30 no no Preprocessor1_Mo…

7 train/test split 0.977 0.0230 34 no no Preprocessor1_Mo…

8 train/test split 0.975 0.0255 35 no no Preprocessor1_Mo…

9 train/test split 0.969 0.0313 43 no no Preprocessor1_Mo…

10 train/test split 0.973 0.0265 52 no no Preprocessor1_Mo…

# … with 10,287 more rows

def roc_plot(X_test,Y_test, fitted_model, pos_label='yes'):

# calculate the fpr and tpr for all thresholds of the classification

probs = fitted_model.predict_proba(X_test)

probs_no = probs[:,1]

fpr, tpr, threshold = metrics.roc_curve(Y_test, probs_no, pos_label = pos_label)

roc_auc = metrics.auc(fpr, tpr)

plt.clf()

plt.title('Receiver Operating Characteristic')

plt.plot(fpr, tpr, 'b', label = 'AUC = %0.2f' % roc_auc)

plt.legend(loc = 'lower right')

plt.plot([0, 1], [0, 1],'r--')

plt.xlim([0, 1])

plt.ylim([0, 1])

plt.ylabel('True Positive Rate')

plt.xlabel('False Positive Rate')

plt.show()

return roc_auc

def grid_search_fit(pipe, param_grid, X_train, Y_train, X_test, Y_test, cv=10, scoring='roc_auc', plot=True, report=False):

grid = GridSearchCV(pipe, param_grid, cv=10, scoring=scoring)

grid.fit(X_train, Y_train)

fitted_model=grid.best_estimator_

score=grid.score(X_test, Y_test)

yhat=grid.predict(X_test)

if report:

print(metrics.classification_report(Y_test, yhat))

if plot:

roc_plot(X_test, Y_test, fitted_model, 'yes')

return (fitted_model, score, yhat)

model = LogisticRegression(penalty='elasticnet', solver='saga', max_iter=1000)

#model = SGDClassifier(max_iter=1000, penalty='elasticnet')

steps.append(("model", model))

param_grid = {'model__l1_ratio':np.arange(0,1,0.1)}

# param_grid = [

# {'penalty' : ['l1', 'l2', 'elasticnet', 'none'],

# 'C' : np.logspace(-4, 4, 20),

# 'solver' : ['lbfgs','newton-cg','liblinear','sag','saga'],

# 'max_iter' : [100, 1000,2500, 5000]

# }

# ]

pipe = Pipeline(steps)

grid = GridSearchCV(pipe, param_grid, cv=10, scoring='roc_auc')

grid.fit(data_bank_marketing_train, y_train)GridSearchCV(cv=10,

estimator=Pipeline(steps=[('dummy',

ColumnTransformer(remainder='passthrough',

transformers=[('dummy',

OneHotEncoder(drop='first',

sparse=False),

Index(['job', 'marital', 'education', 'default', 'housing', 'loan', 'contact', 'month', 'day_of_week', 'poutcome'], dtype='object'))],

verbose_feature_names_out=False)),

('normalize', MinMaxScaler()),

('zv', VarianceThreshold()),

('model',

LogisticRegression(max_iter=1000,

penalty='elasticnet',

solver='saga'))]),

param_grid={'model__l1_ratio': array([0. , 0.1, 0.2, 0.3, 0.4, 0.5, 0.6, 0.7, 0.8, 0.9])},

scoring='roc_auc')In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook. On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

GridSearchCV(cv=10,

estimator=Pipeline(steps=[('dummy',

ColumnTransformer(remainder='passthrough',

transformers=[('dummy',

OneHotEncoder(drop='first',

sparse=False),

Index(['job', 'marital', 'education', 'default', 'housing', 'loan', 'contact', 'month', 'day_of_week', 'poutcome'], dtype='object'))],

verbose_feature_names_out=False)),

('normalize', MinMaxScaler()),

('zv', VarianceThreshold()),

('model',

LogisticRegression(max_iter=1000,

penalty='elasticnet',

solver='saga'))]),

param_grid={'model__l1_ratio': array([0. , 0.1, 0.2, 0.3, 0.4, 0.5, 0.6, 0.7, 0.8, 0.9])},

scoring='roc_auc')Pipeline(steps=[('dummy',

ColumnTransformer(remainder='passthrough',

transformers=[('dummy',

OneHotEncoder(drop='first',

sparse=False),

Index(['job', 'marital', 'education', 'default', 'housing', 'loan', 'contact', 'month', 'day_of_week', 'poutcome'], dtype='object'))],

verbose_feature_names_out=False)),

('normalize', MinMaxScaler()), ('zv', VarianceThreshold()),

('model',

LogisticRegression(max_iter=1000, penalty='elasticnet',

solver='saga'))])ColumnTransformer(remainder='passthrough',

transformers=[('dummy',

OneHotEncoder(drop='first', sparse=False),

Index(['job', 'marital', 'education', 'default', 'housing', 'loan', 'contact', 'month', 'day_of_week', 'poutcome'], dtype='object'))],

verbose_feature_names_out=False)Index(['job', 'marital', 'education', 'default', 'housing', 'loan', 'contact', 'month', 'day_of_week', 'poutcome'], dtype='object')

OneHotEncoder(drop='first', sparse=False)

['age', 'campaign', 'pdays', 'previous', 'emp.var.rate', 'cons.price.idx', 'cons.conf.idx', 'euribor3m', 'nr.employed']

passthrough

MinMaxScaler()

VarianceThreshold()

LogisticRegression(max_iter=1000, penalty='elasticnet', solver='saga')

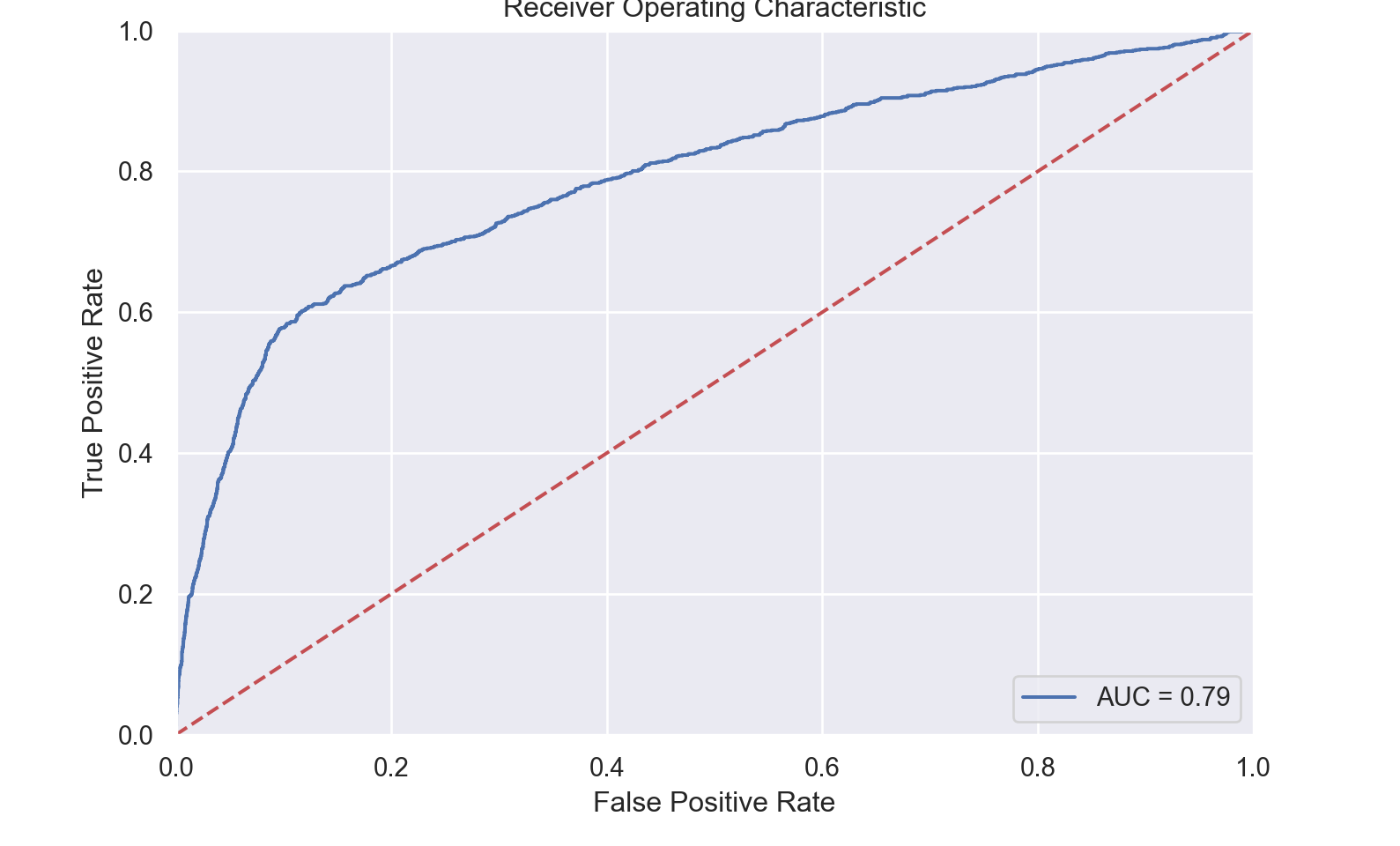

{'model__l1_ratio': 0.6000000000000001}fitted_model=grid.best_estimator_

score=grid.score(data_bank_marketing_test, y_test)

#score

yhat=grid.predict_proba(data_bank_marketing_test)

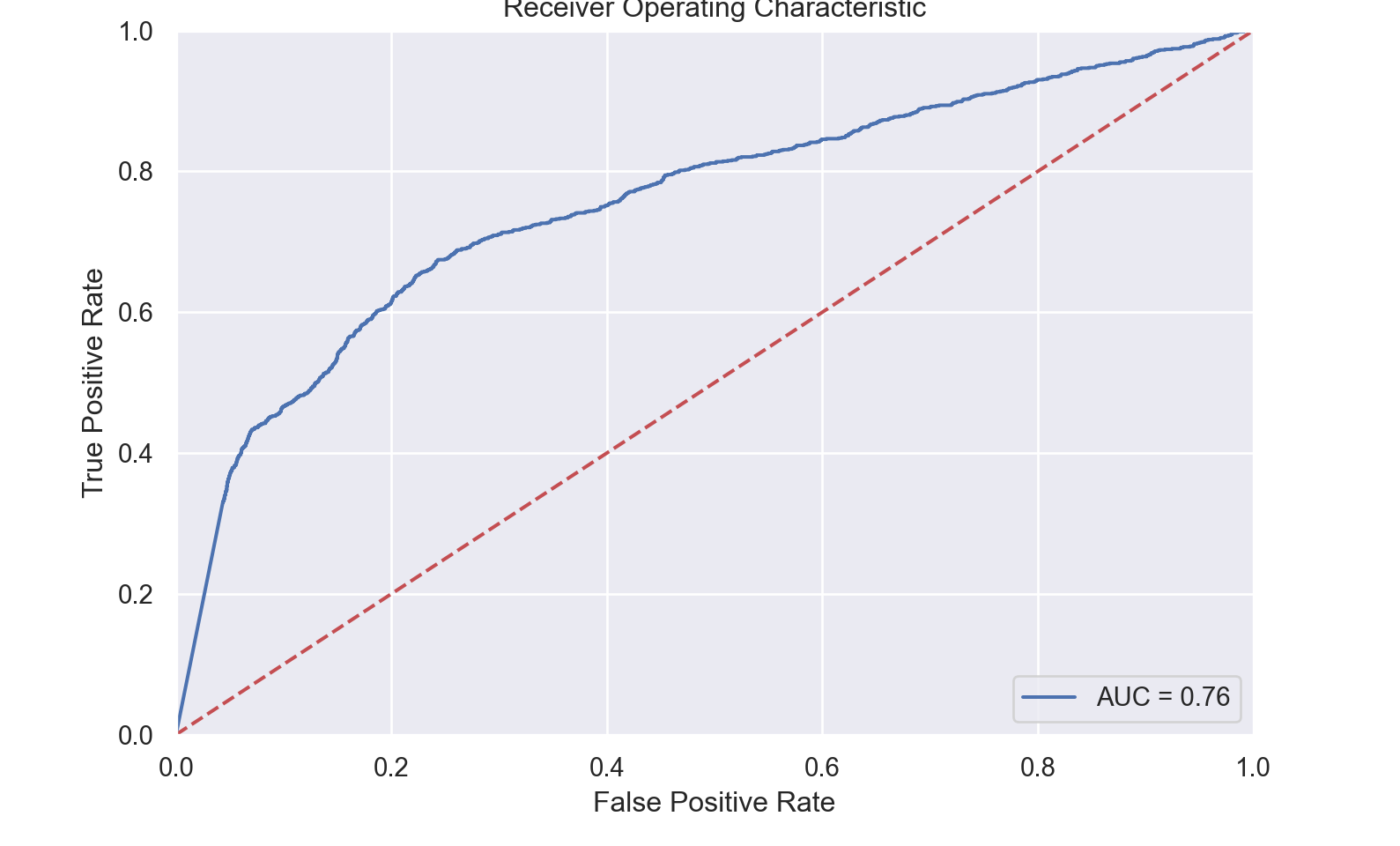

roc_plot(data_bank_marketing_test, y_test, fitted_model, 'yes')

#sgdclass_param_grid = {'model__alpha': [0.0001, 0.001, 0.01, 0.1, 1, 10, 100],

# "model__l1_ratio": np.arange(0.0, 1.0, 0.1)}0.7904608842023623

import MLJLinearModels.LogisticClassifier

LinearBinaryClassifier = MLJLinearModels.LogisticClassifierLogisticClassifierProbabilisticPipeline(

standardizer = Standardizer(

features = Symbol[],

ignore = false,

ordered_factor = false,

count = false),

continuous_encoder = ContinuousEncoder(

drop_last = false,

one_hot_ordered_factors = false),

logistic_classifier = LogisticClassifier(

lambda = 2.220446049250313e-16,

gamma = 0.0,

penalty = :l2,

fit_intercept = true,

penalize_intercept = false,

scale_penalty_with_samples = true,

solver = nothing),

cache = true)

#tuning = RandomSearch(rng=123);

tuning = Grid(rng=123);

# tuning=LatinHypercube(gens = 1,

# popsize = 100,

# ntour = 2,

# ptour = 0.8,

# interSampleWeight = 1.0,

# ae_power = 2,

# periodic_ae = false,

# rng=123)

r = range(model,

:(logistic_classifier.lambda),

lower=0,

upper=1,

unit=0.01)NumericRange(0 ≤ logistic_classifier.lambda ≤ 1; origin=0.5, unit=0.01)NumericRange(0 ≤ logistic_classifier.gamma ≤ 1; origin=0.5, unit=0.01)

tuned_model = TunedModel(model=model,

ranges=[r, s],

resampling=CV(nfolds=10),

measures=auc,

tuning=tuning,

n=200);

tuned_mach = machine(tuned_model, X_train, y_train);

fit!(tuned_mach);

yhat=MLJ.predict(tuned_mach, X_test);

rep = report(tuned_mach);

print(

"Measurements:\n",

" brier loss: ", brier_loss(yhat,y_test) |> mean, "\n",

" auc: ", auc(yhat,y_test), "\n",

" accuracy: ", accuracy(mode.(yhat), y_test)

)Measurements:

brier loss: 0.16162546559785088

auc: 0.769700437197346

accuracy: 0.9018290708967304

# LogisticModel = machine(LinearBinaryClassifierPipe, X_train, y_train);

# fit!(LogisticModel);

# fp = fitted_params(LogisticModel);

# fp.logistic_classifier

#keys(fp)

#rpt = report(LogisticModel)

#keys(rpt)

# fi = rpt.linear_binary_classifier.coef_table |> DataFrames.DataFrame

#ŷ = MLJ.predict(LogisticModel, X_test);

#

# print(

# "Measurements:\n",

# " brier loss: ", brier_loss(ŷ,y_test) |> mean, "\n",

# " auc: ", auc(ŷ,y_test), "\n",

# " accuracy: ", accuracy(mode.(ŷ), y_test)

# )

#

# #confmat(mode.(ŷ),y_test)

#

# e_pipe = evaluate(LinearBinaryClassifierPipe, X_train, y_train,

# resampling=StratifiedCV(nfolds=6, rng=42),

# measures=[brier_loss, auc, accuracy],

# repeats=1,

# acceleration=CPUThreads())

#show(iterated_pipe, 2)

# iterated_pipe = IteratedModel(model=LinearBinaryClassifierPipe,

# controls=controls,

# measure=auc,

# resampling=StratifiedCV(nfolds=6, rng=42))

#mach_iterated_pipe = machine(LinearBinaryClassifierPipe, X_train, y_train);

#fit!(mach_iterated_pipe);

#residuals = [1 - pdf(ŷ[i], y_test[i,1]) for i in 1:nrow(y_test)]

# r = report(LogisticModel)

#

# k = collect(keys(fp.fitted_params_given_machine))[3]

# println("\n Coefficients: ", fp.fitted_params_given_machine[k].coef)

# println("\n y \n ", y_test[1:5,1])

# println("\n ŷ \n ", ŷ[1:5])

# println("\n residuals \n ", residuals[1:5])

# println("\n Standard Error per Coefficient \n", r.linear_binary_classifier.stderror[2:end])

#confusion_matrix(yMode, y_test)nb_recipe <-

recipe(formula = y ~ ., data = data_bank_marketing_train) %>%

step_rm(duration) %>%

step_dummy()

nb_spec <-

naive_Bayes(smoothness = tune(), Laplace = tune()) %>%

set_engine("naivebayes")

nb_workflow <-

workflow() %>%

add_recipe(nb_recipe) %>%

add_model(nb_spec)

#nb_params = extract_parameter_set_dials(nb_spec)

# nb_grid = nb_params %>% grid_latin_hypercube(size = 20, original = FALSE)

#

# nb_tune <-

# nb_workflow %>%

# tune_grid(

# data_folds,

# grid = nb_grid

# )

# nb_tune

# select_best(nb_tune, metric = "roc_auc")

final_params = tibble(

smoothness = 0.5923033,

Laplace = 0.4830422

)

final_nb_wflow <-

nb_workflow %>%

finalize_workflow(final_params)

final_nb_fit <-

final_nb_wflow %>%

last_fit(data_bank_marketing_split)

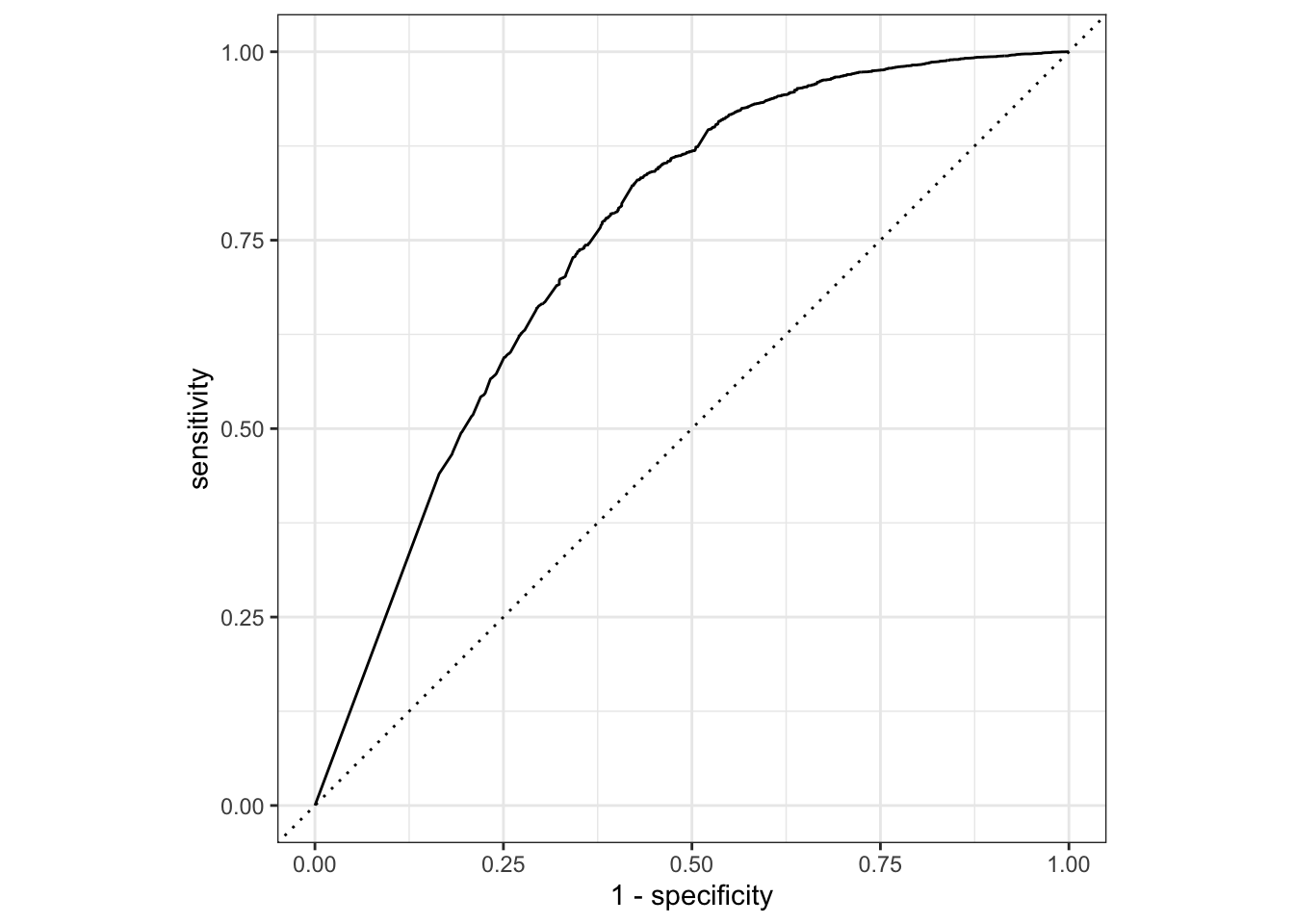

final_nb_fit %>% collect_metrics()# A tibble: 2 × 4

.metric .estimator .estimate .config

<chr> <chr> <dbl> <chr>

1 accuracy binary 0.880 Preprocessor1_Model1

2 roc_auc binary 0.795 Preprocessor1_Model1# A tibble: 10,297 × 7

id .pred_no .pred_yes .row .pred_class y .config

<chr> <dbl> <dbl> <int> <fct> <fct> <chr>

1 train/test split 1.00 0.00000488 7 no no Preprocessor1_…

2 train/test split 1.00 0.000000414 18 no no Preprocessor1_…

3 train/test split 1.00 0.00000451 21 no no Preprocessor1_…

4 train/test split 1.00 0.000000644 22 no no Preprocessor1_…

5 train/test split 1.00 0.00000345 24 no no Preprocessor1_…

6 train/test split 1.00 0.000000957 30 no no Preprocessor1_…

7 train/test split 1.00 0.00000110 34 no no Preprocessor1_…

8 train/test split 1.00 0.00000159 35 no no Preprocessor1_…

9 train/test split 1.00 0.00000488 43 no no Preprocessor1_…

10 train/test split 1.00 0.00000200 52 no no Preprocessor1_…

# … with 10,287 more rows

GaussianNB()In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook.

On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

GaussianNB()

array([[9.99990953e-01, 9.04749432e-06],

[8.12354222e-01, 1.87645778e-01],

[9.99999789e-01, 2.10792883e-07],

...,

[9.99294556e-01, 7.05443805e-04],

[9.99995515e-01, 4.48497521e-06],

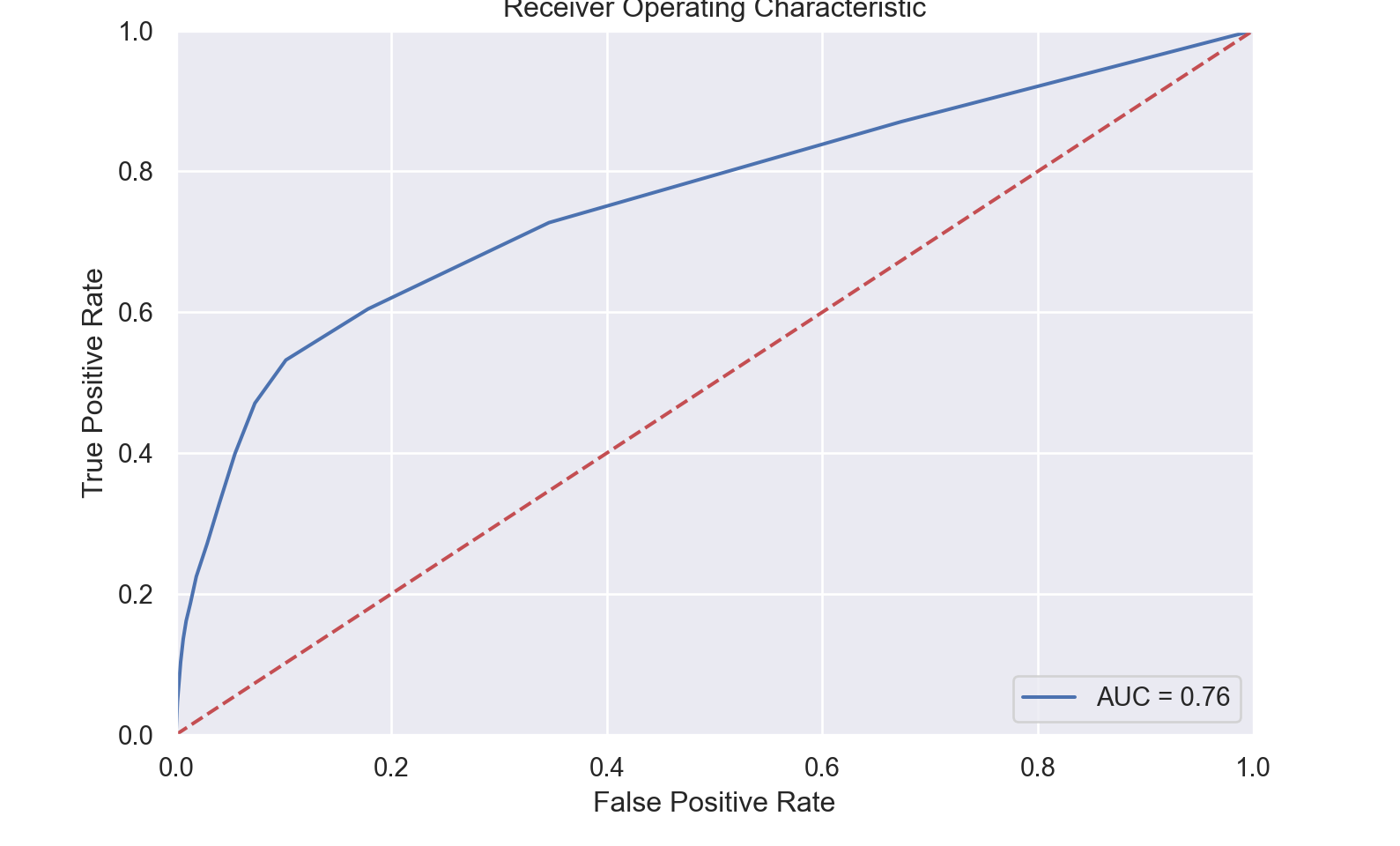

[7.16817215e-01, 2.83182785e-01]])0.7567412601500412

import NaiveBayes

GaussianNBClassifier = @load GaussianNBClassifier pkg=NaiveBayes;

model = Standardizer |> ContinuousEncoder |> GaussianNBClassifier()ProbabilisticPipeline(

standardizer = Standardizer(

features = Symbol[],

ignore = false,

ordered_factor = false,

count = false),

continuous_encoder = ContinuousEncoder(

drop_last = false,

one_hot_ordered_factors = false),

gaussian_nb_classifier = GaussianNBClassifier(),

cache = true)

# Model training fails with error: nested task error: PosDefException: matrix is not positive definite; Cholesky factorization failed.

# Pre-processing to eliminate collinearity may be needed

# mach = machine(model, X_train, y_train);

#

# fit!(mach);

# yhat=MLJ.predict(mach, X_test);

# rep = report(mach);

# print(

# "Measurements:\n",

# " brier loss: ", brier_loss(yhat,y_test) |> mean, "\n",

# " auc: ", auc(yhat,y_test), "\n",

# " accuracy: ", accuracy(mode.(yhat), y_test)

# )#use_kknn(y ~ ., data = data_bank_marketing_train)

kknn_recipe <-

recipe(formula = y ~ ., data = data_bank_marketing_train) %>%

step_rm(duration) %>%

step_string2factor(one_of("job", "marital", "education", "default", "housing",

"loan", "contact", "month", "day_of_week", "poutcome", "y")) %>%

step_novel(all_nominal_predictors()) %>%

step_dummy(all_nominal_predictors()) %>%

step_zv(all_predictors()) %>%

step_normalize(all_numeric_predictors())

kknn_spec <-

nearest_neighbor(neighbors = tune()) %>%

set_mode("classification") %>%

set_engine("kknn")

kknn_param = extract_parameter_set_dials(kknn_spec)

kknn_workflow <-

workflow() %>%

add_recipe(kknn_recipe) %>%

add_model(kknn_spec)

set.seed(66214)

# kknn_tune <-

# tune_grid(kknn_workflow, resamples = data_folds, size =10)

final_params <-

tibble(

neighbors = 14

)

final_kknn_wflow = kknn_workflow %>% finalize_workflow(final_params)

final_kknn_wflow══ Workflow ════════════════════════════════════════════════════════════════════

Preprocessor: Recipe

Model: nearest_neighbor()

── Preprocessor ────────────────────────────────────────────────────────────────

6 Recipe Steps

• step_rm()

• step_string2factor()

• step_novel()

• step_dummy()

• step_zv()

• step_normalize()

── Model ───────────────────────────────────────────────────────────────────────

K-Nearest Neighbor Model Specification (classification)

Main Arguments:

neighbors = 14

Computational engine: kknn final_kknn_fit = final_kknn_wflow %>% last_fit(data_bank_marketing_split)

final_kknn_fit %>% collect_metrics()# A tibble: 2 × 4

.metric .estimator .estimate .config

<chr> <chr> <dbl> <chr>

1 accuracy binary 0.894 Preprocessor1_Model1

2 roc_auc binary 0.751 Preprocessor1_Model1# A tibble: 10,297 × 7

id .pred_no .pred_yes .row .pred_class y .config

<chr> <dbl> <dbl> <int> <fct> <fct> <chr>

1 train/test split 1 0 7 no no Preprocessor1_Mo…

2 train/test split 0.932 0.0682 18 no no Preprocessor1_Mo…

3 train/test split 1 0 21 no no Preprocessor1_Mo…

4 train/test split 0.932 0.0682 22 no no Preprocessor1_Mo…

5 train/test split 1 0 24 no no Preprocessor1_Mo…

6 train/test split 1 0 30 no no Preprocessor1_Mo…

7 train/test split 0.749 0.251 34 no no Preprocessor1_Mo…

8 train/test split 1 0 35 no no Preprocessor1_Mo…

9 train/test split 1 0 43 no no Preprocessor1_Mo…

10 train/test split 1 0 52 no no Preprocessor1_Mo…

# … with 10,287 more rows

model = KNeighborsClassifier()

param_grid = {'model__n_neighbors':np.arange(0,20,1)}

steps[-1] = ("model", model)

pipe = Pipeline(steps)

grid = GridSearchCV(pipe, param_grid, cv=10, scoring='roc_auc')

grid.fit(data_bank_marketing_train, y_train)GridSearchCV(cv=10,

estimator=Pipeline(steps=[('dummy',

ColumnTransformer(remainder='passthrough',

transformers=[('dummy',

OneHotEncoder(drop='first',

sparse=False),

Index(['job', 'marital', 'education', 'default', 'housing', 'loan', 'contact', 'month', 'day_of_week', 'poutcome'], dtype='object'))],

verbose_feature_names_out=False)),

('normalize', MinMaxScaler()),

('zv', VarianceThreshold()),

('model', KNeighborsClassifier())]),

param_grid={'model__n_neighbors': array([ 0, 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16,

17, 18, 19])},

scoring='roc_auc')In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook. On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

GridSearchCV(cv=10,

estimator=Pipeline(steps=[('dummy',

ColumnTransformer(remainder='passthrough',

transformers=[('dummy',

OneHotEncoder(drop='first',

sparse=False),